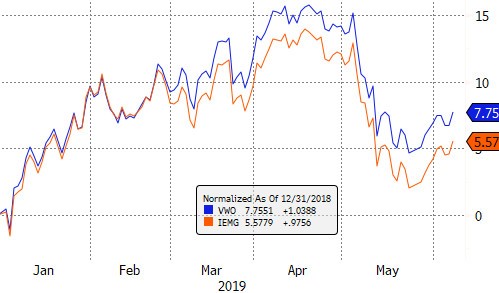

It’s been a wild ride for emerging markets (EM) this year. After starting 2019 with a bang, the world’s largest EM fund, the $61.6 billion Vanguard FTSE Emerging Markets ETF (VWO), was suddenly caught reeling.

VWO’s stellar year-to-date gain of 15.7% in April turned into a much more modest 4.6% gain in May, before rebounding slightly to 6.7% currently.

The rival iShares Core MSCI Emerging Markets ETF (IEMG), with $56.8 billion in assets, followed a similar path this year—a hot start followed by a recent retrenchment.

YTD Returns For VWO, IEMG

China ETFs Surprise

Perhaps the biggest surprise is that, despite being ground zero for the most consequential trade war in decades, Chinese stocks are actually doing quite well this year.

In fact, eight of the top 10 best-performing EM ETFs are China funds. That includes the Global X MSCI China Consumer Staples ETF (CHIS), up 26.92%; the CSOP FTSE China A50 ETF (AFTY), up 23.8%; and the KraneShares CICC China Leaders 100 Index ETF (KFYP), up 20%.

India’s Divergence

While China dominates the best-performing EM ETF list, the other side of the ledger features a more eclectic group of funds.

At the top of this list is the Columbia India Small Cap ETF (SCIN), down 7.4% year to date. SCIN is one of several India-related ETFs that have fared poorly this year despite the recent reelection of business-friendly Prime Minister Narendra Modi.

Other Underperformers

Outside of India ETFs, other poor-performing emerging market ETFs include the iShares MSCI Turkey ETF (TUR), the iShares MSCI Chile ETF (ECH) and the iShares MSCI Qatar ETF (QAT), with losses of 1% to 6.5%.

Ironically, a China equity ETF is also struggling this year, the Global X MSCI China Communication Services ETF (CHIC), down 0.7% even as other China funds surge.

CHII’s performance goes to show that EM ETFs aren’t all built the same. Just as with U.S. funds, exposure can vary widely, so it’s always important to check under the hood.

You can reach Sumit Roy at sroy@etf.com

More on ETF.com

Surging US Dollar Impacting ETFs

Floods & Tariffs Lift Grain ETFs

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.