Warren Buffett, the longtime head of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has delivered an impressive nearly 20% annualized return for shareholders since 1965, doubling the S&P 500's benchmark return. These exceptional results stem from Buffett and his late partner Charlie Munger's business acumen, combined with Berkshire's ability to strategically invest funds generated by its insurance business.

In light of Buffett's stellar track record, let's examine a few of his favorite stocks and whether you should buy and hold them for the long term.

1. Berkshire Hathaway

Let's start with Buffett's favorite business: Berkshire Hathaway, with its Class B shares trading around $475 per share. The conglomerate holding company owns a majority stake in more than 60 businesses, like Dairy Queen and GEICO. Additionally, the company has a portfolio of over 40 stocks totaling $300 billion in value, with its largest stakes in Apple, American Express, and Bank of America.

Berkshire recently reported its third-quarter 2024 earnings, with slight revenue and operating earnings declines compared to Q3 2023. Specifically, Berkshire delivered $93 billion in revenue and $10.1 billion in operating earnings, a drop of 0.2% and 6.2%, respectively.

While those numbers appear uninspiring on the surface, it's important to note that Berkshire's insurance business can be cyclical, which played out to the company's detriment in its recent quarter. Notably, insurance losses reached $15.2 billion, up 10.5% year over year, and underwriting expenses cost the company $4.9 billion, an increase of 41.1% year over year.

The biggest bull case for Berkshire is undoubtedly its $325 billion pile of cash and cash equivalents, making it arguably the company most prepared for a market downturn and a perfect hedge play for individual investors. When that will be is anybody's guess, but as Buffett awaits to deploy Berkshire's cash hoard, the company will earn approximately $14 billion annually at the current 4.5% Treasury bill rate.

2. Chubb Limited

Berkshire also recently purchased a 6.7% stake in Chubb Limited (NYSE: CB). This Switzerland-based company, known for property and casualty insurance, trades for $285 per share and has surged 25% in 2024 following record revenue and operating income.

During Q3 2024, Chubb generated $14.9 billion in revenue and $2.3 billion in operating income, up 14.3 billion, representing a year-over-year increase of 7.2% and 14.3%, respectively. Notably, Chubb did have an increase of pre-tax catastrophe losses of $765 million during the quarter, an increase of $95 million, including $250 million attributable to Hurricane Helene.

The company's balance sheet is healthy, with $23.8 billion in net cash, even after it acquired Healthy Paws, a leading pet insurance provider, for an undisclosed price, and increased its controlling stake in Huatai Group, a Chinese-based insurance and financial services company.

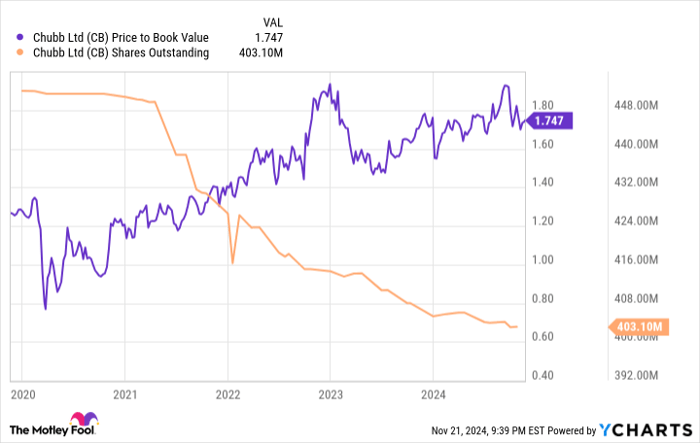

Additionally, management consistently returns capital to shareholders through dividends and share repurchases. Chubb has paid and raised its dividend for 15 consecutive years and currently pays a quarterly dividend of $0.91 per share, equating to an annual yield of 1.3%. Also, management has repurchased 10.8% of its outstanding shares over the past five years.

In a recent shareholder letter, Buffett talked about the stockholder benefit of the capital allocation strategy, saying, "The math isn't complicated: When the share count goes down, your interest in our many businesses goes up."

Chubb trades at a hefty price-to-book value of 1.75, which is near the high end of its five-year median. Still, given its record revenue and earnings, robust balance sheet, and shareholder-friendly history, the stock appears deserving of its high valuation.

CB Price to Book Value data by YCharts

3. DaVita

Berkshire owns a 44% stake in the final stock on the list, DaVita (NYSE: DVA), a healthcare company specializing in outpatient kidney dialysis services. Trading at around $164 per share, it has delivered an outstanding 54% return in 2024.

As of Sept. 30, DaVita provided dialysis services to approximately 265,400 patients across 3,113 outpatient centers, 85% of which were located in the United States. In its latest reported quarter, the company achieved record financial results, generating $3.3 billion in revenue and $535 million in operating income.

The company does have some balance sheet concerns, considering it has $8.5 billion in net debt and a market capitalization of $13.5 billion. That debt is also gradually costing more to service each quarter as interest rates remain elevated, carrying an expense of $134.6 million for Q3 2024, an increase of $37 million from Q2 2024.

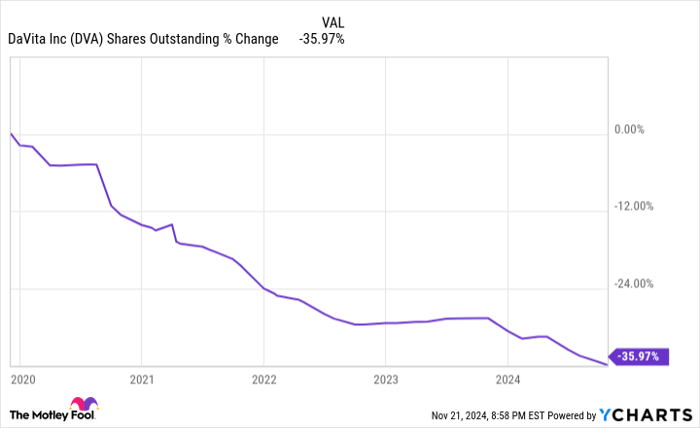

Still, with its trailing-12-month free cash flow of $1.4 billion, management could pay it down if it so chooses. Instead, management is aggressively buying back its stock, lowering its shares outstanding by 36% over the past five years, suggesting it believes the company is undervalued at a price-to-free-cash-flow ratio of 10.4.

DVA Shares Outstanding data by YCharts

Finally, DaVita does have long-term growth potential as it is expected to expand into new markets. In fact, earlier this year, it unveiled plans to strengthen its presence in Brazil and Colombia and to establish operations in Chile and Ecuador for the first time.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Bank of America is an advertising partner of Motley Fool Money. American Express is an advertising partner of Motley Fool Money. Collin Brantmeyer has positions in American Express, Apple, and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.