Warren Buffett is widely regarded as one of the best investors of all time, and the stock of the company he runs, Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A), has helped create a number of millionaires over the years. In fact, it has even helped create a couple of billionaires in Buffett and his now-deceased former right-hand man, Charlie Munger.

The question now, though, is: Can the stock be a millionaire-maker in the years to come? Although I think the stock will continue to do fine over the long term, I actually would buy at current prices. Let's look at why I would pass on buying Berkshire Hathaway stock at the moment.

Valuation matters

Above all else, Buffett is a value investor who looks to buy great companies when he thinks there is a disconnect between their current valuations and their intrinsic value. This investment strategy has served Buffett well over time. But recently, it appears he has been struggling to find attractive stock investments, including with his own stock.

In recent quarters, Buffett has been a huge seller of stocks, while not adding many positions. Last quarter, Berkshire sold $36.1 billion in stock, while only buying $1.5 billion. Buffett continued to greatly reduce his stakes in top holdings Apple and Bank of America, while also reducing or exiting smaller positions. Berkshire added two new small positions in the quarter, buying shares of Domino's Pizza and Pool Corp.

The moves, combined with the company generating $10.1 billion in operating profit, left Berkshire with $325.2 billion in cash and short-term investments in U.S. Treasuries on its balance sheet. That's an increase from the $167.6 billion in cash and Treasuries it held at the end of last year.

Perhaps even more telling, though, was that even with Berkshire's huge cash stockpile, Buffett decided not to buy back any Berkshire stock in the quarter. The Oracle of Omaha had been scaling back repurchases in recent quarters, but the third quarter of 2024 was the first quarter in which the company did not buy back stock since 2018.

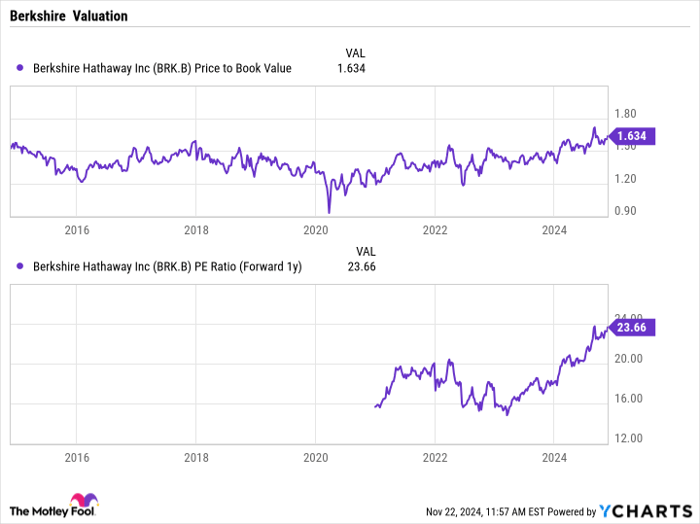

While Buffett had previously espoused buying back shares only when Berkshire traded below a certain book value per share level, he later changed his stance on that, saying that he did not think price-to-book (P/B) or price-to-earnings (P/E) were the best ways to measure intrinsic value. However, based on those valuation metrics, the stock is trading at high levels historically.

BRK.B Price to Book Value data by YCharts.

At about 1.6 times price-to-book (P/B) and a forward price-to-earnings (P/E) ratio of 23 times next year's analyst estimates, Berkshire stock looks pricey by historical measures. Buffett seems to agree after not buying back stock for the first time in more than six years. The fact that he didn't find other places to invest also speaks volumes.

Image source: Getty Images.

Buffett is not getting any younger

Buffett created a unique model in the insurance industry where he found it better to invest his company's float -- the money an insurer holds that hasn't been paid out in claims yet -- in equities instead of fixed-income investments. Together with his investment acumen, this has led to greatly superior returns for his company and its shareholders.

The model he created and the structure he has put in place will survive long after he is gone. That said, Buffett himself cannot be replaced. While he has a team in place that has been helping run the day-to-day operations for years, there is a certain aura that Buffett brings that will be missed. This includes both his stock-picking prowess, and companies being more open to selling themselves to Berkshire given Buffett's reputation.

Buffett, 94, is not getting any younger, and he won't be running Berkshire forever. While he has argued that once he's gone, Berkshire stock will go up the next day since a break-up would now be on the table, I highly doubt that would be the case. I think many investors are attracted to Berkshire due to Buffett and may look to sell once he's gone.

That said, Apple thrived after the death of Chief Executive Officer Steve Jobs, so a stock can still perform well over the long term even when its iconic leader passes away.

Nonetheless, between the stock's current high valuation, Buffett hoarding cash, and his advanced age, I would not be looking to jump into Berkshire Hathaway stock at current levels.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Bank of America is an advertising partner of Motley Fool Money. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Domino's Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.