Labcorp LH is a leading healthcare diagnostics company providing comprehensive clinical laboratory services and end-to-end drug development support. The company provides vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions.

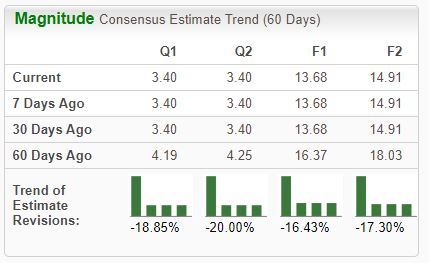

Analysts have slashed their earnings expectations for the company, pushing it down to a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at a few other company characteristics.

Current Standing

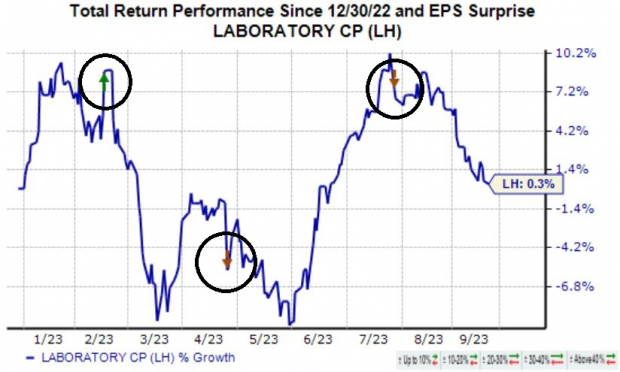

Labcorp shares have seen rollercoaster-type price action in 2023, up a modest 0.3% on a year-to-date basis and widely lagging behind the general market.

As illustrated below, the market hasn’t reacted well to the company’s recent quarterly reports, facing selling pressure regularly.

Image Source: Zacks Investment Research

Regarding the most recent quarterly release, Labcorp fell short of the Zacks Consensus EPS Estimate by 1.5% but exceeded revenue expectations modestly. Earnings declined 31% from the year-ago period, whereas sales contracted 18% year-over-year.

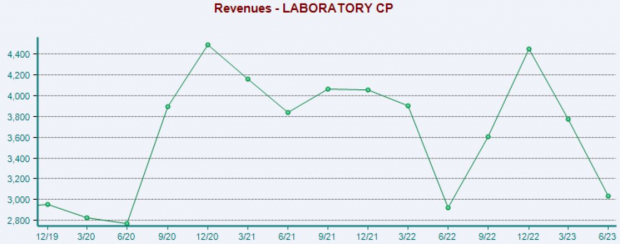

Further, operating income totaled $266 million, down nearly 40% from the comparable period last year due to the notable reduction in COVID-19 testing. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

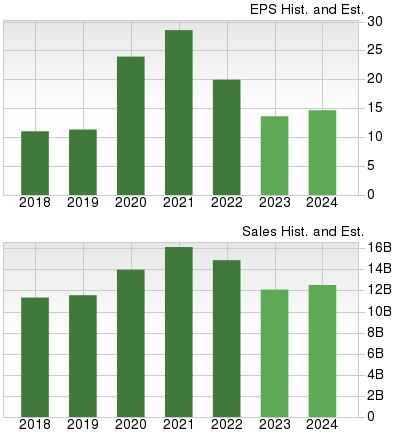

The company is forecasted to witness a growth slowdown in its current year (FY23), likely a reflection of reduced COVID-19 testing. Earnings are forecasted to be down more than 30% on 19% lower revenues in FY23 before returning to growth in FY24.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and a slowdown in COVID-19 testing paint a challenging picture for the company’s shares in the near term.

Labcorp LH is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

Labcorp (LH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.