DICK'S Sporting Goods Inc. DKS is a significant omnichannel sporting goods retailer that offers athletic shoes, apparel, accessories, and a broad selection of outdoor and athletic equipment for team sports, fitness, camping, fishing, tennis, golf, water sports, and more.

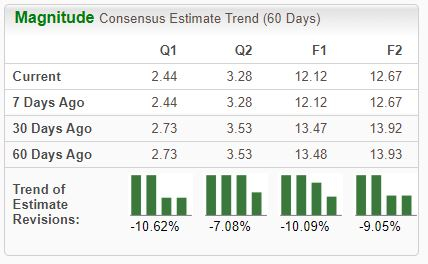

Analysts have slashed their earnings expectations as of late, pushing the stock down into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at a few other characteristics of DKS.

DICK’S Sporting Goods

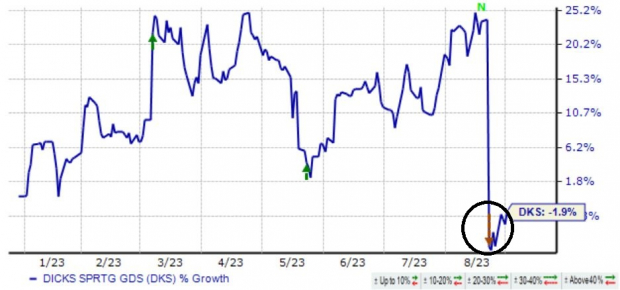

The company’s latest quarterly report disappointed investors, with DKS falling short of the Zacks Consensus EPS Estimate by 25% and delivering a fractional revenue surprise. Earnings declined 24% year-over-year, whereas revenue climbed 3.6% from the same period last year.

The company’s profitability picture was massively impacted by elevated inventory shrink, a phenomenon DKS says many retailers are currently facing. And to top it off, DKS lowered its FY23 EPS outlook, causing shares to plummet post-earnings.

Image Source: Zacks Investment Research

Shares now yield 3.5% annually following the sell-off, with a payout ratio sitting at 34% of the company’s earnings. It’s worth noting that the company has been committed to increasingly rewarding its shareholders, sporting a 25% five-year annualized dividend growth rate.

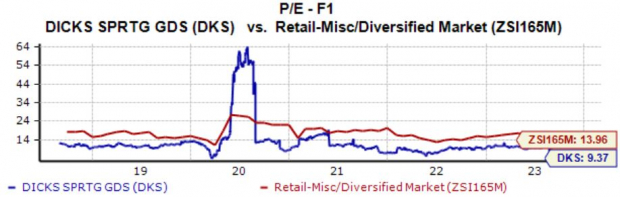

In addition, DKS shares presently trade at a 9.4X forward earnings multiple (F1), below the 10.8X five-year median and the respective Zacks industry average. Shares have traded as high as 12.5X in 2023.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and a recent negative quarterly print paint a challenging picture for the company’s shares in the near term.

DICK’S Sporting Goods DKS is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpDICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.