Columbia Sportswear Company (COLM) fell solidly short of our fourth quarter earnings estimate on February 1 and provided downbeat guidance on the back of cautious retail customers and broader economic uncertainty.

The historic outdoor clothing company faces near-term setbacks and a rapidly fading earnings outlook that’s prompted it to roll out a “multi-year profit improvement program,” which includes planned corporate layoffs.

Quick COLM Overview

Founded in the late 1930s, Columbia remains near the forefront of outdoor clothing, apparel, and footwear. The Portland, Oregon-headquarter firm currently owns multiple outdoor-focused brands, including boot standout Sorel and higher-end apparel maker Mountain Hardwear. The company also owns prAna, which makes everything from rock climbing clothes to yoga gear, and is part of a group of brands attempting to compete against Lululemon (LULU).

The diversification and portfolio expansion has helped Columbia. Still, its namesake brand is by far the largest revenue contributor, bringing in around 80% to 85% of total sales in most quarters.

Image Source: Zacks Investment Research

Columbia competes against The North Face (VFC), Patagonia, and others. The company has boosted its direct-to-consumer business, with that key segment accounting for around 60% of sales during the recently reported fourth quarter.

Recent Performance & Outlook

Columbia’s fiscal 2021 and 2022 sales soared following an 18% drop in 2020. The big Covid-era decline stopped a nice run of solid top line expansion. The company’s fiscal 2023 revenue then climbed by around 0.7%, with fourth quarter sales down 9% YoY. The company’s adjusted quarterly earnings sank as well, missing our EPS estimate by 7%.

Columbia cited a “difficult U.S. marketplace and a warm winter” for some of its fourth quarter woes. Looking ahead, the outdoor apparel maker expects “2024 to be a challenging year.” CEO Tim Boyle noted in prepared Q4 remarks that “retailers are placing orders cautiously, and economic and geopolitical uncertainty remains high.”

Image Source: Zacks Investment Research

Columbia’s fiscal 2024 sales are projected to dip by 2.6% YoY to $3.40 billion. The company’s adjusted earnings are then expected to drop 9% YoY, with a 45% decline expected in the first quarter of 2024, based on current Zacks estimates.

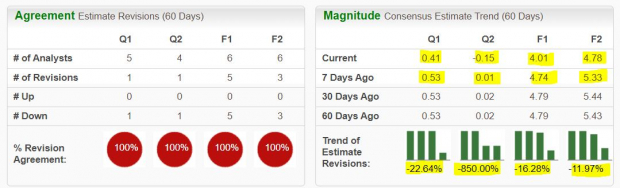

COLM’s earnings outlook is still getting worse, with its most accurate/most recent estimates coming in solidly below its already beaten-down earnings outlook.

Columbia’s downward earnings revisions help it earn a Zacks Rank #5 (Strong Sell) right now. The recent earnings negativity also extends a decline that started in early 2022.

Bottom Line

Columbia stock is down 17% in the last five years to lag the Zacks Consumer Discretionary sector’s 13% decline and the S&P 500’s 83% surge. COLM is trading below its long-term 200-week and 50-week moving averages and 7% above its average Zacks price target.

Columbia is attempting to “mitigate erosion in profitability and to improve the efficiency of our operations” by rolling out a “multi-year profit improvement program targeting $125 to $150 million in annual savings by 2026.” Investors might, therefore, want to keep COLM on their watchlists while avoiding the stock in the near-term.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

V.F. Corporation (VFC) : Free Stock Analysis Report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.