Slower revenue growth has put a dent in the optimism surrounding ATN International’s ATNI diverse business operations which consist of communication companies and renewable energy assets. Unfortunately, with ATN still striving to cross the profitability line this lands its stock a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Slower Sales Growth

An expansive top line is often indicative of a company’s future earnings potential and can catapult speculative high-growth stocks even before their profitable with Carvana CVNA and crypto miners such as Marathon Digital MARA and Riot Platforms RIOT being recent examples.

However, when the revenue of a “speculative” stock slows and the company isn't turning a profit optimism in the market can fade quickly and this appears to be the case with ATNI shares.

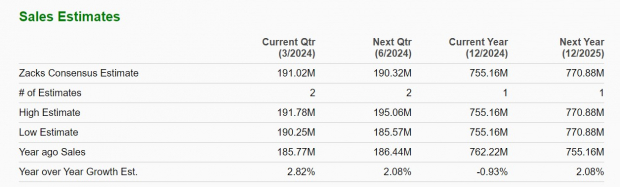

Image Source: Zacks Investment Research

Looking at ATN’s outlook total sales are forecasted to dip -1% in fiscal 2024 to $755.16 million with the company expected to post an adjusted loss of -$0.29 a share. ATN is projected to post a profit of $0.30 a share next year but 2% sales growth is not overly reassuring.

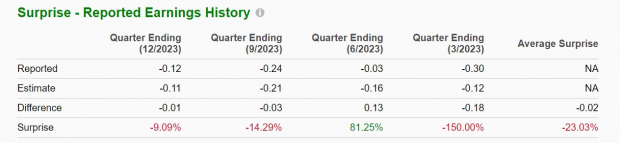

Image Source: Zacks Investment Research

Q4 Earnings Miss & Declining EPS Estimates

Adding more concern to ATN’s profitability prospects is that the infrastructure and communication services provider came up short of its Q4 earnings expectations last week. ATN incurred a net loss -$5.8 million and an adjusted loss of -$0.12 a share compared to estimates of -$0.11 a share.

This was despite Q4 sales of $198.97 million topping estimates of $192.07 million and rising 3% year over year but wasn’t enough to push market sentiment. Furthermore, ATN has now missed earnings expectations in three of its last four quarterly reports.

Image Source: Zacks Investment Research

More concerning is that annual earnings estimates have fallen sharply following ATN’s Q4 report for both FY24 and FY25.

Image Source: Zacks Investment Research

Bottom Line

With ATN International’s stock down -13% in 2024 the slower revenue growth and declining earnings estimates are indicative that more short-term risk is ahead. ATN’s diverse operations should keep the company afloat but its prospects look less reassuring at the moment making its stock one to be avoid.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>ATN International, Inc. (ATNI) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

Riot Platforms, Inc. (RIOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.