Founded in 1931 and headquartered in Northbrook, IL, The Allstate Corporation (ALL) is the third-largest property-casualty (P&C) insurer and the largest publicly-held personal lines carrier in the U.S. Beyond property insurance, the company also provides a range of life insurance and investment products to its diverse customer base.

Headwinds

Catastrophic Loss Risk

The risk of losses due to catastrophic losses is unavoidable for companies like Allstate that are in the property insurance business. Though Allstate’s management can do its best to reduce such losses through its catastrophe management strategy and reinsurance programs, it cannot control the weather. Weather-related losses over the years have put a strain on the company and have increased dramatically since 2019.

For example, in 2022, the company incurred roughly $3.1 billion in catastrophic losses. Meanwhile, in 2023, losses from weather-related damages are expected to more than double year-over-year.

Ballooning Debt

The catastrophic losses incurred by the company have led to exploding levels of debt. Since 2020, Allstate’s debt-to-equity ratio has more than doubled. Remember, the more debt a company incurs, the more interest it will pay.

Image Source: Zacks Investment Research

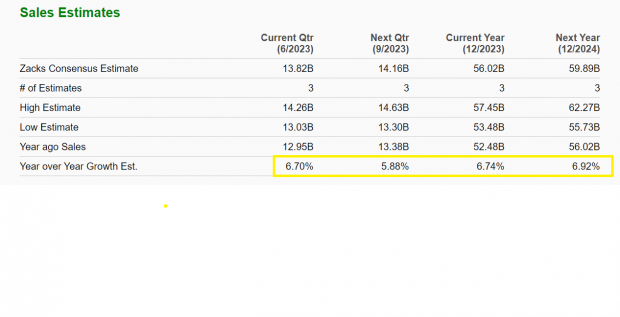

Lack of Growth and High Valuation

The two main investor baskets that exist are growth and value – or a combination of the two (Growth at a Reasonable Price, or GARP). Unfortunately for Allstate’s stock, the company is unattractive from both perspectives. Last quarter, the company posted a loss of $1.30 per share in EPS. Meanwhile, abysmal single-digit sales growth is expected until the end of 2024.

Image Source: Zacks Investment Research

Conversely, despite the lack of growth and expected growth moving forward, Allstate remains overvalued. ALL’s price-to-book ratio of 1.84 is much higher than its peer groups price to book of 1.62.

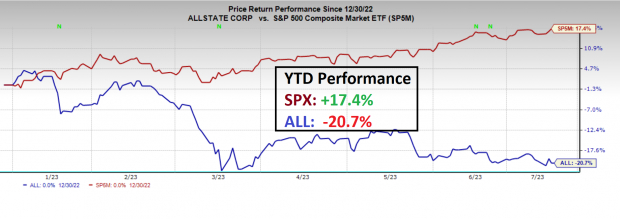

Relative Weakness

Allstate is a relatively stable, slow-growth, old economy type company. In the current risk-on market environment, stocks like Allstate are lagging, while growthy, tech-oriented stocks outperform.

Image Source: Zacks Investment Research

Takeaway

Unpredictability, a high valuation, and rising debt are reasons to avoid Allstate shares. Furthermore, the stock is in a poor environment, and the chart indicates relative weakness.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpThe Allstate Corporation (ALL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.