National Beverage Corp. FIZZ makes LaCroix and other beverages. FIZZ stock has gone on a wild ride in 2021, as part of a wave of short squeezes that hit Wall Street earlier in the year. The company’s near-term earnings outlook has trended in the wrong direction and it might be a bit risky to take a swig of FIZZ shares.

Lost its Fizz?

National Beverage sells sparkling waters, juices, energy drinks, and some carbonated soft drinks, ranging far beyond its widely-popular LaCroix. The flavored seltzer brand, with multiple flavors, has been around for decades, but really kicked things into high gear over the last five-plus years as consumers searched for alternatives to sugary sodas.

LaCroix began to fly off shelves and helped create the current seltzer drink craze that’s spilled over into the alcoholic beverage market. National Beverage’s success saw PepsiCo launch its Bubly brand, while Coca-Cola bought Topo Chico in 2017 and launch its own sparkling water brand.

Plus, retail giants like Target TGT sell their own store brands and startups are popping up all the time. The crowded market makes things harder on National Beverage, and some brands have undercut LaCroix on price.

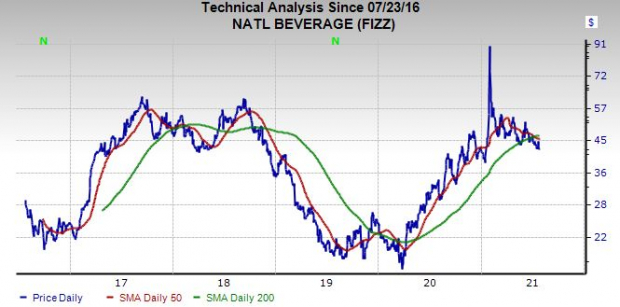

The stock is also currently heavily shorted (around 24% of float at last report), even after a short squeeze helped it skyrocket earlier this year. FIZZ has also seen its consensus earnings estimates slip. And of the two brokerage recommendations Zacks has for the stock, one is a “Hold” and the other is a “Strong Sell.”

Image Source: Zacks Investment Research

Bottom Line

National Beverage’s earnings revisions help it land a Zacks Rank #5 (Strong Sell) at the moment. FIZZ’s Beverages - Soft drinks space also sits in the bottom 25% of over 250 Zacks industries. Therefore, investors might want to stay away from FIZZ as it appears to be more of a trader’s stock at the moment.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

National Beverage Corp. (FIZZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.