Kimberly-Clark KMB is a historic consumer packaged goods power within the broader paper products space. The Kleenex maker is under pressure amid rising costs and its 2022 forecast prompted some more selling of KMB shares.

Paper-Based Goods Titan

Kimberly-Clark’s various brands are household names in the U.S. and throughout much of the rest of the world. KMB’s portfolio includes Huggies, Kleenex, Scott, Kotex, Cottonelle, Depend, GoodNites, Intimus, Neve, and tons of others. Crucially, many of these brands hold the No. 1 or No. 2 spot in terms of market share in the U.S. and beyond.

Kimberly-Clark is exposed to tissue paper, diapers, toilet paper, feminine care, and more. Its portfolio of essentials are hardly going out of style, but its growth days are long gone, with 2020’s 3.7% revenue expansion marking by far its strongest since 2011 as people stocked up on paper towels and more during the heart of the pandemic.

KMB’s 2021 revenue popped 2% but organic sales slipped 1%. Kimberly-Clark also ended last year on a somewhat sour note, with adjusted Q4 earnings down 23% YoY and fiscal 2021 EPS 20% off the pace.

Kimberly-Clark’s 2022 bottom-line guidance came in below Wall Street expectations, with the firm citing higher prices throughout much of its business. “Costs are projected to increase or remain elevated for most inputs including purchased raw materials as well as for distribution and energy.”

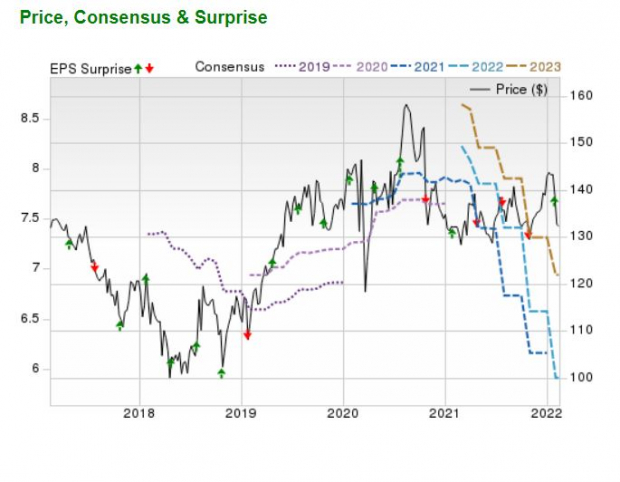

Image Source: Zacks Investment Research

Bottom Line

Kimberly-Clark’s FY22 consensus EPS estimates have dropped 10% since its late January financial release, with FY23 5% lower. The nearby chart showcases the CPG firm’s overall downward earnings revisions activity that helps KMB land a Zacks Rank #5 (Strong Sell) at the moment, alongside its “D” grade for Momentum in our Style Scores system.

KMB shares are down 7% in 2022 and are essentially flat over the past five years vs. the S&P 500’s 95% climb. Plus, the broader Consumer Products – Staples industry, which is in the bottom 11% of over 250 Zacks industries, has fallen 37% in the last three years.

All of this said, Kimberly-Clark operates a stable consumer staples business poised to keep on growing its top and bottom line for years if not decades to come. Plus, its 3.5% dividend yield blows away the 30-year U.S. Treasury’s 2.3%. Still, there appear to be other stronger options at the moment within retail, as KMB faces near-term setbacks.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KimberlyClark Corporation (KMB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.