While homebuilders in particular among other construction sector stocks are seeing expansive growth, Potlatch PCH may be one to avoid.

To that point, Potlatch’s Zacks Building Products-Wood Industry is currently in the bottom 6% of over 250 Zacks industries. Operating as both a real estate investment trust (REIT) and a wood products manufacturer with acres of timberland across several states, volatile lumber prices appear to be weighing on Potlatch’s business operations.

Volatile Lumber Prices

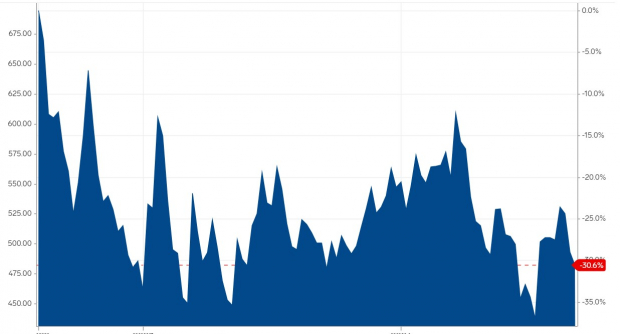

Notably, the price per cubic meter of processed wood formally known as “Lumber Prices” has declined -11% year to date and has plummeted -30% over the last five years as shown in the chart below.

Image Source: Markets Insider

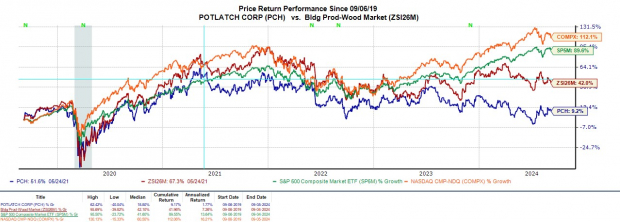

Unfortunately, Potlatch shares have followed a similar trend this year and are down -8% YTD. While PCH is up +9% in the last five years this is very subpar to the broader indexes and its industry’s price return of +42%.

Image Source: Zacks Investment Research

Profitability Concerns

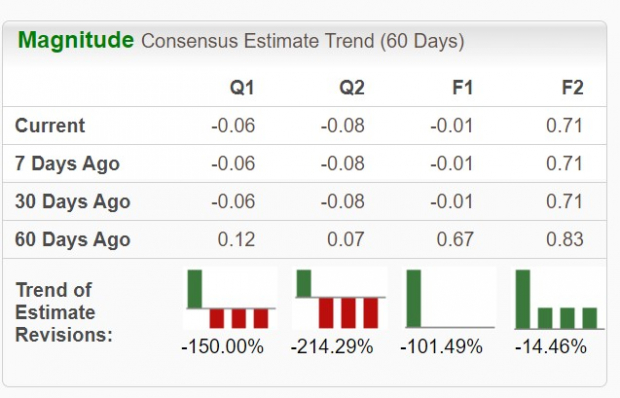

Correlating with the decline in lumber prices, Potlatch’s annual earnings per share are projected to drop to an adjusted loss of -$0.01 in fiscal 2024 compared to $0.43 a share in 2023.

Image Source: Zacks Investment Research

Although Potlatch’s EPS is projected to rebound to $0.71 next year, it’s important to point out that earnings estimate revisions have sharply declined over the last 60 days for both FY24 and FY25.

Image Source: Zacks Investment Research

The Market Tends to Sniff out Overvalued Stocks in September

With September known to be the most volatile month of the year, overvalued and more speculative stocks such as Potlatch tend to decline. As many investors return from summer vacations, this leads to increased trading and volatility in September where portfolios are often rebalanced to include more fundamentally valued stocks as opposed to riskier assets.

Seeing the implied risk to Potlatch’s operations and probability, PCH trades at an extreme P/E multiple of over 1,000X forward earnings. Plus, PCH is at 3.1X sales which is above the optimum level of less than 1X and may be a stretch as the company’s top line expansion is lackluster as well.

Bottom Line

For now, it's best to avoid Potlatch’s stock, especially considering the unfavorable seasonality for the broader market in September. Potlatch shares may certainly have more downside risk ahead as lumber prices remain volatile.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Potlatch Corporation (PCH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.