HAVERTYS HVT is still struggling as the housing market remains in a recession. Will earnings finally turn around in 2025 for this Zacks Rank #5 (Strong Sell)?

HAVERTYS is a home furnishings retailer with 127 showrooms in 17 states, specifically in the Southern and Midwestern regions. Founded in 1885, it specializes in merchandise in the middle to upper-middle price ranges.

HAVERTYS Transitions to a New CEO

On Nov 12, 2024, HAVERTYS announced that long-time CEO and chairman of the board, Clarence H. Smith, will retire from CEO and transition to executive chairman of the board, effective Jan 1, 2025.

Smith had been with the company for 50 years, and CEO for 21 years.

Steven G. Burdette, currently president, will succeed Smith as CEO and will be on the board of directors.

He will be only the 7th CEO in the company’s 139-year history.

HAVERTYS Missed on Q3 2024 Earnings

On Oct 30, 2024, HAVERTYS reported third quarter earnings and missed by $0.19, or 39.6%. Earnings were $0.29 versus the consensus of $0.48.

Sales fell 20.2% to $175.9 million and the all important comparable-store sales decreased 20.5%.

HAVERTYS saw below plan sales, including in the Labor Day sale. It did begin to see an improvement in traffic as the quarter progressed.

Design consultants accounted for 34.5% of written business compared to 29% last year.

The company said the consumer remains cautious on making big-ticket postponeable purchases. The lower home sales and the lack of movement among homeowners, who often buy new furniture when they move, has also dampened demand.

It opened a new store in the quarter and three more locations are expected to open in the fourth quarter. It expects to end 2024 with 129 locations.

In good news, gross margin held up well at 60.2% compared to 60.8% last year.

It had no significant damage to its stores from the recent Florida and Carolina hurricanes.

Analysts Cut 2024 and 2025 Earnings Estimates

Until housing turns around, the furniture retailers will continue to struggle.

2 earnings estimates were cut in the last 30 days for both 2024 and 2025.

The 2024 Zacks Consensus Estimate has fallen to $0.93 from $1.45 just 30 days ago. That’s down 71% from 2023 when the company made $3.25.

The 2025 Zacks Consensus Estimate has also fallen to $1.87 from $2.63 in the last 30 days. But this is earnings growth of 100.5%.

HAVERTYS Has a Great Balance Sheet

Despite the tough market conditions in the furniture industry, HAVERTYS continues to have a great balance sheet.

It had no debt outstanding as of Sep 30, 2024 and credit availability was $80 million.

Cash, cash equivalents and restricted cash equivalents as of Sep 30, 2024, was $127.4 million.

It paid $15.3 million in quarterly cash dividends. HAVERTYS has paid a cash dividend every year since 1935.

The dividend is currently yielding 5.5%.

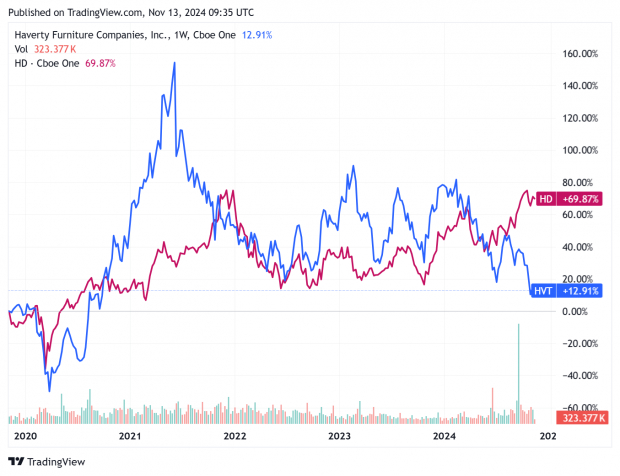

Shares at Multi-Year Lows

Given the pessimism on furniture, it shouldn’t be surprising that HAVERTYS shares are at multi-year lows.

However, until recently, they moved in tandem with other housing related stocks like Home Depot.

Image Source: Zacks Investment Research

With earnings also declining, the shares aren’t cheap on a price-to-earnings (P/E) basis. HAVERTYS trades with a forward P/E of 24.9.

For investors interested in playing a rebound in housing, they should keep HAVERTYS on their watch list.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Haverty Furniture Companies, Inc. (HVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.