Zacks Rank #5 (Strong Sell) stock CVS Health (CVS) is the largest retail pharmacy chain in the United States. The company operates in four main segments: health care benefits, health services, pharmacy and consumer wellness, and corporate/other. Though CVS is a household name, has been in business for more than 60 years, and is highly profitable, the company’s stock is facing several bearish headwinds that are company-specific and industry-wide.

Retail Theft Plagues Pharmacy Industry

Since 2018, the amount of lost retail revenue due to theft has grown each year consecutively and soared overall. For example, in 2018, retailers lost about $50 billion to theft. By 2024, projections call for retail theft losses to balloon to more than $130 billion and a whopping $143 billion by 2025. According to Capital One Financial (COF), “Retailers lost $112.1 billion in gross revenue and $84.9 billion in fraudulent sales returns in 2022.” Meanwhile, “The average shoplifting incident cost retailers $461.86 in 2020.”

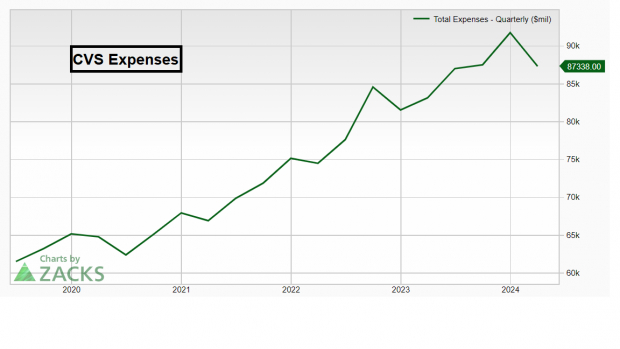

Indeed, there is plenty of time and room for the political blame game. However, as investors, we must focus on what is going on and how it will impact the market while leaving the politics to the dinner table. Brazen organized retail incidents are becoming commonplace. What’s worse, shoplifters are caught roughly 2% of the time and arrested 1% of the time. The troubling trend is leading to higher expenses and worse profit margins.

Image Source: Zacks Investment Research

As a result, CVS and its main drugstore competitor, Walgreens Boots Alliance (WBA), have closed numerous stores in hard-hit areas of the country, such as California and New York. However, customers are turning away from brick-and-mortar drugstores in several open locations. In heavy crime zones like Manhattan, customers must flag down associates to gain access to the growing number of items locked behind protective glass. Instead of accepting the frustrating situation, many retail customers are taking their business to e-commerce retailers such as Amazon (AMZN) or PDD’s (PDD) Temu.

Poor Medicare Advantage Rating Squeezes CVS Profits

Medicare Advantage ratings, or Medicare Star Ratings, measure the performance of Medicare Advantage Part D plans. In 2023, CVS suffered a signficant setback when its largest MA plan, Aetna National PPO, saw its rating plunge from 4.5 to 3.5 stars.

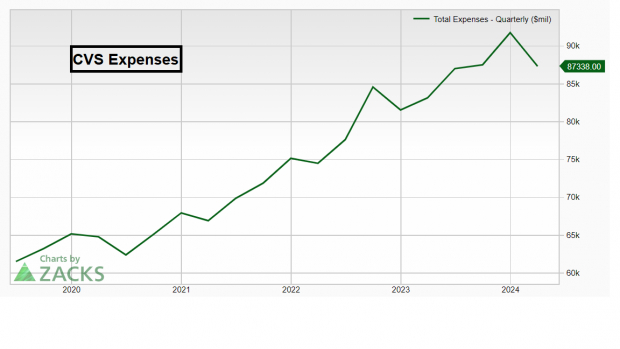

Because of the headwinds above, year-over-year revenue growth at CVS has plunged since 2020.

Image Source: Zacks Investment Research

Relative Performance of CVS Shares Trending Down

CVS shares are down-trending and underperforming the general market by a wide margin – a sign of relative price weakness.

Image Source: Zacks Investment Research

Pharmacy Competitions is Heating Up

Major competitors such as Walgreens, Target (TGT) and Wal-Mart (WMT) are expanding their pharmacy businesses.

Bottom Line

Drugstore giant CVS faces numerous bearish headwinds, which are industry and company-specific. Investors should avoid shares over the next 6-12 months.

Highest Returns for Any Asset Class

It’s not even close. Despite ups and downs, Bitcoin has been more profitable for investors than any other decentralized, borderless form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.