If you’re seeking customer support or service from your brokerage firm, you might turn to search engines like Google or Bing to quickly find the right contact. But be careful where you click. That advertisement you think is for your brokerage firm might actually be part of a scam.

FINRA has observed that bad actors are using sponsored search result ads to impersonate some FINRA member firms’ support centers. When an individual clicks on the ad, instead of being directed to the firm’s page, they’re taken to a fraudulent website controlled by the bad actors. These scammers then attempt to steal funds or personal information from their targets.

This is closely related to tech support scams, a growing category of fraud in which bad actors pretend to be representatives from established tech companies and claim to fix computer problems. And the use of these tactics isn’t limited to financial accounts; fraudulent sponsored ads are also being used in connection with searches for products or other types of support.

How It Works

Scammers create sponsored ads that target individuals seeking technical support by mimicking a firm’s legitimate information, often using the firm’s logo or an extremely similar image. The ad might display the firm’s URL, or web address, even though the link will lead to a different, harmful URL. Along with a fake website, the ad might also contain a fraudulent phone number for the firm. If you call that number, the fraud can occur without you ever visiting the malicious website.

Because the impersonated ad content can closely resemble that of a legitimate search result and sponsored ads often appear in such close proximity to organic search results, these fraudulent ads can be difficult to spot.

If you click on the ad and access the malicious website, the scammers might attempt to gain access to your computer by prompting you to download remote login software or malware. If they successfully gain access, the scammers can retrieve personal information or login credentials, transfer funds and install malware for future attacks—potentially all without you realizing what has occurred.

How to Avoid the Scam

- Rather than going through a search engine, contact your firm’s support center directly from the firm’s website or mobile application, or call the number on your account statement or credit card.

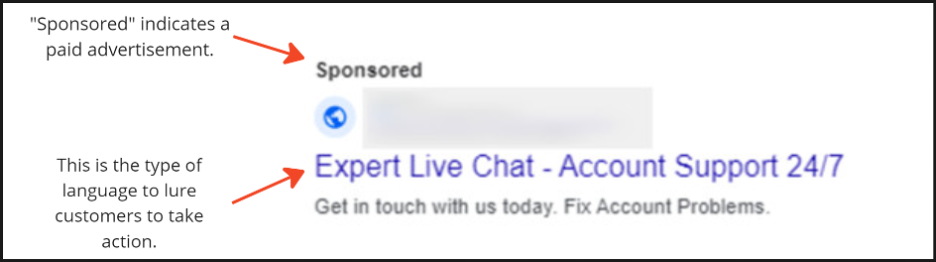

- If you do search for information, take your time and pay close attention to differentiate between ads and legitimate search results. Depending on the search engine, ads might have the word “sponsored” or “ad” in small copy above them or appear in a box or with background shading.

- Carefully read headlines and URLs to look for typos or misleading characters. If you click on a search result, check that the URL you’re taken to matches the web address that was displayed.

- Ensure that your antivirus and malware protection is up to date, and consider using an ad-blocking extension in your internet browser.

- Use caution when downloading software onto your computer, including legitimate remote sharing programs.

- Don’t grant access to your computer or provide sensitive personal information. If at any point during a support session you suspect a scam or feel uncomfortable or unsafe, end the session immediately by closing your browser and related programs, disconnecting your internet, or hanging up the call.

- Never provide your login information or one-time verification codes to a third party.

If you believe you’ve been the victim of a support center scam, change your passwords immediately. Run an antivirus scan on your computer, and carefully examine your financial accounts for any unauthorized transfers, withdrawals or charges. Immediately report the incident to your firm, and report any fraudulent ads to the relevant search engine company by looking for an option to flag the ad or sending feedback through your search settings.

You might also want to file a tip with FINRA, the SEC or the FBI’s Internet Complaint Center.

Learn more about other types of imposter investment scams and how to protect your money.

FINRA is dedicated to investor protection and market integrity. It regulates one critical part of the securities industry – brokerage firms doing business with the public in the United States. FINRA, overseen by the SEC, writes rules, examines for and enforces compliance with FINRA rules and federal securities laws, registers broker-dealer personnel and offers them education and training, and informs the investing public. In addition, FINRA provides surveillance and other regulatory services for equities and options markets, as well as trade reporting and other industry utilities. FINRA also administers a dispute resolution forum for investors and brokerage firms and their registered employees. For more information, visit www.finra.org.

Photo Credit: @istockphoto.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.