BDSwiss Outlook: Is the Worst Just Starting For Coronavirus?

Marshall Gittler is the Head of Investment Research at online brokerage firm BDSwiss Global

A few days ago I wrote a piece entitled, “Is the worst over?” I was referring to the global economy, which was showing the proverbial “green shoots,” in this case defined as “indications that economic activity in May was slightly less horrible than in April.”

However, I’ve often quoted Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, who famously said, “You don’t make the timeline, the virus does.” So today I’d like to take a look at what’s happening with the virus.

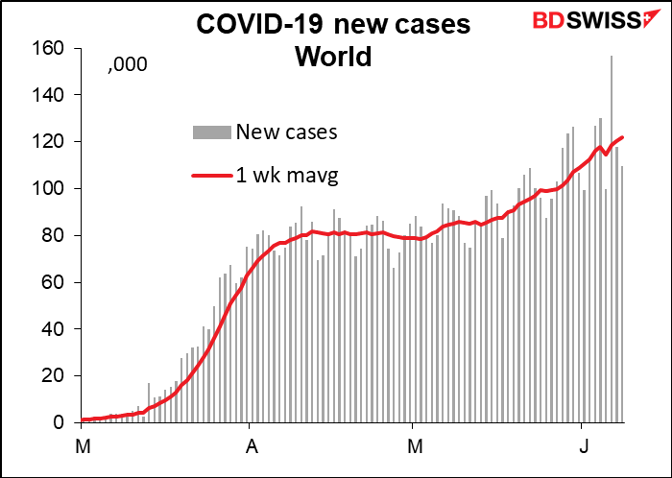

In a nutshell, it’s not great. In fact, it’s terrible. World Health Organization (WHO) Director-General Dr Tedros Adhanom Ghebreyesus observed this week that “Although the situation in Europe is improving, globally it is worsening.”

Indeed it is.

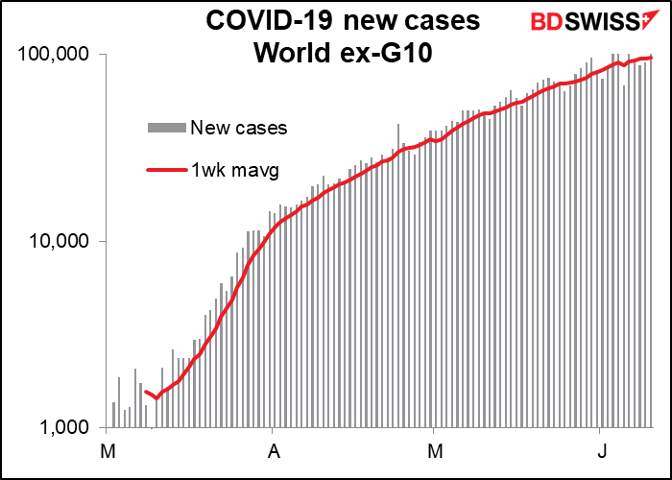

Most of the acceleration is coming from the developing world:

If we re-plot that graph in logarithmic scale, we get the tell-tale straight line that spells exponential growth. Exponential growth is great when we’re talking about the number of transistors on a chip, but disastrous in the case of a potentially deadly disease.

The G10 however is another story. There, new cases are falling, although the pace of decline has plateaued out recently.

I’m going to focus on the G10, because this is a foreign exchange column, not a medical column, and most of my readers are probably trading G10 FX not EM FX. Of course, the health and safety of the developing world is important for the global economy and therefore will have repercussions back to the G10. Moreover, a pandemic that’s raging in one part of the world will eventually be raging in all parts of the world. Nonetheless that’s some time down the road.

Within the G10, new cases continue to decline outside the US, but the US has stopped improving.

Looking at that data another way, we can see that new cases are only a fraction of their peak level in six of the 10 countries/regions. Canada and Britain still have a relatively high burden, but at least they are headed in the right direction. They bear watching however.

There are two outliers: Sweden, where the pandemic is now at its peak, and the US, which has plateaued at a relatively high level.

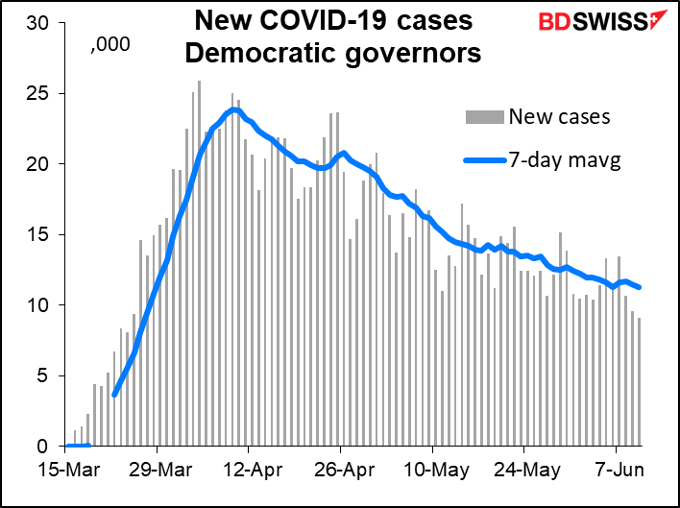

The US data shows some notable differences among the states, probably a reflection of a) the different degree of urbanization in each state, and b) the different approach each state locked down. In general, states with governors from the Democratic Party tend to be more urban and went into lockdown earlier and more stringently. States with Republican governors tend to be more rural and have generally taken a looser attitude towards lockdown.

The result is easily visible in the data. The more urban Democratic states saw a much higher peak much earlier (mostly that was New York and New Jersey) but the numbers have been coming down steadily. (Blue is the color of the Democratic Party, red is the color of the Republican Party)

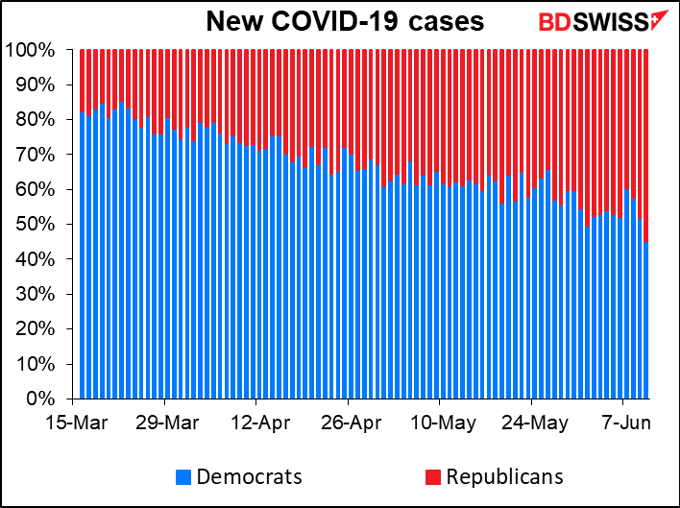

The Republican states got off to a slower start, but the numbers have been increasing recently.

As a result the new cases are now divided fairly evenly between the two.

I looked at how the latest seven-day average of new cases compared with the average a week ago. On this basis, there are 28 states and territories where the number of cases is falling and 24 where it’s rising (I’m including Puerto Rico and Washington DC in my calculations and assigning both to the Democrats). It’s lower in 16 Democratic states and higher in 10; on the other hand, it’s lower in only 12 Republican states and higher in 14.

In this graph, the Y-axis (vertical) is the average number of new cases over the last week, while the X-axis (horizontal) is how this compares with a week earlier. You can easily see which states are the most troubled.

Michigan is a statistical fluke – there was a huge increase of 5,888 cases on 7 June, vs an average of 272 cases a day in the week beforehand and 385 cases a day afterward. It looks like a testing program suddenly uncovered a lot of previously undiagnosed cases.

That leaves Texas and California as the biggest problem states. New cases in Texas bottomed five days after the lockdown effectively ended. They’ve since hit a record high. (Note: most states had a gradual relaxation of lockdown. If possible, I’m taking as the date the time when restaurants reopen.)

California is an odd situation. Roughly half the new cases are in the Los Angeles area.

New cases took off in Arizona eleven days after lockdown ended there.

Florida was declining, but then two weeks after they relaxed the lockdown, new cases flared up again.

Note that California, Texas and Florida are the three most populous states, with a combined 90.5mn people. Arizona is smaller (7.3mn) but has the fastest growth rate in the last week. While these states haven’t seen the sort of case numbers that New York had (#4 in population and nearly 20,000 total cases per million), the four states are seeing 2,700-4,100 cases per million, similar to what Italy and France experienced and just below the UK. And unlike Europe and New York nowadays, the number of cases in these states is continuing to rise.

North Carolina has shown a steady rise.

This is all nice and good and useful if you’re planning on traveling in or to the US, but why should a forex market participant be interested in all this? For two reasons:

- The number of new cases is clearly increasing as states emerge from lockdown. To make matters worse, the massive demonstrations that the US has seen recently, while IMHO justified from a political point of view, may well exacerbate the problem. This suggests that the dreaded “second wave” of infections may well be starting.

- Trump won all the states mentioned above except for California. The fact that the virus is starting to become more virulent in Republican states is yet another threat to his reelection (did I hear someone mention something about clouds and linings?). It’s hard to vote for someone if you’re dead. Furthermore, voters may well hold it against someone who told them the virus would disappear like magic in April, especially if their grandfather happens to die a few weeks before the election. Not to mention that older people, the most endangered by Trump’s bungling of this whole affair, have the highest voter turnout.

That may be one the reasons why the Democratic candidate has recently been surging as the likely winner in the 2020 Presidential election on Predictit.org, an academic betting website.

FX Market implications: USD-negative now, USD-positive later In the immediate future, I expect that the eruption of a “second wave” of infections in the US would be negative for the dollar. It would at least cause another downturn in economic activity, at worst even another lockdown. If that were to happen as the rest of the industrial world was getting back to normal, the growth differential between the US and the rest of the world would explode, to the detriment of the US and USD. Furthermore, another leg down in US economic activity would force the Fed to take even more extreme loosening measures, such as yield curve control, which would diminish the attractiveness of Treasury bonds and thereby discourage inflows into the dollar. A researcher at the St. Louis Fed has already argued that negative interest rates will be necessary to achieve a V-shaped recovery.

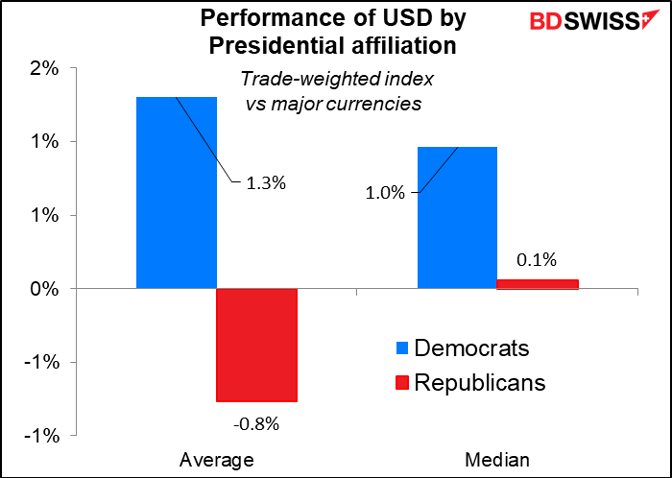

As November approaches however any increase in the likelihood of Trump being evicted would be positive for the US currency, in my view. That’s because a) most people outside of the US dislike him intensely (he regularly polls outside the US as the least popular leader of any major country) and b) the end of the Trump regime could mean the end of the trade war with China, with beneficial effects on the US economy and world growth in general. Not to mention that the dollar generally does better under Democratic administrations than Republican ones.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.