Baxter International Inc. BAX recently received the FDA’s 510(k) clearance for its ST Set used in continuous renal replacement therapy (“CRRT”). The system is expected to offer additional options to provide CRRT for patients in an acute care environment.

The ST Set, a pre-connected, disposable, extracorporeal (outside the body) circuit, offers blood purification via a semi-permeable membrane and is to be used with the PrisMax or Prismaflex control units (monitors). It has been available to U.S. customers since August 2020 after the receipt of the FDA’s Emergency Use Authorization to provide CRRT to treat patients in an acute care environment during the pandemic. Presently, the ST Set is being used across countries in Europe, Asia Pacific, and North and South America.

With the latest regulatory clearance, Baxter’s Renal Care business is expected to gain a solid foothold in the global arena.

Significance of the Approval

Per management, the ST Set has been playing a crucial role in boosting the availability of CRRT sets, which have been in high demand during the pandemic. The latest clearance, which will provide the ST Set to U.S. healthcare providers and hospitals on a permanent basis, will likely help in broadening access to CRRT for patients with acute kidney injury (“AKI”).

It is worth mentioning that AKI is a sudden decrease in kidney function that occurs over a period of certain hours to days, often resulting from illness, trauma or infection. The sudden loss of kidney function leads to the accumulation of toxins and fluid in blood which, if left untreated, may turn fatal. Further, AKI is an increasingly common complication of acute illnesses in intensive care units and hospitals, and is one of many complications affecting COVID-19 patients.

Industry Prospects

Per a report by Research and Markets, the global hemodialysis market was valued at $78.30 billion in 2019 and is estimated to reach $116.66 billion by 2030 at a CAGR of 3.6%. Factors like rising incidences of renal issues, growing cases of diabetes and hypertension, and shortage of kidney donors are likely to drive the market.

Given the market potential, the latest FDA approval is expected to provide a significant boost to Baxter’s business globally.

Notable Developments

In March, Baxter announced a long-term strategic partnership with Digital Diagnostics to advance diabetic retinopathy detection. The tie-up is aimed at helping front-line care providers deliver better quality of care and improve care outcomes.

The same month, the company announced new data indicating that the use of its Sharesource remote patient management platform with an automated peritoneal dialysis cycler may improve the clinical effectiveness of home kidney patients’ care by extending their time on therapy by 3.4 months.

In February, BAX announced its fourth-quarter 2021 financial results, wherein it registered a robust uptick in worldwide sales. The company also recorded solid performances across its three geographic segments, along with strong growth in its legacy businesses led by BioPharma Solutions.

Price Performance

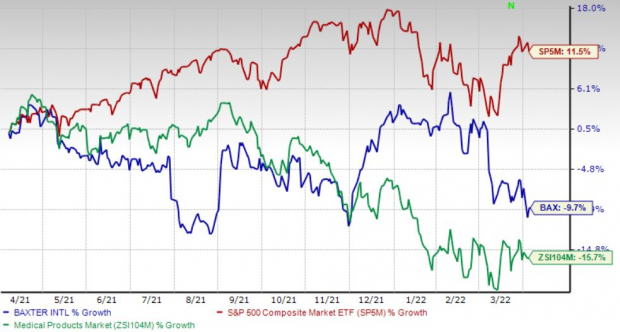

Shares of the company have lost 9.7% in the past year compared with the industry’s 15.7% fall. The S&P 500 has risen 11.5% in the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Baxter carries a Zacks Rank #3 (Hold).

A few stocks from the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, Edwards Lifesciences Corporation EW and Henry Schein, Inc. HSIC.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 20%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 37.5% against the industry’s 54.4% fall over the past year.

Edwards Lifesciences, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 13.9%. EW’s earnings surpassed estimates in three of the trailing four quarters, the average surprise being 6.5%.

Edwards Lifesciences has gained 42.9% compared with the industry’s 1.2% growth over the past year.

Henry Schein has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.5%. It currently has a Zacks Rank #2.

Henry Schein has gained 26.9% compared with the industry’s 8.8% growth over the past year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.