Baxter International Inc. BAX recently announced the receipt of the FDA’s approval and commercial launch of premix (ready-to-use) Norepinephrine Bitartrate in 5% Dextrose Injection (norepinephrine). The company’s formulation of norepinephrine, which is the first and only manufacturer-prepared ready-to-use formulation, is available in two varieties — 4 mg/250 mL (16 mcg/mL) and 8 mg/250 mL (32 mcg/mL).

For investors’ note, norepinephrine — indicated to raise blood pressure in adult patients with severe and acute hypotension or low blood pressure— is currently available from Baxter in the United States.

Norepinephrine uses the company’s proprietary VIAFLO container technology, which is not made with natural rubber latex, PVC or DEHP.

With the latest regulatory clearance and commercial launch of the ready-to-use format of the injection, Baxter will be able to solidify its position in the hospital products space in the United States.

Significance of the Launch

Per management, the ready-to-use formulation of norepinephrine is expected to allow hospitals to store the medication near patient care settings, like the emergency unit or the intensive care unit. This will enable care providers to administer the injection faster, while lessening the risk of compounding errors or touch contamination. This is likely to lead to improved speed, efficiency and safety during any critical care situation.

The use of premixes of standard doses of commonly prescribed drugs may also offer operational efficiencies in the hospital pharmacy. Compounding a drug for patient use comprises of various steps and manual processes that depends on the oversight of pharmacy staffs. Using a ready-to-use product can simplify the preparation process and may also aid in enhancing patient safety by avoiding potential dosing errors that may occur while medications are compounded on site.

Industry Prospects

Per a report by 360 Research Reports, the global norepinephrine (noradrenaline) market is anticipated to reach $774.4 million by 2027 from $465 million in 2020 at a CAGR of 11.8%. Factors like a wide patient pool of hypotension cases worldwide and surge in the elderly population are expected to drive the market.

Given the market potential, the commercial launch of the ready-to-use injection is expected to significantly boost Baxter’s U.S. business.

Notable Developments

Of late, Baxter has been witnessing a few notable developments across its business.

The company, earlier this month, inked a definitive agreement under which it will acquire Hill-Rom Holdings, Inc. HRC, subject to approval of the latter’s shareholders and the fulfilment of customary closing conditions (including regulatory approvals).

Baxter, in August, had extended its multi-year strategic agreement with Amazon Web Services to enable cloud technology solutions to accelerate its digital transformation forward.

In July, the company had announced that its Baxter Healthcare Corporation subsidiary has completed the acquisition of certain assets related to PerClot Polysaccharide Hemostatic System from CryoLife. The transaction reinforces Baxter’s strategy of acquiring products and technologies that both complement and augment its portfolio across the hospital, including in the operating room.

Price Performance

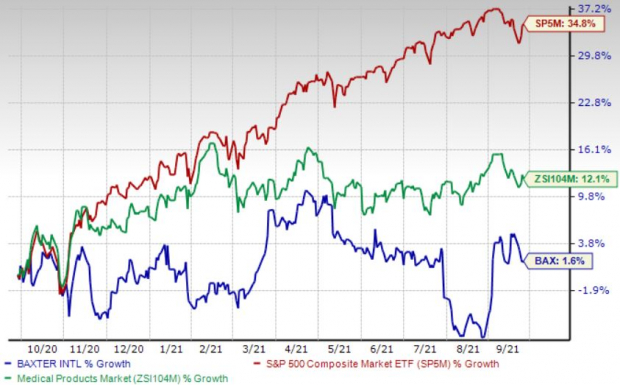

Shares of Baxter have gained 1.7% in the past year compared with the industry’s 12.1% growth and the S&P 500's 34.8% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Baxter carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC and IDEXX Laboratories, Inc. IDXX.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX’s long-term earnings growth rate is estimated at 19.9%. It currently has a Zacks Rank #2.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it's poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

HillRom Holdings, Inc. (HRC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.