Baudax Bio, Inc. BXRX announced additional positive data from its phase II study of BX1000, which is used as a neuromuscular blockade (“NMB”) in patients undergoing elective surgery. The efficacy of the NMB is assessed by analyzing its electromyography (“EMG”).

Additional analysis of EMG of BX1000 confirmed that administration of the higher dose of the long-acting drug showed a benefit profile that compares favorably with the current standard-of-care neuromuscular blocking agent, rocuronium.

The stock of the company jumped 4.4% on Wednesday, following the positive news.

The phase II surgery study compared three different doses of BX1000 to a standard dose of 0.6mg/kg rocuronium in 80 patients who had elective surgery utilizing total intravenous anesthesia. The study was divided into four cohorts, each receiving either of the three BX1000 doses or a dose of rocuronium.

The primary efficacy endpoint of the study was the proportion of patients that met the criteria for Good or Excellent intubating conditions using a standardized scale. The study also evaluated the safety and tolerability profile of BX1000 and rocuronium in the patient population.

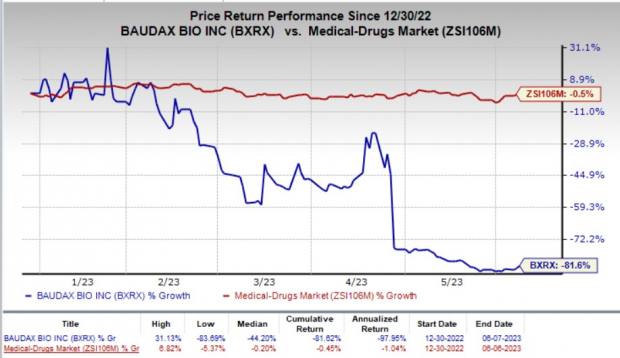

So far this year, shares of Baudax have plunged 81.6% compared with the industry’s 0.5% fall.

Image Source: Zacks Investment Research

In April 2023, the company first reported top-line results from the phase II study of BXRX for NMB in patients undergoing elective surgery. The study met its primary efficacy endpoint, observing all patients in the three BX1000 study cohorts met the criteria for Good or Excellent intubating conditions at 60 seconds. BX1000 was overall well tolerated in all three cohorts which received different doses of the candidate and all patients, across regimens, met the primary efficacy criteria. No severe or serious adverse events were observed during the study.

Top-line results showed evidence of a dose-response across all three doses of BX1000 but only speculated that the degree of blockade for the group receiving the highest dose of BX1000 was comparable to that of the standard dose of rocuronium.

This speculation now stands confirmed as the additional EMG data showed comparable results for the highest dose of BX1000 and the standard dose of rocuronium as 80% NMB was achieved by both in an equivalent time. Full recovery was also achieved in equivalent time for the highest dose of BX1000 and the standard dose of rocuronium, although BX1000 offered a more controlled environment.

The company will continue to develop BX1000 and expects to submit a new drug application by the end of 2025.

Baudax Bio, Inc. Price and Consensus

Baudax Bio, Inc. price-consensus-chart | Baudax Bio, Inc. Quote

Zacks Rank and Other Stocks to Consider

Baudax Bio currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the same industry are Akebia Therapeutics AKBA, Immunogen IMGN and Iterum Therapeutics ITRM, all carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for Akebia Therapeutics’ 2023 loss per share has narrowed from 40 cents to 28 cents. During the same period, the estimate for Akebia Therapeutics’ 2024 loss per share has narrowed from 24 cents to 16 cents. In the year so far, shares of the company have gained by 121.8%.

AKBA beat estimates in three of the trailing four reported quarters and missed the mark on one occasion, delivering an average earnings surprise of 41.41%.

In the past 90 days, the Zacks Consensus Estimate for ImmunoGen’s 2023 loss per share has narrowed from 83 cents to 54 cents. During the same period, the estimate for ImmunoGen’s 2024 loss per share has narrowed from 58 cents to 29 cents. In the year so far, shares of the company have rallied by 196.6%.

IMGN beat estimates in two of the trailing four quarters and missed twice, delivering an average earnings surprise of 7.09%.

In the past 90 days, the Zacks Consensus Estimate for Iterum Therapeutics’ 2023 loss per share has narrowed from $5.91 to $3.31. During the same period, the estimate for Iterum Therapeutics’ 2024 loss per share has narrowed from $4.95 to $3.08. So far this year, shares of the company have risen by 35.7%.

ITRM beat estimates in three of the trailing four reported quarters and missed the mark once, reporting a negative average earnings surprise of 6.56%.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It's undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don't? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse - What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don't miss your chance to access it for free with no obligation.

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Akebia Therapeutics, Inc. (AKBA) : Free Stock Analysis Report

Iterum Therapeutics PLC (ITRM) : Free Stock Analysis Report

Baudax Bio, Inc. (BXRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.