Fintel reports that on August 7, 2023, Barclays maintained coverage of Paylocity Holding (NASDAQ:PCTY) with a Equal-Weight recommendation.

Analyst Price Forecast Suggests 25.67% Upside

As of August 2, 2023, the average one-year price target for Paylocity Holding is 259.20. The forecasts range from a low of 206.04 to a high of $341.25. The average price target represents an increase of 25.67% from its latest reported closing price of 206.25.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Paylocity Holding is 1,402MM, an increase of 19.36%. The projected annual non-GAAP EPS is 4.98.

What is the Fund Sentiment?

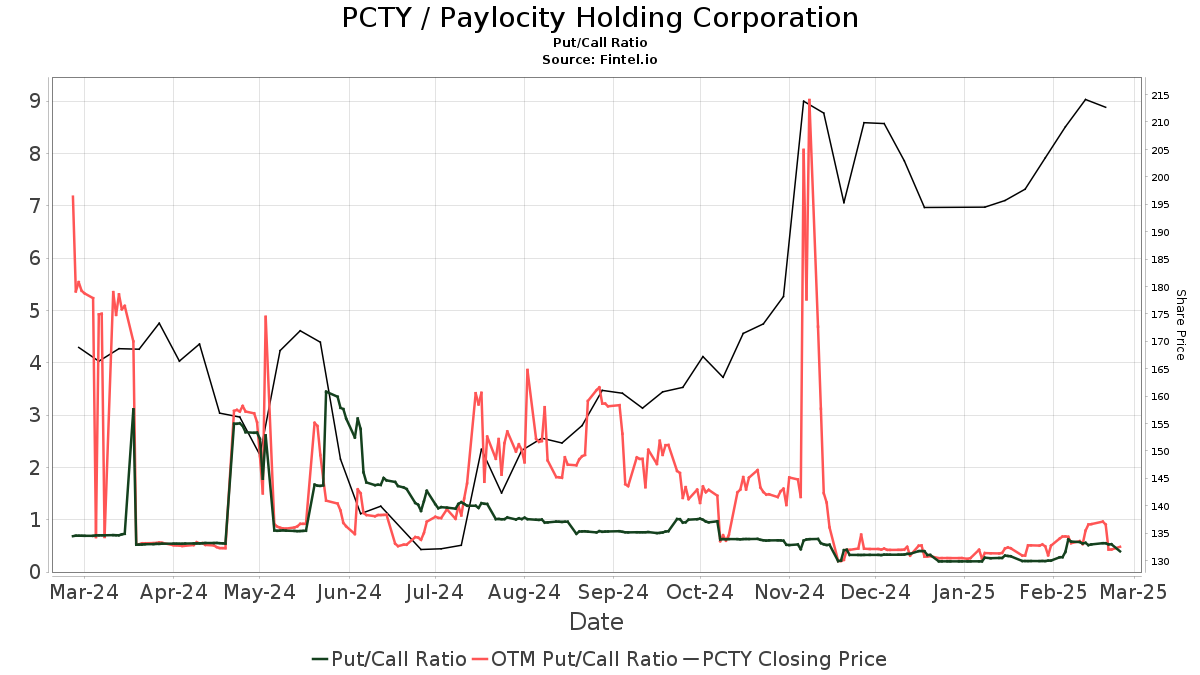

There are 961 funds or institutions reporting positions in Paylocity Holding. This is a decrease of 9 owner(s) or 0.93% in the last quarter. Average portfolio weight of all funds dedicated to PCTY is 0.31%, a decrease of 17.02%. Total shares owned by institutions decreased in the last three months by 0.27% to 49,083K shares.  The put/call ratio of PCTY is 1.02, indicating a bearish outlook.

The put/call ratio of PCTY is 1.02, indicating a bearish outlook.

What are Other Shareholders Doing?

Price T Rowe Associates holds 5,719K shares representing 10.25% ownership of the company. In it's prior filing, the firm reported owning 5,781K shares, representing a decrease of 1.08%. The firm decreased its portfolio allocation in PCTY by 5.79% over the last quarter.

PRNHX - T. Rowe Price New Horizons Fund holds 3,618K shares representing 6.48% ownership of the company. In it's prior filing, the firm reported owning 3,817K shares, representing a decrease of 5.49%. The firm decreased its portfolio allocation in PCTY by 8.33% over the last quarter.

T. Rowe Price Investment Management holds 2,322K shares representing 4.16% ownership of the company. In it's prior filing, the firm reported owning 1,721K shares, representing an increase of 25.88%. The firm increased its portfolio allocation in PCTY by 28.99% over the last quarter.

Wasatch Advisors holds 1,462K shares representing 2.62% ownership of the company. In it's prior filing, the firm reported owning 1,325K shares, representing an increase of 9.34%. The firm increased its portfolio allocation in PCTY by 4.40% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,293K shares representing 2.32% ownership of the company. In it's prior filing, the firm reported owning 1,268K shares, representing an increase of 1.88%. The firm decreased its portfolio allocation in PCTY by 3.71% over the last quarter.

Paylocity Holding Background Information

(This description is provided by the company.)

Paylocity is a leading provider of cloud-based HR and payroll software solutions headquartered in Schaumburg, IL. Founded in 1997, Paylocity offers an intuitive, easy-to-use product suite that helps businesses tackle today's challenges while moving them toward the promise of tomorrow. Known for its unique culture and consistently recognized as one of the best places to work, Paylocity accompanies its clients on the journey to create great workplaces and help people achieve their best through automation, data-driven insights, and engagement.

Additional reading:

- Executive Employment Agreement between Paylocity Corporation and Joshua Scutt, dated August 16, 2021.

- Executive Employment Agreement between Paylocity Corporation and Katherine Ross, dated December 1, 2022.

- Long-Term Financial Targets (1)(2)

- PAYLOCITY HOLDING CORPORATION Unaudited Consolidated Balance Sheets (in thousands, except per share data)

- PAYLOCITY HOLDING CORPORATION Unaudited Consolidated Balance Sheets (in thousands, except per share data)

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Outperform%20Recommendation%20%7C%20Nasdaq&_biz_n=14&rnd=145992&cdn_o=a&_biz_z=1743616637264)

%20Equal-Weight%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=958607&cdn_o=a&_biz_z=1743616637264)

%20Equal-Weight%20Recommendation%20%7C%20Nasdaq&rnd=868474&cdn_o=a&_biz_z=1743616637268)

%20Equal-Weight%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=958607&cdn_o=a&_biz_z=1743616640264)

%20Equal-Weight%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=958607&cdn_o=a&_biz_z=1743616640265)