Fintel reports that on July 20, 2023, B. Riley Securities reiterated coverage of Beam Global (NASDAQ:BEEM) with a Buy recommendation.

Analyst Price Forecast Suggests 113.87% Upside

As of July 6, 2023, the average one-year price target for Beam Global is 26.52. The forecasts range from a low of 11.11 to a high of $42.00. The average price target represents an increase of 113.87% from its latest reported closing price of 12.40.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Beam Global is 46MM, an increase of 46.50%. The projected annual non-GAAP EPS is -0.53.

What is the Fund Sentiment?

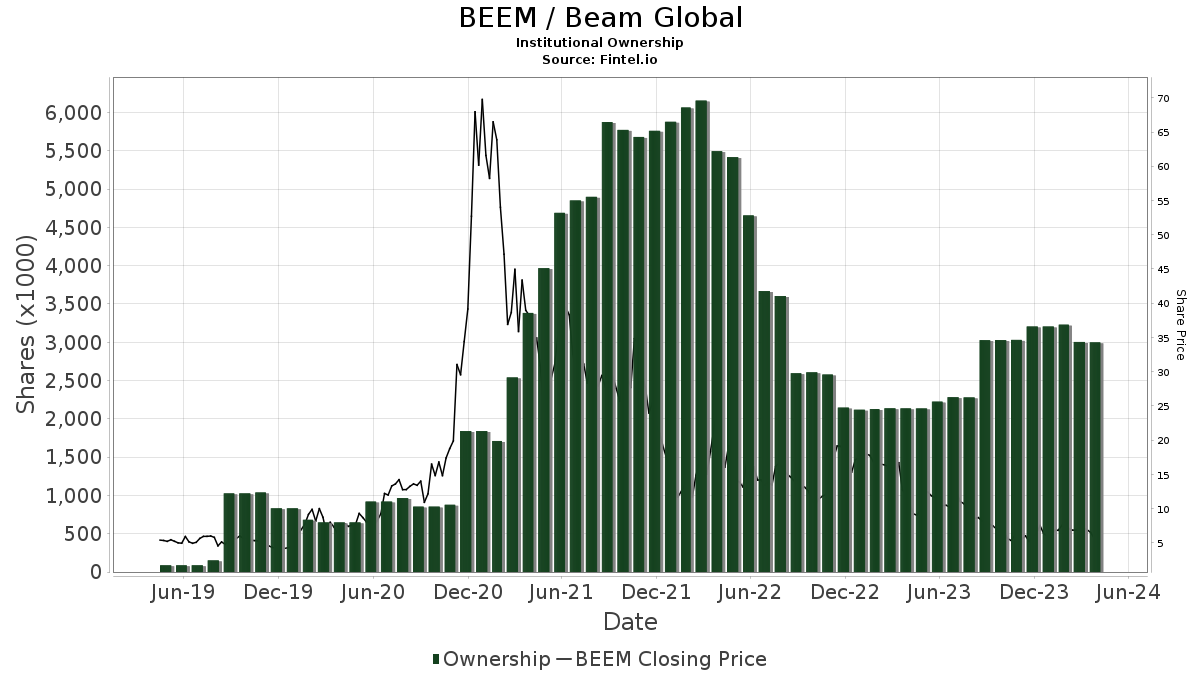

There are 100 funds or institutions reporting positions in Beam Global. This is an increase of 5 owner(s) or 5.26% in the last quarter. Average portfolio weight of all funds dedicated to BEEM is 0.03%, an increase of 19.02%. Total shares owned by institutions increased in the last three months by 6.67% to 2,281K shares.  The put/call ratio of BEEM is 0.23, indicating a bullish outlook.

The put/call ratio of BEEM is 0.23, indicating a bullish outlook.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 318K shares representing 2.95% ownership of the company. In it's prior filing, the firm reported owning 296K shares, representing an increase of 6.70%. The firm decreased its portfolio allocation in BEEM by 9.87% over the last quarter.

Invesco holds 214K shares representing 1.99% ownership of the company. In it's prior filing, the firm reported owning 232K shares, representing a decrease of 8.46%. The firm decreased its portfolio allocation in BEEM by 20.03% over the last quarter.

PBW - Invesco WilderHill Clean Energy ETF holds 207K shares representing 1.93% ownership of the company. In it's prior filing, the firm reported owning 232K shares, representing a decrease of 12.07%. The firm decreased its portfolio allocation in BEEM by 37.67% over the last quarter.

VEXMX - Vanguard Extended Market Index Fund Investor Shares holds 127K shares representing 1.18% ownership of the company. In it's prior filing, the firm reported owning 123K shares, representing an increase of 2.54%. The firm decreased its portfolio allocation in BEEM by 11.70% over the last quarter.

KOMP - SPDR S&P Kensho New Economies Composite ETF holds 124K shares representing 1.16% ownership of the company. In it's prior filing, the firm reported owning 121K shares, representing an increase of 2.85%. The firm decreased its portfolio allocation in BEEM by 15.57% over the last quarter.

Beam Global Background Information

(This description is provided by the company.)

Beam Global is a CleanTech leader that produces innovative, sustainable technology for electric vehicle (EV) charging, outdoor media, and energy security, without the construction, disruption, risks and costs of grid-tied solutions. Products include the patented EV ARC™ and Solar Tree® lines with BeamTrak™ patented solar tracking, and ARC Technology™ energy storage, along with EV charging, outdoor media and disaster preparedness packages.

Additional reading:

- [Signature Page to Follow.]

- Beam Global Reports First Quarter 2023 Operating Results Record Revenues, Positive Gross Margin, $5M cash at time of reporting

- Beam Global Reports Fourth Quarter and Full Year 2022 Financial Results Conference Call Wednesday March 29, 2023 at 4:30 p.m. ET

- Restricted Stock Unit Award Agreement

- Performance Stock Unit Award Agreement

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.