Fintel reports that on September 8, 2023, B of A Securities maintained coverage of Aramark (NYSE:ARMK) with a Buy recommendation.

Analyst Price Forecast Suggests 27.60% Upside

As of August 31, 2023, the average one-year price target for Aramark is 46.82. The forecasts range from a low of 38.38 to a high of $52.50. The average price target represents an increase of 27.60% from its latest reported closing price of 36.69.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Aramark is 18,524MM, an increase of 0.99%. The projected annual non-GAAP EPS is 1.94.

Aramark Declares $0.11 Dividend

On August 2, 2023 the company declared a regular quarterly dividend of $0.11 per share ($0.44 annualized). Shareholders of record as of August 16, 2023 received the payment on August 29, 2023. Previously, the company paid $0.11 per share.

At the current share price of $36.69 / share, the stock's dividend yield is 1.20%.

Looking back five years and taking a sample every week, the average dividend yield has been 1.29%, the lowest has been 0.97%, and the highest has been 2.59%. The standard deviation of yields is 0.27 (n=236).

The current dividend yield is 0.32 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.21. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company has not increased its dividend in the last three years.

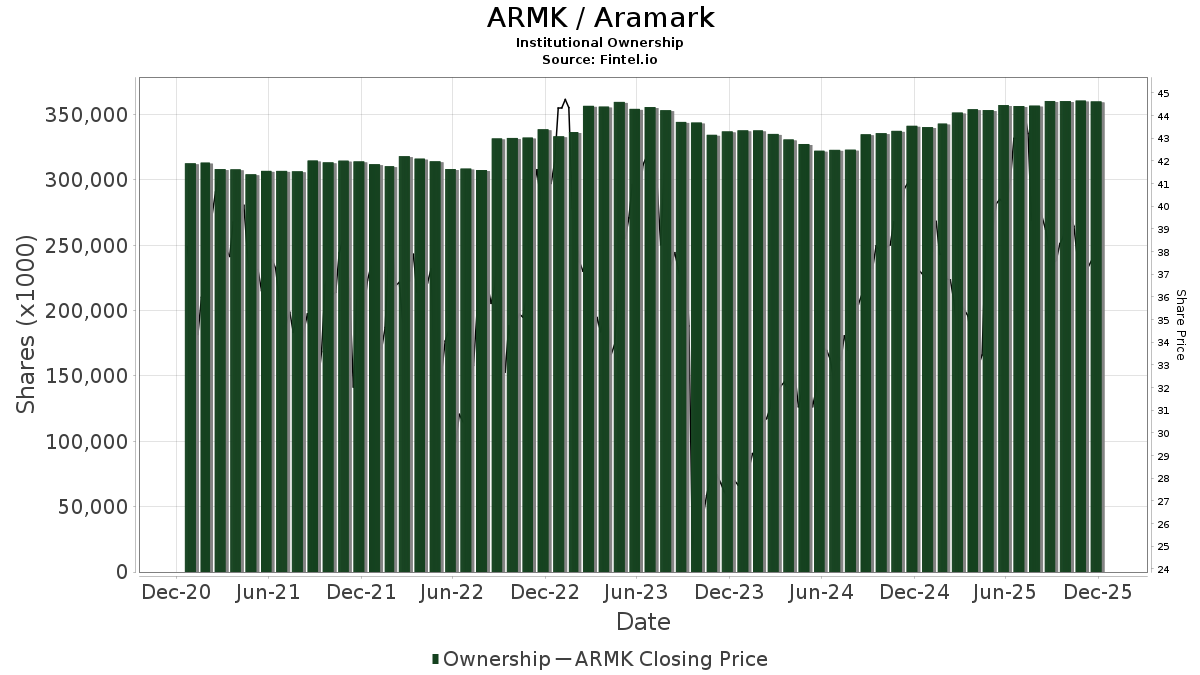

What is the Fund Sentiment?

There are 752 funds or institutions reporting positions in Aramark. This is a decrease of 12 owner(s) or 1.57% in the last quarter. Average portfolio weight of all funds dedicated to ARMK is 0.27%, an increase of 4.38%. Total shares owned by institutions decreased in the last three months by 1.40% to 343,947K shares.  The put/call ratio of ARMK is 0.48, indicating a bullish outlook.

The put/call ratio of ARMK is 0.48, indicating a bullish outlook.

What are Other Shareholders Doing?

Capital International Investors holds 33,660K shares representing 12.89% ownership of the company. In it's prior filing, the firm reported owning 33,614K shares, representing an increase of 0.14%. The firm increased its portfolio allocation in ARMK by 12.94% over the last quarter.

ABALX - AMERICAN BALANCED FUND holds 16,913K shares representing 6.48% ownership of the company. In it's prior filing, the firm reported owning 15,795K shares, representing an increase of 6.61%. The firm increased its portfolio allocation in ARMK by 25.06% over the last quarter.

Barrow Hanley Mewhinney & Strauss holds 11,377K shares representing 4.36% ownership of the company. In it's prior filing, the firm reported owning 13,205K shares, representing a decrease of 16.06%. The firm increased its portfolio allocation in ARMK by 16.10% over the last quarter.

Farallon Capital Management holds 10,887K shares representing 4.17% ownership of the company. In it's prior filing, the firm reported owning 11,238K shares, representing a decrease of 3.22%. The firm increased its portfolio allocation in ARMK by 15.04% over the last quarter.

AMERICAN FUNDS INSURANCE SERIES - Asset Allocation Fund Class 1 holds 10,375K shares representing 3.97% ownership of the company. In it's prior filing, the firm reported owning 11,375K shares, representing a decrease of 9.64%. The firm increased its portfolio allocation in ARMK by 6.96% over the last quarter.

Aramark Background Information

(This description is provided by the company.)

Aramark proudly serves the world's leading educational institutions, Fortune 500 companies, world champion sports teams, prominent healthcare providers, iconic destinations and cultural attractions, and numerous municipalities in 19 countries around the world. It delivers innovative experiences and services in food, facilities management and uniforms to millions of people every day. It strives to create a better world by making a positive impact on people and the planet, including commitments to engage our employees; empower healthy consumers; build local communities; source ethically, inclusively and responsibly; operate efficiently and reduce waste. Aramark is recognized as a Best Place to Work by the Human Rights Campaign (LGBTQ+), DiversityInc, Equal Employment Publications and the Disability Equality Index.

Additional reading:

- LOCK-UP AGREEMENT

- OPTION SALE AGREEMENT Date: August 9, 2023 To: MR Bridgestone Offshore Fund AB Ltd. (“Counterparty”) Address: 712 Fifth Avenue Suite 17F New York, NY 10019 Attention: Mantle Ridge LP – Chris Lee Email: chris.lee@pchcapital.com Phone: (646) 762-8540 F

- ARAMARK 21,262,245 Shares of Common Stock Underwriting Agreement

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Q4%202019%20Earnings%20Call%20Transcript%20%7C%20Nasdaq&_biz_n=13&rnd=521177&cdn_o=a&_biz_z=1743609041977)

%20Buy%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=225165&cdn_o=a&_biz_z=1743609041977)

%20Buy%20Recommendation%20%7C%20Nasdaq&rnd=859718&cdn_o=a&_biz_z=1743609041982)

%20Buy%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=225165&cdn_o=a&_biz_z=1743609044977)

%20Buy%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=225165&cdn_o=a&_biz_z=1743609044978)

%20Buy%20Recommendation%20%7C%20Nasdaq&_biz_n=15&rnd=225165&cdn_o=a&_biz_z=1743609044979)