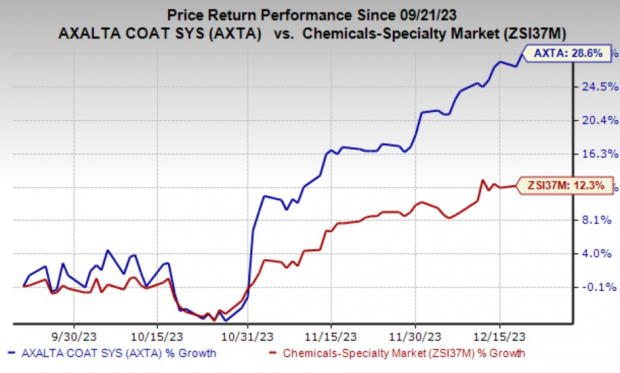

Axalta Coating Systems Ltd.’s AXTA shares have gained 28.6% in the last three months. Owing to the upside, the stock outperformed the industry’s rise of 12.3% over the same time frame. The company has topped the S&P 500’s roughly 6.7% rise over the same period.

Image Source: Zacks Investment Research

Let’s look at the factors driving this Zacks Rank #1 (Strong Buy) stock.

What’s Going in Axalta’s Favor?

In the third quarter, Axalta demonstrated robust performance with a notable 15.4% year-over-year increase in earnings and a 5.7% year-over-year sales growth — totaling $1.3 billion. Income from operations soared 32% year over year to $163 million, enhancing the operating margin by 250 basis points (bps) to 12.5%. Adjusted EBIT also improved, rising to $188 million from $148 million, showcasing a 240 bps increase in the adjusted EBIT margin to 14.3% compared with the previous year’s levels.

The Performance Coatings segment reported a 2.2% increase in net sales, attributed to an enhanced price mix and positive effects from foreign currency translation, partly offset by lower volumes. The segment's Adjusted EBIT totaled $135 million, with a margin of 15.8%. Mobility Coatings experienced substantial growth, with a 13% increase in net sales. The upside can be attributed to price-mix growth and volume improvement, particularly in Greater China. The segment's Adjusted EBIT surged to $40 million, marking the seventh consecutive quarter of sequential earnings improvement.

Axalta witnessed a significant rise in cash provided by operating activities, reaching $210 million compared with $80 million in the same period last year. Free cash flow experienced substantial growth, totaling $182 million compared with $51 million in the corresponding period.

During the third quarter, Axalta initiated a share repurchase program, buying back approximately 1.8 million common shares at an average price of $27.79 per share, totaling $50 million. The company strategically expanded its portfolio by acquiring Andre Koch AG, a well-established Refinish distribution partner headquartered in Switzerland. Encouraged by these positive developments, Axalta raised its full-year 2023 earnings outlook.

In terms of earnings, Axalta Coating reported adjusted earnings of 45 cents per share in the third quarter, surpassing the Zacks Consensus Estimate of 38 cents. The company has outperformed earnings estimates in three of the last four quarters, delivering an average surprise of 6.7% during this period.

The Zacks Consensus Estimate for AXTA's 2023 earnings is pegged at $1.58, indicating year-over-year growth of 6.7%. The consensus estimate for the current year has seen an upward revision of 8.2% in the past 60 days, highlighting a positive outlook for healthy growth potential.

Axalta Coating Systems Ltd. Price and Consensus

Axalta Coating Systems Ltd. price-consensus-chart | Axalta Coating Systems Ltd. Quote

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the Basic Materials space are Centrus Energy Corp. LEU, sporting a Zacks Rank #1, and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LEU’s current-year earnings has been revised upward by 30.5% in the past 60 days. LEU beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 47.7%. The company’s shares have increased 57.5% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5%, on average. The stock has rallied around 86.4% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents per share, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 41.3% in the past year.

Zacks Naming Top 10 Stocks for 2024

Want to be tipped off early to our 10 top picks for the entirety of 2024?

History suggests their performance could be sensational.

From 2012 (when our Director of Research, Sheraz Mian assumed responsibility for the portfolio) through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2024. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.