August 2021 Review and Outlook

Executive summary:

- Fed re-emphasizes the importance of long-term 2% inflation growth

- The S&P 500, Nasdaq and Dow made new all-time highs

- Large caps outperformed small caps

- Large-cap growth outpaced Value, but small-cap Value outperformed Growth

- Oil declined over 7%

- U.S. unemployment rate continued to decline and currently stands at 5.4%

Index performance for August:

U.S. equity indexes hit new highs, bucking the traditional trend that August is one of the worst-performing months for stocks. The S&P 500 has now climbed higher for seven straight months, its longest winning streak since January 2018. Inflation concerns, supply-chain constraints, labor shortages and the spread of the coronavirus Delta variant were not enough to keep the markets down.

Speaking from the symposium at Jackson Hole last week, Fed Chair Jerome Powell's made dovish comments that spurred equities higher. Powell emphasized that the Federal Open Market Committee "remains steadfast in our oft-expressed commitment to support the economy for as long as is needed to achieve a full recovery." Chair Powell also suggested tapering may start at year's end if "substantial further progress" on inflation measures cooperate, economic momentum continues, and employment numbers continue to see "clear progress." Currently, the unemployment rate stands at 5.4%, and economists expect the rate to continue its downward trend and drop to 5.2% when August data is released.

The yield on the benchmark 10-year Treasury increased in August from a low of 1.17% to close at 1.30% at month-end. However, bonds yields have steadily declined from the March highs above 1.7%, supporting equities as inflation concerns abated.

10-year Treasury yield over one year:

10-year Treasury yield for the last 10 years:

Value vs. Growth:

Growth outperformed Value in August as inflation concerns abated. Since the beginning of the year, Value has outpaced Growth, but this trend reversed this month as the “reopening” trade that favored Value and cyclical names were put on hold as the Delta variant delayed the expected reopening of many businesses. Lower inflation has also led to a potential investor shift into more risky investments as market volatility subsided.

Russell 1000 Value vs. Growth Indexes August 2021:

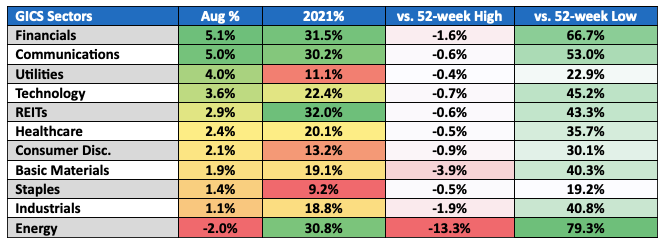

Sector performance total return for August:

Earnings commentary:

Corporate profits surged for Q2’21, coinciding with the S&P 500 Index trading at all-time highs.

With 98% of the S&P 500 members reporting for Q2, earnings growth of 89% handily beat the 63% that was expected at the beginning of the quarter, helping stocks move higher. The 87% of companies that beat on both earnings and sales consensus estimates were both records, well above the 75% five-year average for EPS and 65% average for sales.

The average upside beat for S&P 500 companies stands at 16.4% for the quarter, while sales estimates were higher by 4.6%. Though earnings were expected to show significant growth due to comparisons with last year’s corona-influenced results, the better-than-expected results supported stocks as analysts revised future earnings estimates higher.

VIX:

Volatility subsided by month’s end. The CBOE Volatility Index or VIX, a popular measure of the stock market’s expectation of volatility, spiked mid-August to 24.74 but since settled to close lower for the month at 16.67.

VIX, August:

VIX, two year:

Economic commentary:

The U.S. Department of Labor’s August 6th Employment Situation Report posted better-than-expected numbers on job creation, unemployment and wage growth. This strong report will keep the timing of the Fed’s tapering in the forefront as investors question how much Fed support is needed in a goal to strengthen the economy.

U.S. Initial and Continuing Jobless Claims continue to trend at the lowest levels seen since the Pandemic started (though still elevated when compared to pre-pandemic numbers).

The U.S. Department of Commerce’s 2nd estimate for Q2’21 GDP of 6.6% (the broadest measure of goods and services produced across the economy) showed little change from the advance estimate of 6.5%. The Conference Board forecasts that U.S. Real GDP growth will rise to 7.0% in Q3 2021 and 6.0% y/y in 2021, continuing a steady economic rebound.

Personal income increased 1.1% in August from July (consensus +0.3%), strengthened by wage growth and a bump from the advanced Federal Child Tax Credit payments. Personal spending increased 0.3% (consensus +0.4%), but real PCE declined 0.1% (a potential drag on Q3 GDP forecasts). The PCE Price Index rose 0.4%. The core PCE Price Index, which excludes food and energy, increased 0.3%, in line with consensus.

The PCE Price Index was up 4.2% year-over-year versus 4.0% in June, and the core PCE Price Index was 3.6%.

U.S. Unemployment Monthly Rate:

Commodities:

Dr. Copper:

Copper prices have receded from the May highs, declining nearly 9% since that time. The base metal was down over 15% in the middle of August before rallying back at month’s end. For August, Copper fell 3%.

Copper Five Year:

Copper August:

Oil:

The energy sector fell mid-month in the wake of concerns stretching from China’s economy, Covid, and the tapering of Federal Reserve stimulus. WTI fell to the lowest since May before facing energy supply disruptions resulting from Hurricane Ida. WTI crude oil saw a monthly decline of 7.34%, the biggest loss since October 2020. Energy stocks fell 2% in August, being the only sector to post a negative performance for the month.

Gold:

Gold slumped below $1,700 to a more than four-month low on 8/9, after strong U.S. jobs data increased expectations of the Fed potentially raising rates sooner than anticipated. Gold quickly wiped out the weekly loss after a plunge in the U.S. consumer sentiment fell to the lowest level in nearly a decade. After recovering losses seen in early August, Gold finished up 0.03% for the month.

Dollar:

The world’s largest reserve currency reached a 2021 high of $93.73 on 8/20 before declining throughout the rest of August. Despite the recent pullback, the U.S. Dollar Index finished up 0.54% for the month.

Cryptocurrency:

Following July’s gains, Bitcoin continued to move sharply higher to close out August up 13.90%. Investors are turning their attention to Bitcoin as its price continues to eye a breakout move above $50,000.

Looking ahead:

Concerns about the spread of the Delta variant and inflation could continue to weigh on the markets, though these have not stopped large-cap indexes from achieving new records in August. Timing from the Fed on tapering will be a driver of market volatility. Look for comments out of the FOMC meeting on Sept. 22. Other upcoming items to note next month are August’s non-farm payroll release Friday and this quarter’s Quad-Witch expiration on Sept. 17.

The information contained herein is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. All information contained herein is obtained by Nasdaq from sources believed by Nasdaq to be accurate and reliable. However, all information is provided “as is” without warranty of any kind. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.