AT&T Inc. T has gained 32.9% year to date compared with the industry’s rally of 30%. It has outperformed peers like Verizon Communications Inc. VZ but lagged T-Mobile US, Inc. TMUS.

In the recently released third-quarter financial results, AT&T witnessed solid wireless traction and customer additions, partially offset by lower demand for legacy voice and data services. The company recorded strong subscriber growth backed by a resilient business model and robust cash flow position, driven by diligent execution of operational plans. AT&T expects to continue investing in key areas of 5G and fiber and adjust its business according to the evolving market scenario to fuel long-term growth.

YTD Price Performance of T

Image Source: Zacks Investment Research

T Focuses on Customer-Centric Business Model

AT&T continues to enhance its network infrastructure, including 5G and fiber networks, to provide best-in-class coverage and capacity across the nation. The infrastructure investments position it for growth by ensuring widespread access to its services. AT&T's commitment to closing the digital divide underscores its dedication to fostering inclusive connectivity and driving socio-economic progress as the digital landscape evolves.

With a customer-centric business model, AT&T is likely to benefit from the increased deployment of mid-band spectrum and greater fiber densification. An integrated fiber expansion strategy is expected to improve broadband connectivity for enterprise and consumer markets, while steady 5G deployments are likely to boost end-user experience.

For a seamless transition among Wi-Fi, Long-Term Evolution (LTE) and 5G services, AT&T intends to deploy a standards-based nationwide mobile 5G network. Its 5G service entails utilizing millimeter wave spectrum for deployment in dense pockets, while in suburban and rural areas, it intends to deploy 5G on mid- and low-band spectrum holdings.

The acquisition of mid-band spectrum (C-Band) further offers significant bandwidth with better propagation characteristics for optimum coverage in rural and urban areas. AT&T believes that as the 5G ecosystem evolves, customers can experience significant enhancements in coverage, speeds and devices. The company added 226,000 fiber customers in the third quarter of 2024 and remains on track to surpass 30 million fiber locations by the end of 2025.

T Strives for Fully-Integrated Open RAN System

To augment operational efficiency and help build a more robust ecosystem of network infrastructure providers and suppliers, AT&T intends to leverage Ericsson ERIC technology to deploy a commercial-scale open radio access network (Open RAN) across the country. The Open RAN architecture facilitates healthy competition among vendors for the supply of essential components and reduces dependence on a single manufacturer. It is likely to offer more flexibility, lower costs and monetize the network while thwarting security risks by avoiding reliance on non-U.S. vendors such as Huawei.

AT&T aims to deploy Open RAN for 70% of its wireless network traffic across open-capable platforms by late 2026. The company expects to have fully integrated Open RAN sites operating in coordination with Ericsson from 2024, enabling it to move away from closed proprietary interfaces for rapid scaling and management of mixed supplier hardware at each cell site. From 2025, the company intends to scale this Open RAN environment throughout its wireless network in coordination with multiple suppliers to establish itself as the leading player in the industry.

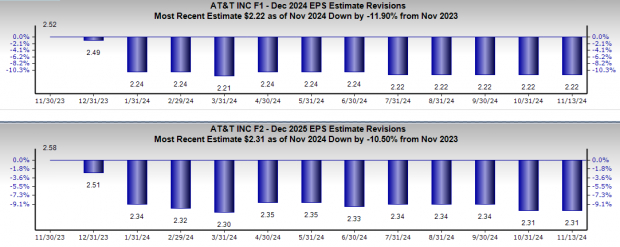

Estimate Revision Trend of T

Despite solid wireless traction, earnings estimates for AT&T for 2024 have moved down 11.9% to $2.22 over the past year, while the same for 2025 has declined 10.5% to $2.31. The negative estimate revision depicts bearish sentiments for the stock.

Image Source: Zacks Investment Research

T Plagued by Margin Erosion

AT&T is facing a steady decline in legacy services. The company’s wireline division is struggling with persistent losses in access lines as a result of competitive pressure from voice-over-Internet protocol service providers and aggressive triple-play (voice, data, video) offerings by the cable companies. High-speed Internet revenues are contracting due to the legacy Digital Subscriber Line decline, simplified pricing and bundle discounts. As AT&T tries to woo customers with healthy discounts, freebies and cash credits, margin pressures tend to escalate, affecting its growth potential.

AT&T has also offered a muted outlook for 2024 amid a challenging macroeconomic environment. For 2024, management expects adjusted earnings to be between $2.15 and $2.25 per share as high investments in infrastructure upgrades weigh on margins.

Image Source: Zacks Investment Research

End Note

By investing steadily in infrastructure and pioneering new technologies, AT&T is well-positioned to bridge the digital divide and enhance the connectivity landscape nationwide. This is likely to translate into solid postpaid subscriber growth and higher average revenue per user in the Mobility Service business.

However, a saturated wireless market and price wars owing to competitive pressure have eroded its profitability. The downtrend in estimate revisions further portrays skepticism about the stock’s growth potential. With a Zacks Rank #3 (Hold), AT&T appears to be treading in the middle of the road, and investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.AT&T Inc. (T) : Free Stock Analysis Report

Ericsson (ERIC) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.