Ashland Global Holdings Inc. ASH recently announced that it has entered into an un-collared accelerated share repurchase (ASR) agreement with JPMorgan Chase Bank, National Association, to buy back a total of $450 million of Ashland common stock. The program is subject to the $1 billion share repurchase program authorized by the company on Mar 15, 2018, from which $800 million is outstanding. The initial delivery will be of roughly 3.9 million shares.

The ASR agreement is scheduled to be terminated latest by Mar 31, 2022, but might be concluded early under certain circumstances. JPMorgan Chase might need to deliver additional shares of common stock to Ashland, or under certain circumstances the latter might be required to deliver shares of common stock or make a cash payment at its election.

Ashland noted that the announcement throws light on the company’s dedication to enhancing shareholder value. Its strong balance sheet and cash flow along with net proceeds from the divestment of performance adhesives are expected to allow it to invest in various growth initiatives.

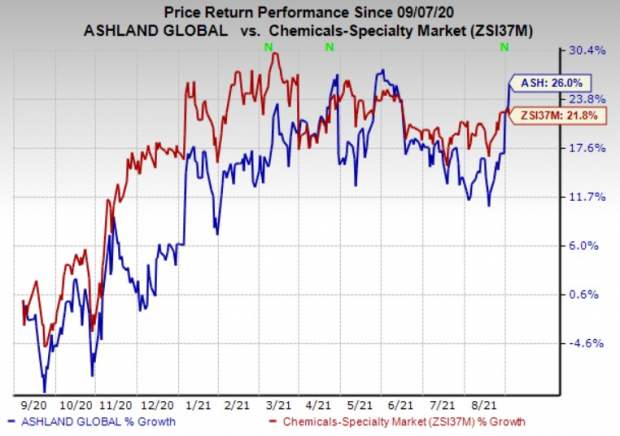

Shares of Ashland have jumped 26% in a year compared with the industry’s rise of 21.8%. The estimated earnings growth rate for the company for the current fiscal year is 67.9%.

Image Source: Zacks Investment Research

In the fiscal third quarter, the company’s adjusted earnings per share were $1.22, which missed the Zacks Consensus Estimate of $1.27. Its revenues were $637 million, increasing 11% year over year. The top line beat the Zacks Consensus Estimate of $635.9 million.

In its fiscal third-quarterearnings call Ashland said that it is working to leverage the ongoing strong demand to satisfy the incremental demand of the consumers. The company also reaffirmed its expectations for full-year results.

Ashland Global Holdings Inc. Price and Consensus

Ashland Global Holdings Inc. price-consensus-chart | Ashland Global Holdings Inc. Quote

Zacks Ranks & Stocks to Consider

Currently, Ashland has a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include AdvanSix Inc. ASIX and Hawkins, Inc. HWKN, each flaunting a Zacks Rank #1 (Strong Buy) and Atotech Limited ATC, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 160.4% for the current year. The company’s shares have appreciated 171.6% in a year.

Hawkins has a projected earnings growth rate of 24.9% for the current year. The company’s shares have risen 48.1% in a year.

Atotech has a projected earnings growth rate of roughly 122% for the current year. The company’s shares have rallied 24.4% in a year.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

AdvanSix Inc. (ASIX): Free Stock Analysis Report

Hawkins, Inc. (HWKN): Free Stock Analysis Report

Atotech Limited (ATC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.