Artificial Intelligence and Robotics Indexes

What’s driving the superior performance of NQROBO?

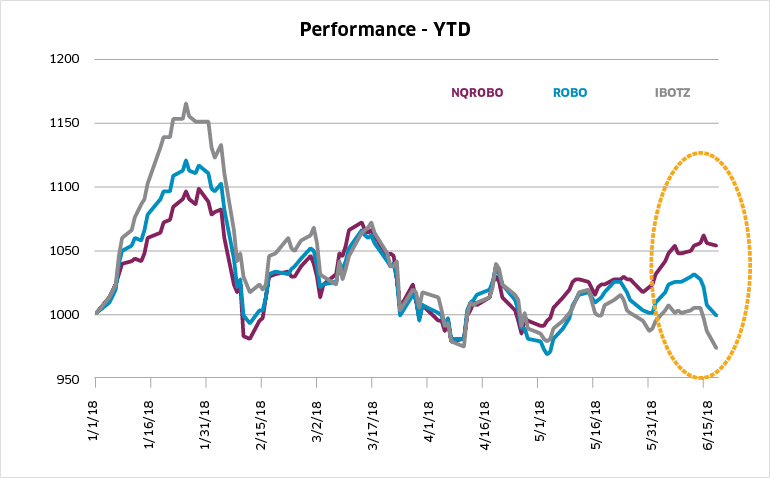

Nasdaq CTA Artificial Intelligence and Robotics Index (NQROBO) outperformed the ROBO Global Robotics and Automation Index (ROBO) and the Indxx Global Robotics & Artificial Intelligence Thematic Index (IBOTZ) year-to-date (5.33% vs. ROBO: -0.19%; IBOTZ: -2.71%) while the volatility has remained close.

Source: Nasdaq, Bloomberg. Note: Data from 12/29/2017 to 6/18/2018.

All the three indexes were designed to provide global exposure to the Artificial Intelligence and Robotics spaces. Despite the similar thematic coverage, each of the indexes offers a different perspective. Out of the 144 unique holdings across the indexes, only 18 are common in all three. It is critical for investors who want to gain access to the AI and Robotics space to precisely understand the differences in these indexes and what’s driving the divergence in performance.

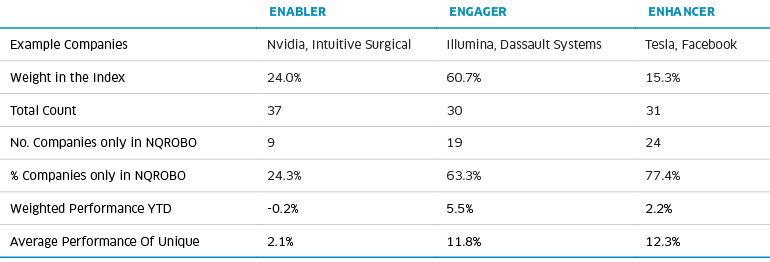

The important difference about NQROBO when compared to the other two indexes is that its tiered methodology is designed to track the three levels of the AI and Robotics industry involvement – enabler, engager and enhancer1. Each of the three classifications has its own tiered weighting that is updated at each rebalance: enablers are 25%, engagers are 60% and enhancers are 15% (see here for more information on the index methodology).

While IBOTZ and ROBO include companies that either serve as building blocks or are directly involved in creating products or services, these indexes generally overlook companies that leverage artificial intelligence and robotics to make these products or services more valuable. By company count, 63% of “engager” and 77% of “enhancer” companies in NQROBO are unique to the index and do not appear in IBOTZ or ROBO.

It’s important to note the very strong performance of these missing names from the competing indexes. On average, the companies only in NQROBO that are engagers and enhancers have YTD performances of 12% each, with enablers tallying a 2% return (still a far cry from the negative returns experienced by the competing indexes on aggregate YTD). In addition, it’s worth pointing out the weighted performance by each category (enablers were negative by a hair at -0.2% and engagers and enhancers were positive at 5.5% and 2.2%, respectively).

See below for this information and other statistics further breaking out the index by enablers, engagers and enhancers.

Source: Nasdaq, FactSet. Note: Data as of 6/18/2018.

Examples of these “engager” and “enhancer” companies in NQROBO that do not appear in IBOTZ or ROBO and have driven the strong performance of the index are shown below.

Source: Nasdaq, FactSet. Note: Data as of 6/18/2018.

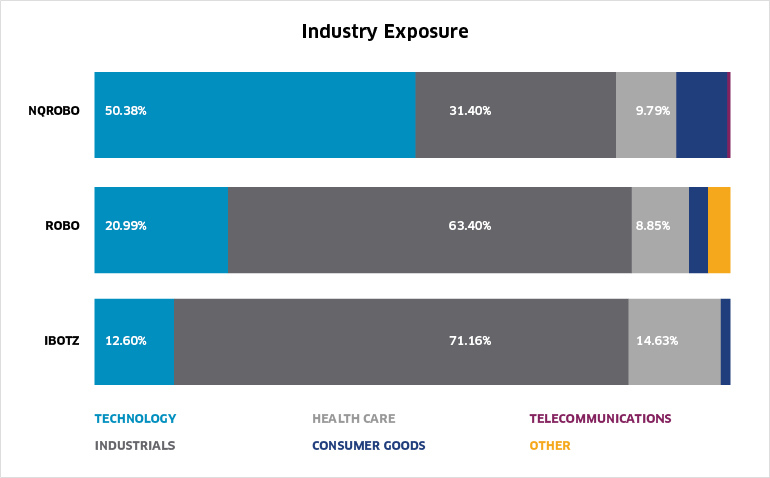

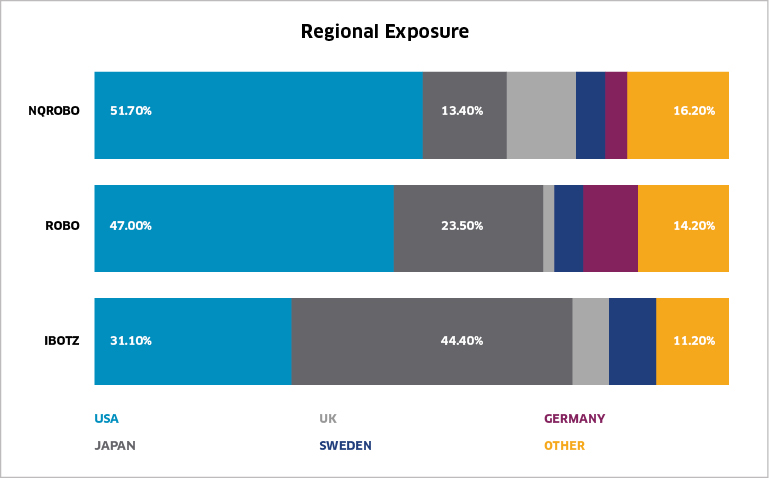

In addition, the three indexes in the space provide quite distinct country and industry exposures despite the fact that in theory these all provide global exposure to the AI and Robotics space.

Source: Nasdaq, Indxx, ROBO Global, Bloomberg. Note: Data as of 6/18/2018.

NQROBO assigns the highest weight to companies domiciled in the USA (52%) followed by ROBO (47%), while IBOTZ tilts more heavily towards Japan (44%).

When comparing the industry breakdown of the three indexes in question, NQROBO provides the highest exposure to the Technology sector (50%) when compared to IBOTZ (12.6%) and ROBO (21%). The other big difference is that IBOTZ and ROBO both assign the highest weight to Industrials (71% and 63%, respectively), while NQROBO allocates a lower weight (31%) to this sector.

This analysis shows that while NQROBO, IBOTZ and ROBO share the common themes of global AI, Robotics and Automation, their underlying components vary greatly from one index to another and hence, performance.

Conclusion:

The Nasdaq CTA Artificial Intelligence & Robotics Index (NQROBO) offers investors a robust exposure to the global AI and Robotics market while ensuring investability, sufficient liquidity and size. Though there are other indexes which provide exposure to the global AI, Robotics and Automation fields, there is a distinct disparity in the underlying basket of stocks. NQROBO’s methodology, which includes enablers, engagers and enhancers, captures companies in all three stages of the AI and Robotics space.

Investors looking to get exposure to the artificial intelligence and robotics industries can invest in the product tied to NQROBO, the First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT).

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing.

ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2018. Nasdaq, Inc. All Rights Reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.