By Ilan Furman, CFA

After 100 days of Javier Milei’s presidency one thing is clear – Milei’s approach to stabilize Argentina’s economy is very different to what was seen in the past. As one prominent Argentine entrepreneur mentioned in a meeting – the country is ending a 70-year Peronism cycle.

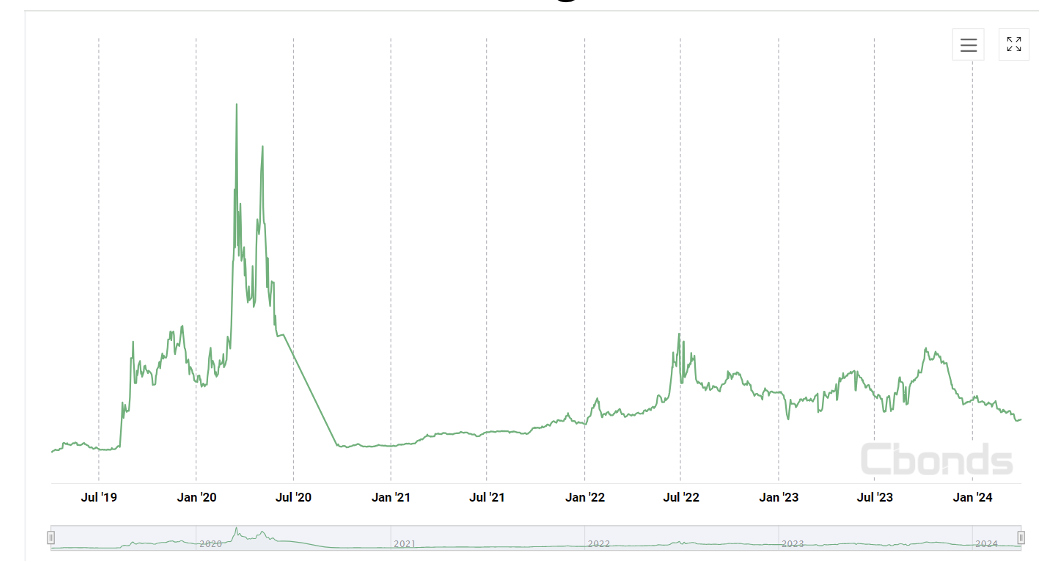

Given Argentina’s financial distress on one hand, and its vast potential on the other – Milei’s suggested path is attracting global attention and support from the financial community as seen in Argentina’s CDS compression.

CDS 5Y Argentina

Source: Cbonds

However, the way to normalize Argentina’s economy is still long and complex. Considering Argentina defaulted on its debt in 2001, 2014 and 2020 – on top of statistics and financial projections – a lot of hope and faith is needed.

Argentina’s economy – a very tough starting point for Milei –

Argentina's economy has been in a state of chronic distress, characterized by hyperinflation, budget deficits, and repeated defaults on debt—2001, 2014, and most recently in 2020. The core of Argentina’s financial distress is a history of excessive government spending, money printing leading to hyperinflation and eventually default.

On December 10, 2023, when Milei took office, Argentina’s economy was at a low point: a debt of $263 billion to foreign creditors, including $43 billion to the IMF, spiraling inflation exceeding 200%, and a significant disparity between the official exchange rate and the "blue dollar."

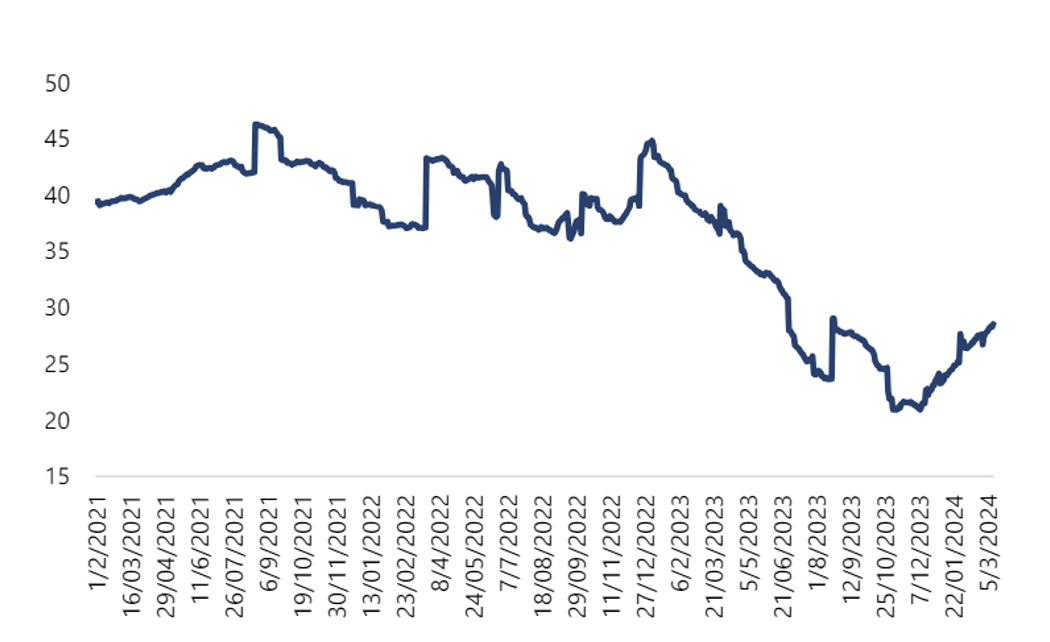

Argentina central bank net international reserves

Source: BCRA

Milei’s first 100 days – key achievements

In the first 100 days there are already financial achievements. Inflation in February fell more than expected, but to a still very high 13% monthly.

Key policy measures have included slashing fuel subsidies, reducing central government transfers to provinces, and adjusting the official exchange rate. This boosted agricultural exports and eased currency flows.

Argentina reached a primary budget surplus in January and February for the first time since 2011. This is a big difference from the 3% budget deficit witnessed last year. Moreover, spending on contributory pensions, a major budget item, fell by almost 40% in real terms compared with the same period last year.

On the funding side, foreign reserves have grown by over $7bn and the government successfully extended the maturity of stacks of peso debt, reducing pressure on the treasury.

Impact on the population -

Despite these fiscal victories, the repercussions on the Argentine population have been severe. Poverty rates have escalated to 50%, salaries have regressed to levels not seen in two decades, and there's been a notable decline in essential purchases such as prescription medicines. The economy is projected to contract by 4% this year, according to Barclays.

In the meantime, Milei's popularity remains robust, yet his political position remains isolated. Milei has a mere 15% of seats in the lower house, not enough to pass the meaningful reforms needed.

Given the complex task of normalizing Argentina’s economy it’s too early to call either success or failure.

The success of reforms depends on Milei's ability to navigate the complex political landscape and sustain the momentum of his economic reforms. For that he needs the support of the public and to improve his congress position in the coming mid-term election.

Argentine companies highlighted by Bridgewise –

There are several Argentine companies the Bridgewise algorithm is highlighting. In this review, the focus is the banking and agriculture sectors.

The banking sector is a promising area for growth in case of economic normalization. Following years of financial distress, Argentina’s credit and mortgage penetration is extremely low in regional and global standards.

This is likely to reverse in a case of economic stabilization and restored faith in the banking sector. Argentina’s banks are well managed from a balance sheet perspective. It is interesting to note that in the past few years we saw big banks in US and EU fail, but none of the Argentine banks.

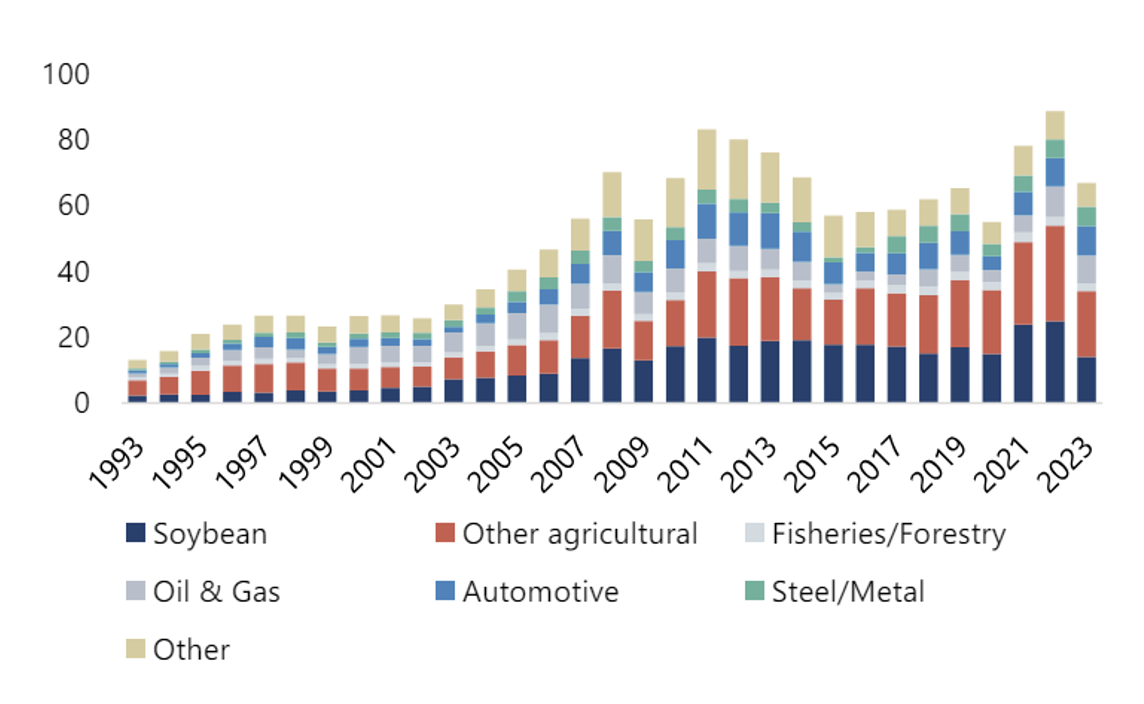

The agriculture sector is one of the most important for Argentina’s exports, as seen in the chart below:

Argentina – exports by sector

Source: Indec

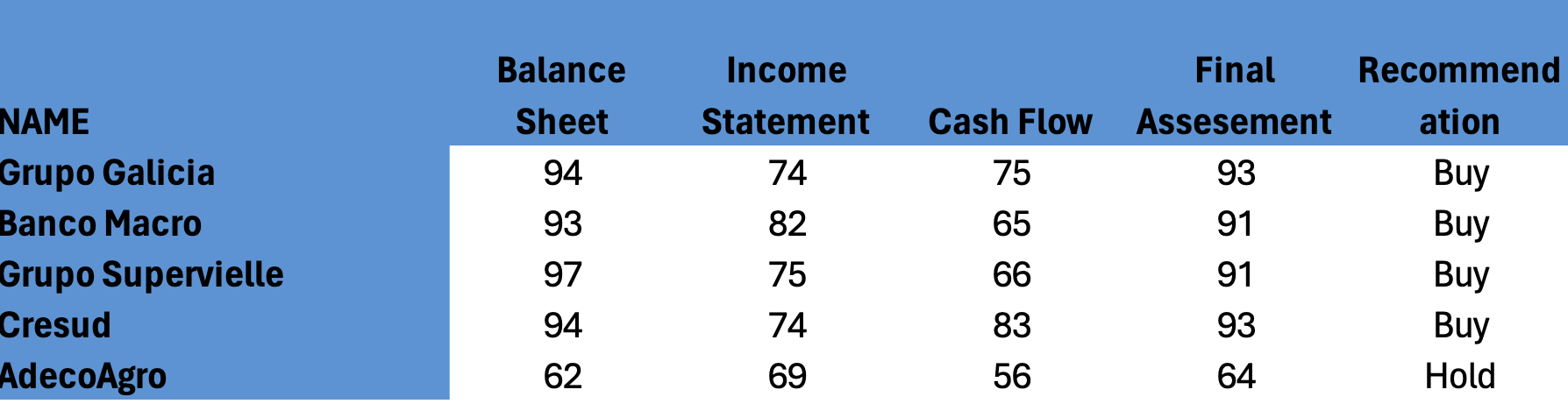

Argentina investments – banks and agriculture equities highlighted by Bridgewise:

Galicia, Argentina’s largest bank, received the highest score, followed by Banco Macro and Grupo Supervielle. All banks receive a very high balance sheet score, implying on the prudent financial management.

The agriculture sector, which is very important to Argentina (as seen in Export by sector breakdown) is represent by Cresud and AdecoAgro.

Cresud owns and manages a portfolio of 26 farms mostly in Argentina and Brazil. The size of its farm portfolio is 867,000 hectares under management, of which 72% is owned by the company. Cresud holds 34.38% of Brasilagro and 53.94% of IRSA, the leading real estate player in Argentina.

AdecoAgro operates as an agro-industrial company in South America, with operations in Argentina, Brazil, and Uruguay. The company owns a total of 252K hectares of land comprising of 30 farms in Argentina, Brazil and Uruguay. The company owns and operates several processing and manufacturing facilities such as rice mills, dairy free stall, milk processing, peanut and sunflower processing and large sugar and ethanol operation in Brazil (crushing capacity of 14.2 million tons).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.