A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

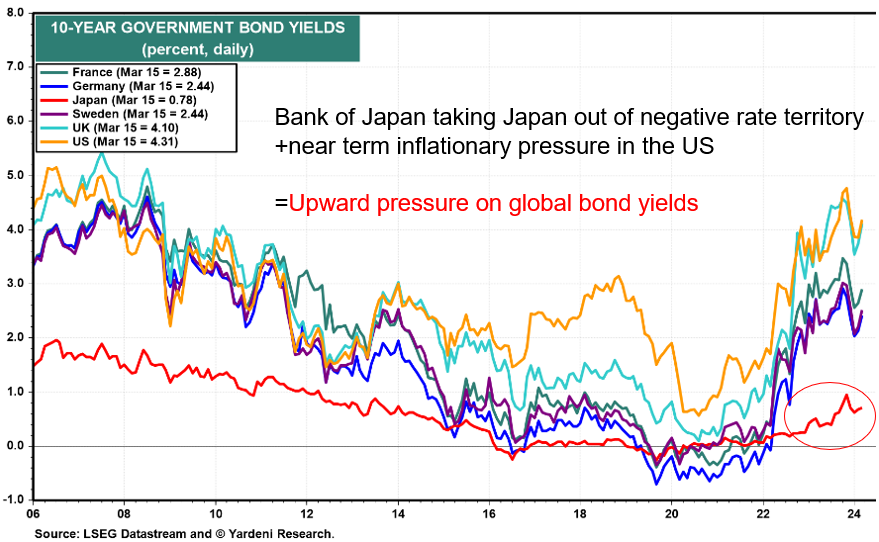

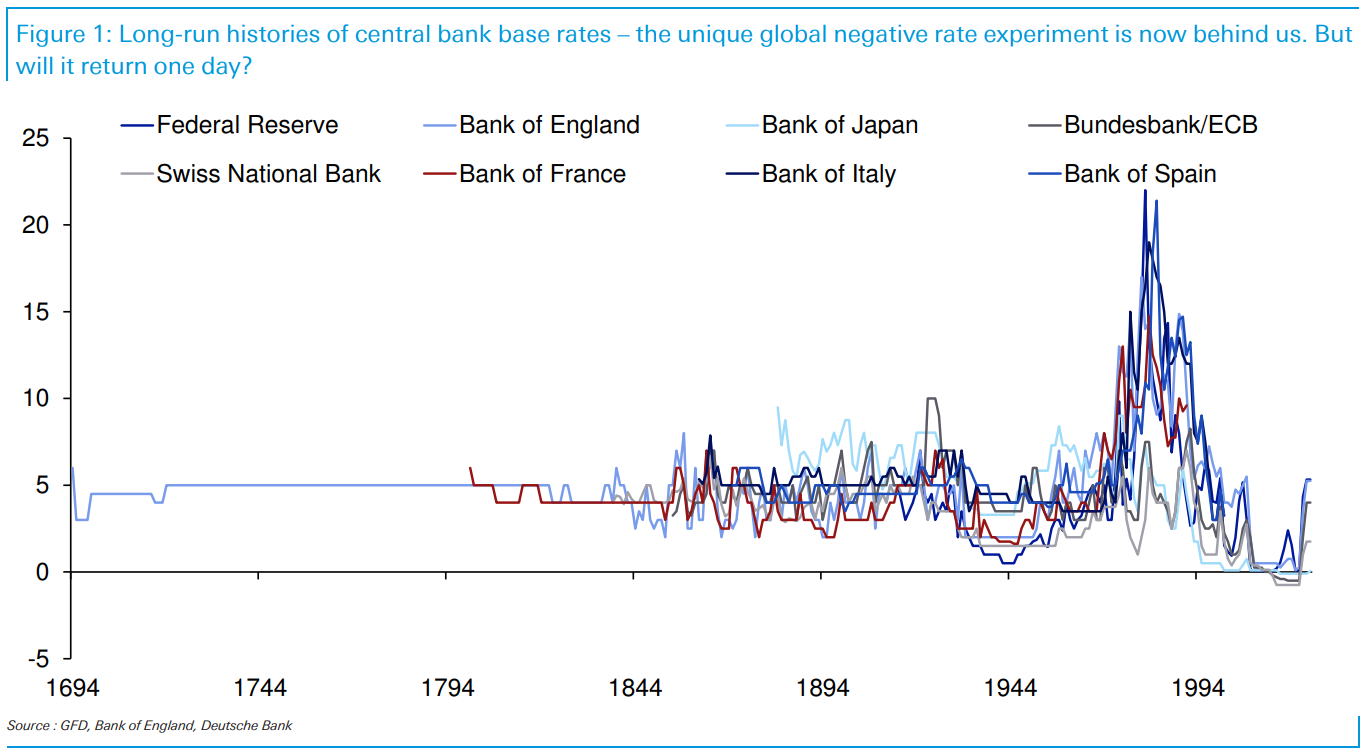

#marketseverywhere | The Bank of Japan "lifted rates from -0.1% to a range of 0-0.1%. They also scrapped YCC and ended ETF and REIT purchases but these programs had been pretty dormant of late. They are continuing JGB purchases at the same rate for now...the monetary base and the BoJ's balance sheet will decline going forward."

-Deutsche Bank, Jim Reid

* source: Yardeni Research

| NVDA pulling back after yesterday's keynote by CEO... market sentiment tied to a certain degree to NVDA performance

* source: CNBC

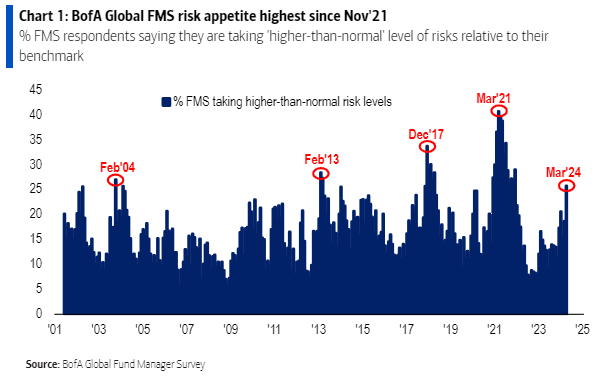

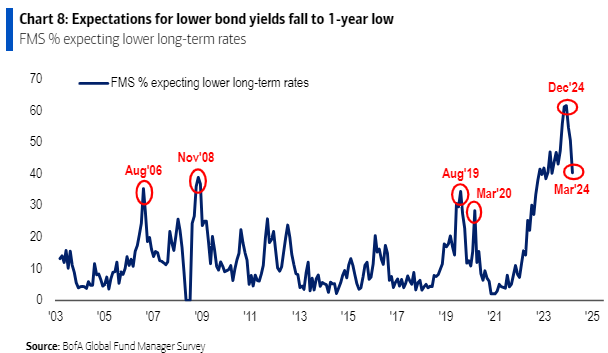

| BofA's Global Fund Manager Survey: "Growth expectations at 2-year highs = stock allocation at 2-year highs = big rotation to Europe, EM & financials"

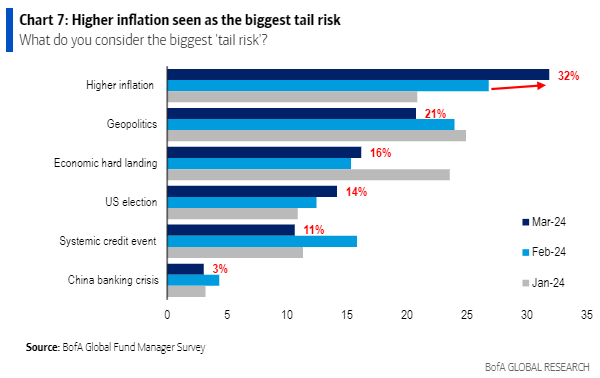

inflation risk is back to the fore

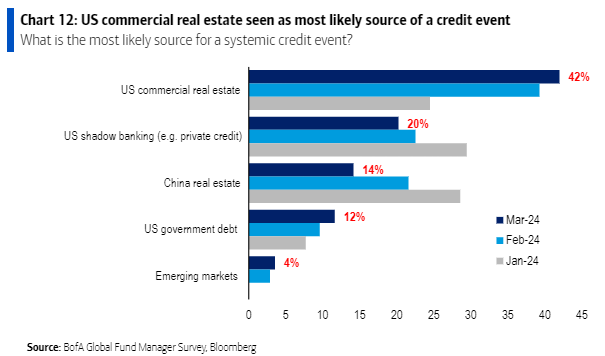

US commercial real estate seen as most likely source of credit event

rates to remain higher for longer

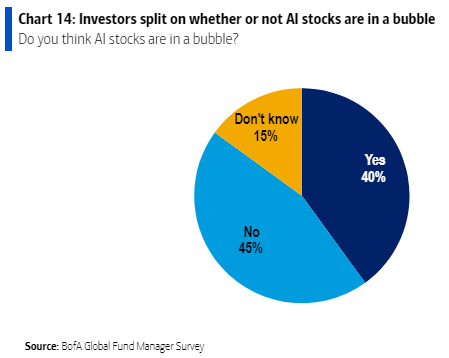

| are we in an AI bubble? | universe of AI-themed ETFs traded in the U.S. has soared to $6.9B as of the end of Feb from $2.6B a year earlier -RTRS

* source: BofA, Global Fund Manager Survey

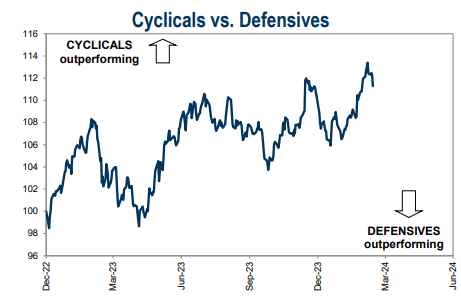

| better than expected economic outlook = defensives underperforming...

* source: Goldman Sachs Global Investment Research

| The end of an era with Japanese interest rates back in positive interest rates. Pros and cons of easy money over the last decade:

Pros: "it lowered borrowing costs for whole swathes of the global economy, eased the deleveraging burden after the GFC, prevented too much hoarding of deposits/precautionary savings, and arguably helped ensure deflation didn’t set in."

Cons: "it likely encouraged asset bubbles and lending/investments in inefficient entities, thus potentially locking in low productivity. Plus, there’s evidence that the biggest companies benefit most from ultra-loose policy, so it can increase market concentrations and hurts competition. It also discouraged savings, and was a drain on bank profitability which arguably impacted credit availability in the economy. Indeed, the concept of the “reversal rate” gained traction through the negative rate period, which is the rate when any further easing is likely to be counterproductive, as it tightens financial conditions rather than loosens them."

* source: Deutsche Bank

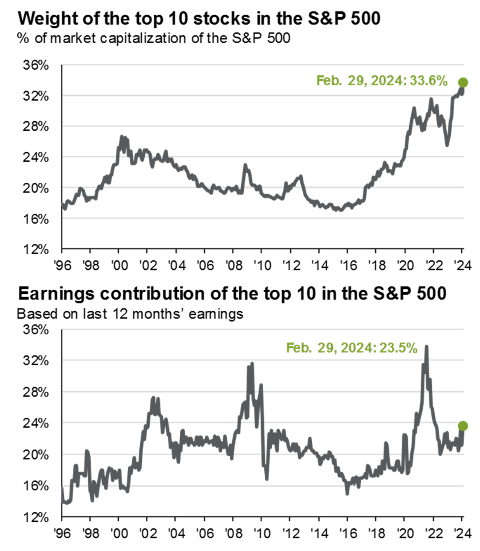

| concentration risk...

* source: JPM AM

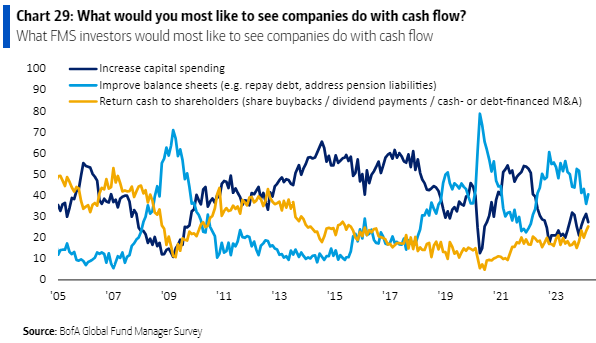

| "investors looking for corporates to return cash to shareholders is up to the highest level since Feb'16."

* source: BofA, Global Fund Manager Survey

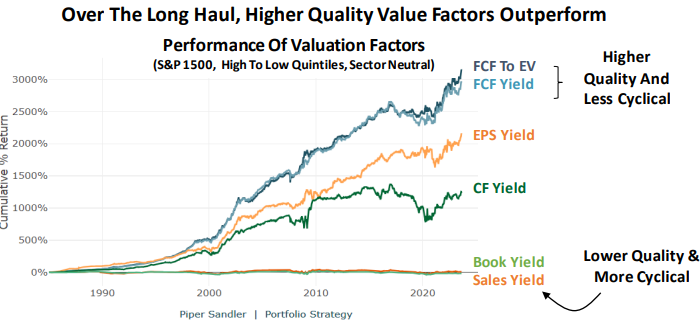

| #QualityMatters | "Free cash flow yield is a factor that marries quality with valuation. This factor tends to work throughout the majority of the cycle and is one of the top-performing factors throughout the decades" -Piper Sandler, Michael Kantrowitz

* source: Piper Sandler, Michael Kantrowitz

1) KEY TAKEAWAYS

1) Equities MIXED to LOWER | Oil + Dollar HIGHER | TYields + Gold LOWER

DJ +0.2% S&P500 -0.3% Nasdaq -0.8% R2K -0.4%

Stoxx Europe 600 +0.1% APAC stocks MIXED, 10YR TYield = 4.314%

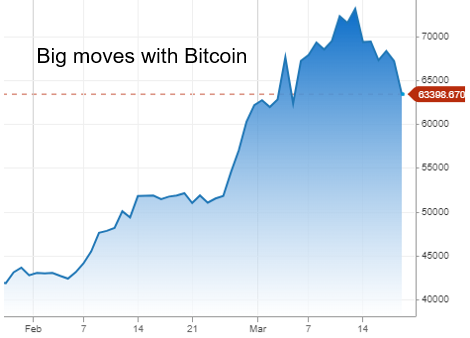

Dollar HIGHER, Gold $2,151, WTI +0%, $83; Brent +0%, $87, Bitcoin $63,254

2) Big moves in bitcoin....

* source: CNBC

3) THIS WEEK:

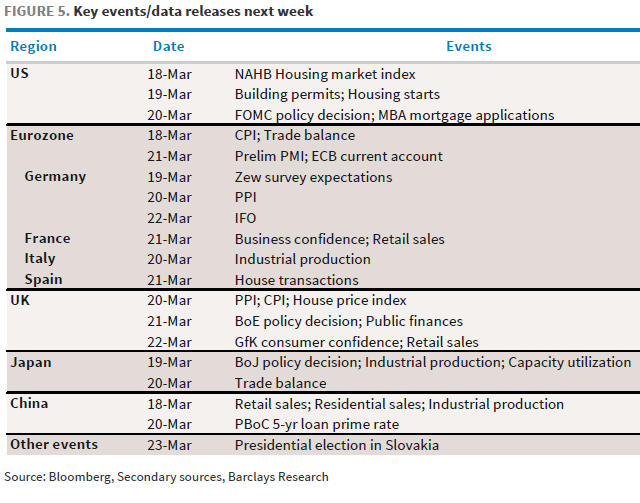

"Policy decisions from the Fed, the BoJ and the BoE will be the key highlights next

week.

Key economic updates will come from global flash PMIs on Thursday as well as inflation reports in Japan and the UK.

Economic activity indicators for China are due Monday."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) MARKETS, MACRO, CORPORATE NEWS

- Bank of Japan scraps radical policy, makes first rate hike in 17 years-RTRS

- Australia's central bank holds rates, waters down tightening bias-RTRS

- ECB ready in June to discuss rate cuts, de Guindos says-RTRS

- Central Banks mustn’t hail victory too soon, BIS’s Carstens says-BBG

- Bullish investors pile into EM, European stocks in March, BofA survey-RTRS

- Treasury ETF hit by record losing streak, $2 billion of outflows-BBG

- Trading floors buzz with excitement as BOJ axes negative rates-BBG

- US yields nearing level that could pressure stocks, Morgan Stanley says-RTRS

- Fed swaps price in less than 50% chance of a June rate cut-BBG

- Short volatility trades are starting to rule currency markets-BBG

- Hedge fund groups sue SEC to challenge Treasury dealer rule-FT

- Chinese authorities accuse Evergrande of inflating revenues by $80bn-FT

- China seen leaving benchmark lending rates unchanged in March-RTRS

- Congress reaches tentative deal to avoid government shutdown-AXIOS

- In Wisconsin, vote for Biden or Trump could come down to grocery prices-WP

- DOJ to push for TikTok divestiture in Senate briefings-BBG

- EU to impose tariffs on Russian grain-FT

- Sunak struggles for control in face of dire polls and Tory Anger-BBG

- AMLO prepares to take over Vulcan property in Mexico’s Mayan Riviera-BBG

- Exxon CEO says not trying to buy Hess but eyes its Guyana stake-RTRS

- Telecom Italia eyes €1 billion asset sales to speed debt cutting-BBG

- Meta offers to almost halve Facebook, Instagram monthly fees to €5.99-RTRS

- Legal & General lines up bankers to sell housebuilder Cala-SKY

- Exclusive: Fosun open to sale of Portuguese bank stake, sources say-RTRS

- US lawmakers reach deal to keep government open through Sept. 30-BBG

- Enel suspends sale of Argentina’s Edesur amid Milei optimism-BBG

- Nvidia unveils powerful chip in push to extend dominance in AI market-FT

- Disney secures support from proxy firm in Nelson Peltz battle-YAHOO

- UAW wants vote to unionize Volkswagen plant in Tennessee-AXIOS

Oil/Energy Headlines: 1) Gunvor says drones shut 600,000 barrels of Russian refining-BBG 2) US aims to return emergency oil reserve to prior levels by year-end-RTRS 3) Bloomberg reported ConocoPhillips CEO sees near-term price range for oil at $70-$90-BBG 4) Saudi Aramco CEO says no peak in oil demand for some time to come-RTRS 5) India buying more US oil as sanctions stifle Russian flows-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.