A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

are things getting bubbly? = expected rate cuts (getting pushed/pared back) + AI revolution + soft/no economic landing...

| "February was another strong month for risk assets, with several major equity indices at record highs. That included the S&P 500, which surpassed the 5,000 mark for the first time, as well as the Nikkei, which surpassed its previous record from 1989. In part, that was because of continued excitement around AI, and the Magnificent 7 posted their best performance in 9 months."

-Jim Reid, Deutsche Bank

* source: CNBC

risk appetite robust here...

* source: BofA's The Flow Show

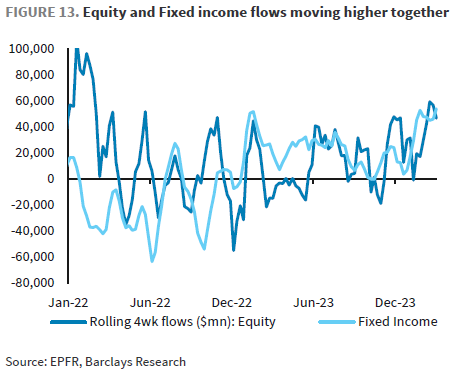

equity + debt flows have been robust in 2024...

flows favor TECH (concentration risk)

* source: Barclays' Emmanuel Cau

flows favor TECH (concentration risk)!!!

* source: BofA's The Flow Show

| "US national debt rising $1tn every 100 days..."debt debasement" trades like gold & bitcoin closing in on all-time highs."

-Michael Hartnett, The Flow Show, BofA

* source: BofA's The Flow Show

* source: CNBC

| Inflation is still around, just not intense...

“The Core PCE deflator was basically as expected, up 0.42% m/m in Jan (we had 0.46%) – rounding out a bundle of hotter inflation readings for last month – CPI, PPI, PMI prices paid for both mfg and svc, and NFIB.”

-Piper Sandler

* source: Oxford Economics

| Uptick in M&A "largely reflects corporate managements’ better visibility of the forward path of monetary policy as well as the growing optimism over the prospects of a soft landing."

-Goldman Sachs Global Investment Research

* source: Goldman Sachs Global Investment Research

| are things getting bubbly?

"Fed cuts sparking "animal spirits" & push into riskier assets; EM distressed debt up 24% since Oct'23 low (after epic bear market - Chart 4) as investors chase "spread compression"; biotech 30%, small-cap growth 17% past 3 months as investors chase "mean reversion" (outperformance of mega-cap growth stocks 31ppt vs small-cap growth & 41ppt vs small-cap value past 12 months - Charts 5 & 6)."

-Michael Hartnett, The Flow Show, BofA

* source: BofA's The Flow Show

"the “WallStreetBets” forum on Reddit is red hot again"

* source: CNBC

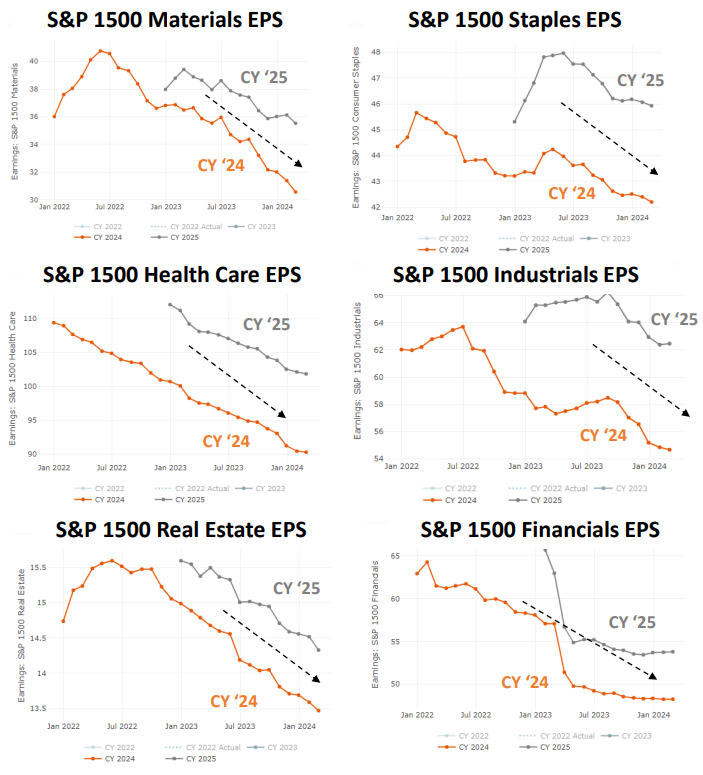

| for the rally to broaden, sustained earnings growth across the board is needed...

Most Sector EPS Estimates Are At The Lows For ’24 And ‘25

* source: Piper Sandler

| Similar story in Europe:

"The rally looks tired, but it feels like the equity market still wants to go up. Post P/E re-rating ytd, we think improving growth data is needed for more upside and a broadening of the rally, starting with ISM today. Although Q4 results were mixed overall, EU mega caps' outperformance has been supported by strong earnings."

-Barclays' Emmanuel Cau

* source: Barclays' Emmanuel Cau

1) KEY TAKEAWAYS

1) Dollar + Oil + Gold HIGHER | Equities + TYields MIXED

DJ -0.3% S&P500 -0.0% Nasdaq +0.1% R2K -0.0% Cdn TSX +0.6%

Stoxx Europe 600 +0.4% APAC stocks HIGHER, 10YR TYield = 4.246%

Dollar HIGHER, Gold $2,050, WTI +2%, $80; Brent +2%, $83, Bitcoin $62,067

2) Will the rally broaden out and equal weight index outperform?

* source: JPM AM

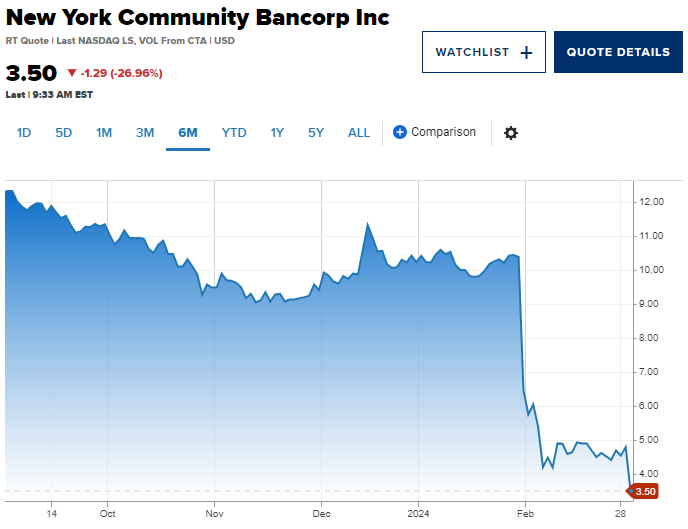

3) Commercial real estate the next shoe to fall?

"NYCB has been under pressure in recent months due in part to concerns about its exposure to commercial real estate."

* source: CNBC

4) NEXT WEEK:

"The US jobs report and Fed Chair Powell's testimonies will be among the highlights next week.

In Europe, there will be the ECB decision and economic activity indicators for key countries.

And on the political side, next week will see 'Super Tuesday' in the US, as well as the UK Budget.

Over in Asia, the focus will be on the National Party Congress in China and the

Tokyo CPI in Japan.

Corporate earnings include Broadcom and Target."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) MARKETS, MACRO, CORPORATE NEWS

- Fed's Mester still expects 3 rate cuts in 2024 after new inflation reading-YF

- Fed's Williams reiterates rate cut likely later this year-RTRS

- ECB cutting too soon would be worse than delaying, survey shows-BBG

- New Zealand central bank: policy needs to stay restrictive for some time-YF

- Inflation remains sticky in Europe, core prices cooling less than expected-CNBC

- EZ manufacturing activity eases slightly in Feb – PMI-SC

- China's factory activity shrinks 5th month, raises pressure more stimulus-RTRS

- China manufacturing slump weighs on Asia factory activity-BBG

- South Korea’s exports keep rising, supporting growth outlook-BBG

- UK store traffic slumps most since COVID as economic woes linger-BBG

- UK factories struggle in February as job cuts accelerate, PMI shows-RTRS

- Japan's Feb factory activity shrinks most in over 3 yrs on weak demand-RTRS

- A golden age for stock markets is drawing to a close-ECONM

- Chinese stocks snap record run of outflows as rescue clouds data-BBG

- US Senate approves bill to avert government shutdown, sends it to Biden-RTRS

- China home sales drought persists despite mounting support-BBG

- Xi’s one-man rule over China’s economy is spurring unrest-BBG

- Chinese province invites overseas investors link strategic supply chains-SCMP

- US says it struck missiles, drone that posed threat to Red Sea ships-RTRS

- Embracer Group to sell Saber in $500 million deal-BBG

- BOJ’s Ueda keeps market players guessing over rate hike timing-BBG

- London-listed Bridgepoint eyes successor to veteran Jackson-SKY

- CG Power eyes 10% profit margin semiconductor assembly testing unit-CNBC

- Prestige Estates expects Mumbai to contribute ₹5,000 crore to sales-CNBC

- Southern Cross’ big shareholders in push to oust board and executives-AFR

- Dell jumps on server sales fueled by excitement for AI work-MSN

- Meta on collision course with Australian government after announcing endto journalism funding deals-TG

Oil/Energy Headlines: 1) Saudi Arabia may keep April crude prices to Asia little changed-RTRS 2) Oil demand at 4-year high to hold steady for 2024, EIA says-BBG3) US distillate demand fell in December to lowest since June 2020, EIA says-RTRS4) India expects piracy attacks to rise, stretching Navy resources-BBG 5) US oil, gas rig count gains 5 to 669 as Q4 earnings hint at upstream capex rise-PLATTS 6) Kuwait fuel oil exports rise for second month as Al Zour ramps up-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.