These EV Stocks May Not Be Familiar Names But That Is Changing This Week

Electric vehicle stocks received another boost this week. This came after General Motors (GM Stock Report) accelerates its ambition to transition to electric vehicles. While this is not exactly a tide that lifts all boats, it sure did vouch for green energy transportation in the near future. On top of this, bullish movements from Tesla (TSLA Stock Report) have also renewed interest among EV stock enthusiasts. With TSLA stock’s upcoming inclusion in the S&P 500, investors continued to bid up its stock price after a Morgan Stanley analyst gave a $540 price target. While companies like Tesla, Nio (NIO Stock Report), and Xpeng Motors (XPEV Stock Report) have gotten all the attention, many smaller companies are also making their presence felt this week. While there may be concerns of a potential bubble, the reality is that EVs are undeniably a growing segment of the auto market.

“When it comes to renewable energy, this is not something that happens years in the future. It’s happening today,” says Allister Wilmott, president of ARC Aviation Renewables, a solar-power and LED aviation lighting firm. “Already, about one in 40 new cars is electric. But that number grows every year, and 20% or more of all new car sales will likely be electric by 2030.”

Gone were the days when Tesla was the only pure EV play when you want to invest in this space. In fact, today new players continue to enter the space. And many of them have the potential to be game-changers for investors hoping for triple-digit percentage gains over this decade. With all that in mind, would you consider adding these EV stocks to your watchlist today?

Read More

- Top Stay-At-Home Stocks To Watch As Third Wave Of Coronavirus Haunts

- Should Investors Watch These Renewable Energy Stocks Right Now? 3 Up Over 100%+ Since March

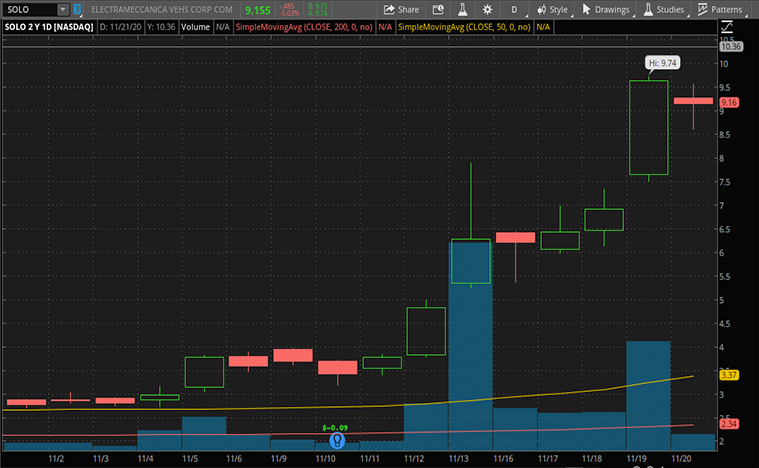

Best EV Stocks To Buy [Or Sell] Now: Electrameccanica Vehicles Corp (SOLO)

First, up the list, Electrameccanica Vehicles Corp. (SOLO Stock Report) is unlike other EV manufacturers. The company, which is based in Vancouver, Canada, makes three-wheel electric vehicles. Technically, SOLO is a motorcycle. However, it is fully enclosed and drives like a car with a steering wheel and foot pedals. While vehicles with three wheels have existed in the past, they are not exactly popular by any measure. But you could say the same about EVs. The idea of electric vehicles had been around for over 100 years. But things are finally taking off with better batteries.

The company’s recent bullish momentum is not without reason. As it is not a household name, you may be unfamiliar with the company, let alone the company’s progress. For investors who come across this company for the first time, you may find it shocking that the company has more than 64,000 preorders for the SOLO EV. They could bring in a revenue of $2 billion. Since the news went out, investors are starting to realize the potential and the value the company would bring to shareholders. As of Thursday’s closing, SOLO stock has surged more than 330% year-to-date. With its unique twist on EVs, would you take a chance on SOLO stock in this overcrowded EV space?

The SOLO could hit the market in early 2021. Like me, you may be skeptical at first. But there is certainly a potential value proposition here. It could be an alternative option for short commutes. There could also be applications for deliveries and for first responders. Granted, there is no guarantee that all 64,000 preorders will convert into actual sales. There could presumably be some cancellations if people dislike the final product. Nevertheless, the EV could still appeal to those who live on their own. The question is, do you have the appetite for SOLO stock?

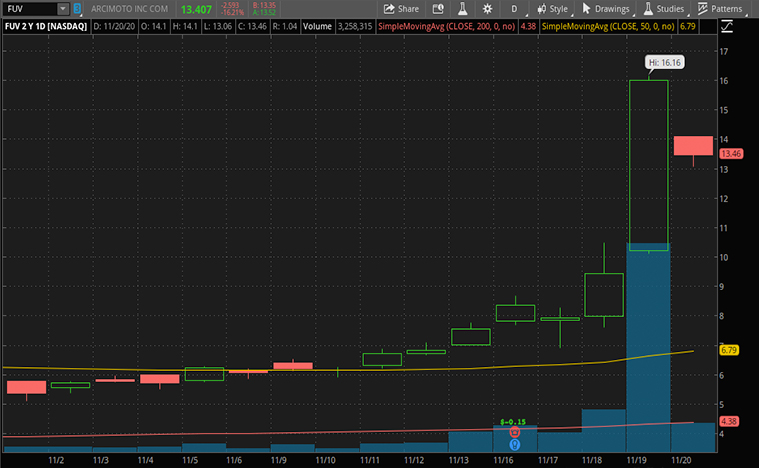

Best EV Stocks To Buy [Or Sell] Now: Arcimoto Inc

Arcimoto Inc. (FUV Stock Report) is another three-wheel electric vehicle making big moves, jumped nearly 70% during Thursday’s intraday trading. Nevertheless, the stock appears to be taking a breather during pre-market trading as of 8.40 a.m. ET. The company has made a name for itself by launching the Fun Utility Vehicle (FUV), which starts at $17,900, has a similar range to SOLO, and a top speed of 75 mph.

Arcimoto has been clear about its potential use cases. It offers its Deliverator and Rapid Responder, which are otherwise identical to the FUV but with some customizations. These target package delivery and emergency response respectively. They aim to improve speed and efficiency for last-mile delivery logistics and for law enforcement and emergency services.

With these products, Arcimoto has been targeting municipal customers. The company is having a pilot program with the city of Orlando. Now that Orlando is willing to give it a chance, this could potentially be a game-changer for the company. And if a deal materializes, it’s not surprising that other cities will follow suit. However, investors should note that the current initiative is just a test and not an actual rollout. Considering that, would you bet on FUV stock to eventually win municipal customers?

[Read More] Are These The Top Tech Stocks To Buy Now As The Third Wave Of Coronavirus Ravages The U.S.?

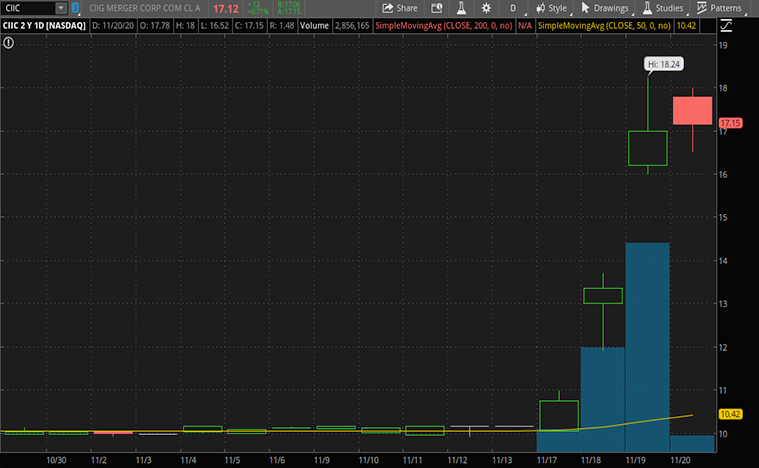

Best EV Stocks To Buy [Or Sell] Now: CIIG Merger Corp

British electric vehicle start-up Arrival is the latest special purpose acquisition company (SPAC) that will go public through a reverse merger with CIIG Merger Corp (CIIC Stock Report). The stock price was up another 27.25% on Thursday’s intraday trading, adding to its 24% rise Wednesday. This company announced earlier this week to bring the company public to the Nasdaq under the new ticker symbol ‘ARVL’. Unlike many other EV companies out there, Arrival focuses on electric buses and vans, not passenger vehicles.

This year has seen a flurry of EV manufacturers going public through the SPAC pathway led by Nikola (NKLA Stock Report) and Workhorse Group (WKHS Stock Report). So what makes Arrival so special? Part of it is that Arrival uses micro-factories instead of large-scale production facilities. This way, Arrival could reduce the capital requirement for manufacturing. That could reduce costs for their customers, potentially helping to accelerate the shift to EVs.

More importantly, unlike other EV SPAC companies, Arrival already has an impressive order backlog. According to the company, it has received $1.2 billion in orders. And even more excitingly, part of that backlog is an order from United Parcel Service (UPS Stock Report) for 10,000 electric vans. Investors also must remember that Arrival does not compete directly with Tesla or Fisker (FSR Stock Report) as these two companies focus on consumers. With contracts worth $1.2 billion and production scheduled for the last quarter of 2021, could Arrival dominate electric vans and buses in the long run? If so, is CIIC stock on your watchlist today?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.