Doctors and stock traders are very different professions. After all, if I get something wrong, I can simply cut the position, take a small monetary loss, and move on. If a doctor gets it wrong, people die. Still, there is one thing that we have in common: When people find out what I do for a living, most people have questions, just like they do with doctors. Because of the relatively minor consequences should my analysis prove inaccurate, I will usually answer those questions to the best of my ability when asked. Yesterday, however, I was asked one that gave me pause: A friend asked me, "Are stocks cheap yet?"

That type of question demands a simple "yes" or "no" answer, but my response to it was anything but simple. "That depends," I said, "To start with, how do you define cheap, and then cheap as compared to what?" That may sound like an evasion, but they are actually important questions for investors to ask themselves when thinking about buying on a market dip.

The most basic measure of value in an individual stock, and market indices on average, is the Price to Earnings Ratio, or P/E. That expresses the relationship between the price of a company’s stock and its Earnings Per Share (EPS). There are two types of P/E that are commonly used, trailing and forward. Trailing P/Es compare the current price to the EPS in the last four quarterly earnings reports, while forward P/Es look at price relative to analysts’ estimates for earnings over the next year. Obviously trailing P/Es, being based on data rather than estimates that are nearly always wrong, making it a more reliable and consistent indicator, so let’s focus on that.

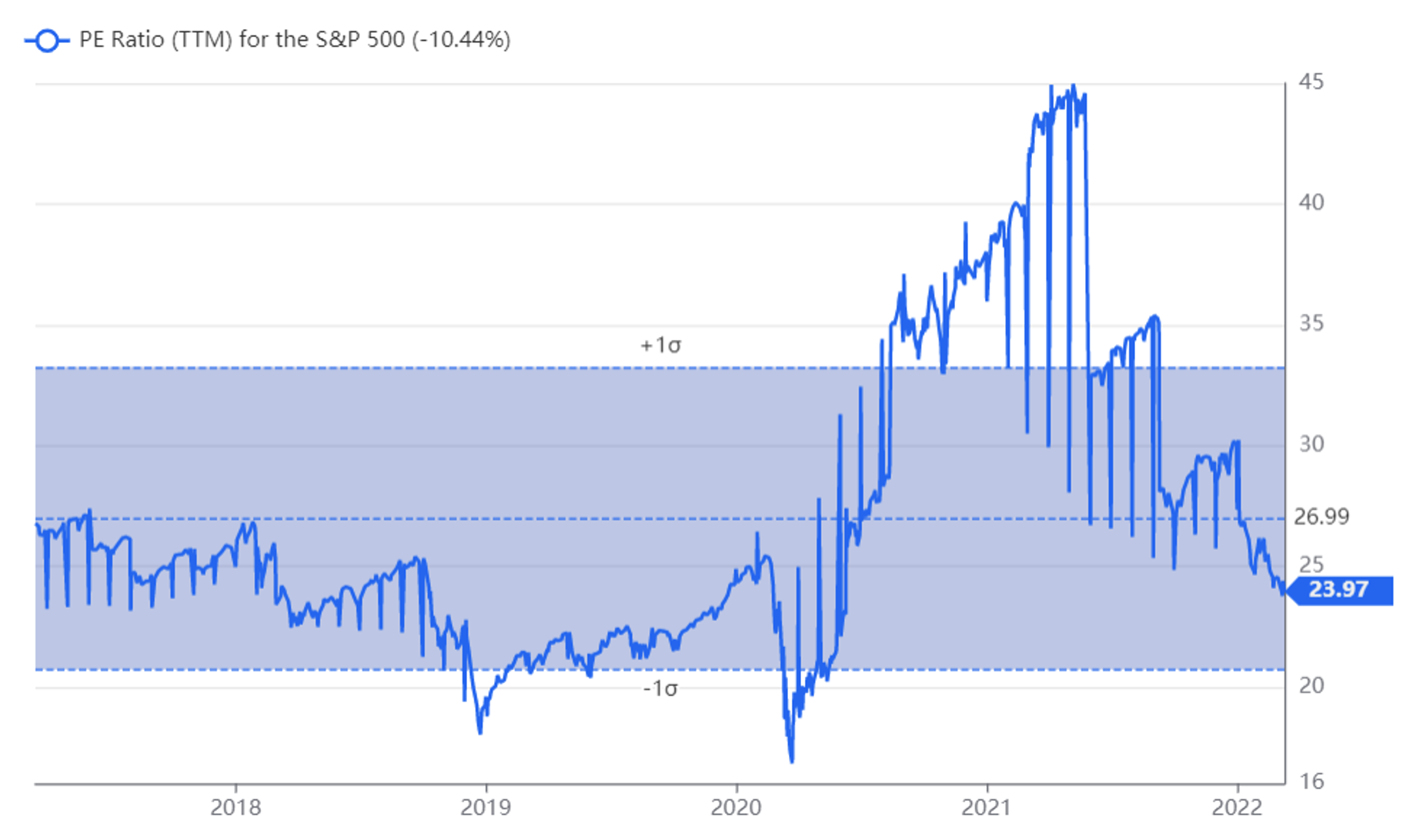

If we do, and we look at changes to the average P/E for the S&P 500 over the last few months, it appears on the surface that stocks are indeed cheap. After all, it has fallen considerably and, as the chart below shows, is now below its five-year average of 26.99.

There are a couple of issues with that average, however.

First, it is distorted by what happened in early 2020. When Covid first hit, big swathes of the economy were completely shut down, and average earnings within the S&P 500 collapsed. Stock prices fell too, but trailing P/Es use last year’s earnings, so the average fell massively as the market dropped, but then climbed back to its high of around 45 as stocks bounced back strongly at a time when the trailing earnings were extremely low due to the shutdown.

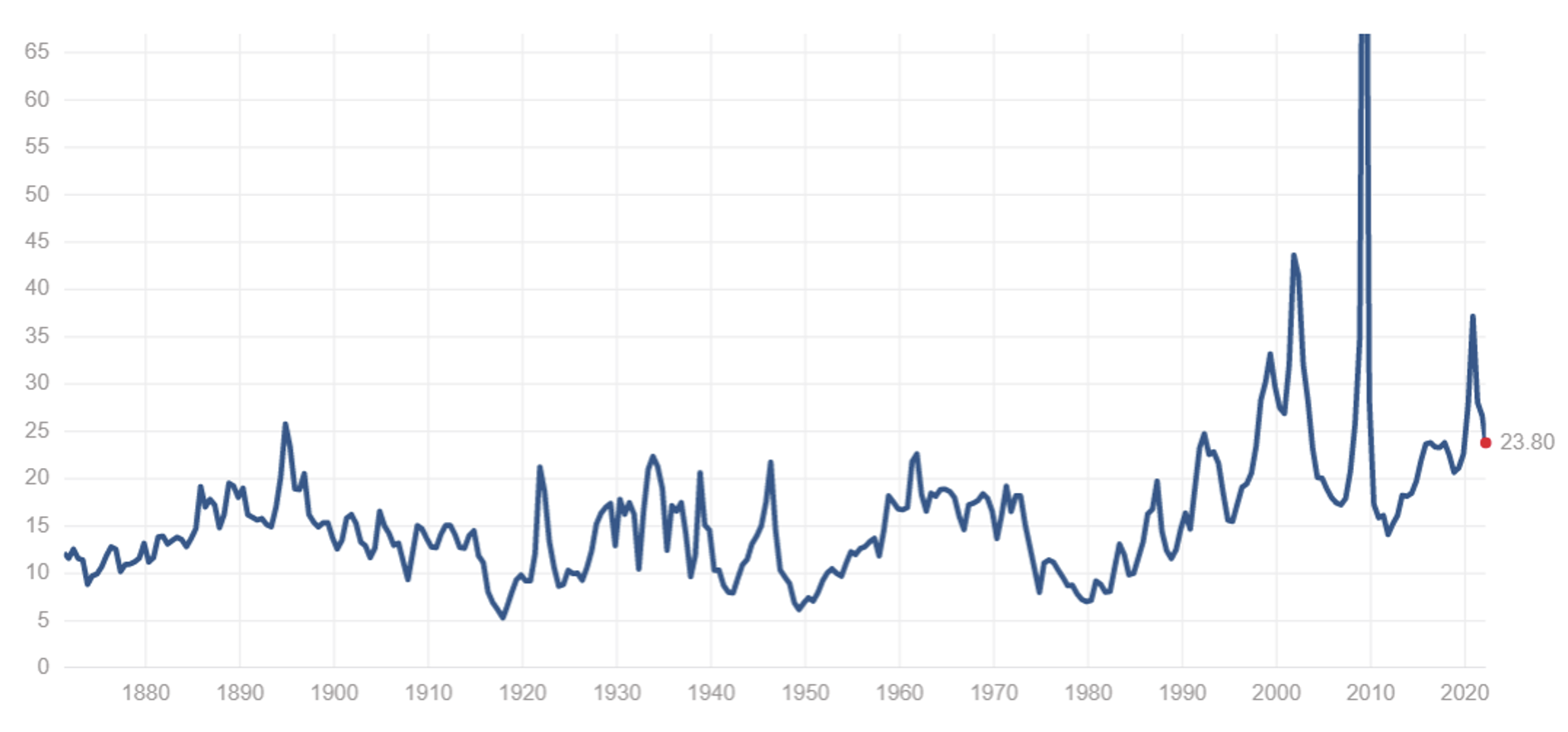

That distortion becomes clear if you look at the average P/E for the index (or its equivalent) over a longer period. When you do that, the average is under 16, so the current levels of around 24 could be said to indicate that stocks are actually overpriced by 50% at current levels. However, that is also too simplistic.

Times have changed. Computerization, automation, and globalization may be unpopular in some circles, but they have caused increases in productivity over the last twenty years or so, and those increases are continuing. That will have increased what constitutes a “normal” P/E, as will one other important change: There is just more money in the market now than there has been in the past, and not just because of normal growth.

If you look at the long-term chart for average P/E above, you will see that, while volatile, that average has been on an upward trend since the early 1980s. That isn’t an accident. It represents the period in history when retirement savings shifted from pensions to 401Ks. As a result, individuals became more aware of the market and started to buy stocks rather than just save money. More recently, that shift from saving to investing has been accelerated by low-fee, online platforms, and low interest rates. There is just a lot more money looking for a return from stocks, and that has pushed up what constitutes a normal P/E.

As you can see, the seemingly simple question "Are stocks cheap yet?" is anything but. The answer depends not just on your definition of "cheap" but is also influenced by the fact that cheap is a comparative word, so what time frame you are using for your comparisons matters too. That is why my immediate answer to my friend’s question was so unsatisfying. Unfortunately however, even after considering all the factors, the equally unsatisfying thought-out answer to that question is: "Not really, but they aren’t expensive anymore, either."

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.