A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

...price of a 30-second ad during Super Bowl I (1967) was $37,500, price for Super Bowl LVII $7,000,000 = 185x jump;

nothing keeps pace with Super Bowl inflation (93 of 100 most watched TV shows in '23 were NFL games);

but if they could chicken wings would now cost $43/lb (was 23c/lb in 1967), 6-pack of beer would be $340, gallon of gasoline $61, avg US house price $4.2mn & S&P500 would be 16374."

-Michael Hartnett, The Flow Show, BofA

S&P500 all time highs

* source: Yardeni Research

* source: CNBC

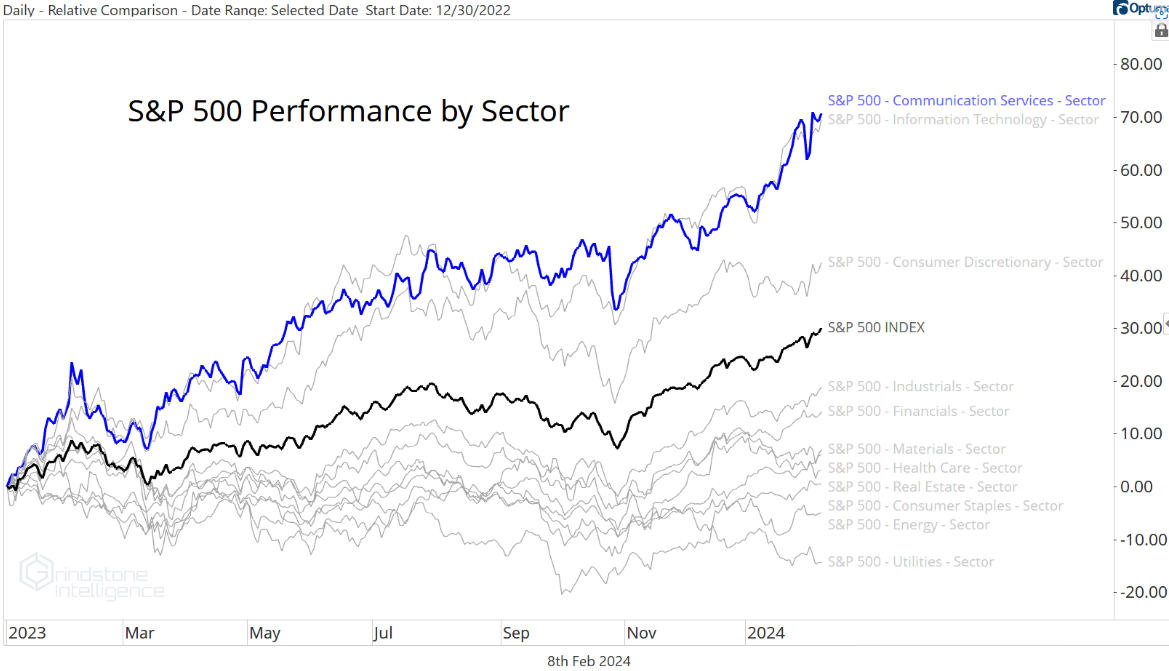

Comms + Tech (+large caps generally) dominate

on relatively narrow breadth

* source: Grindstone Intelligence

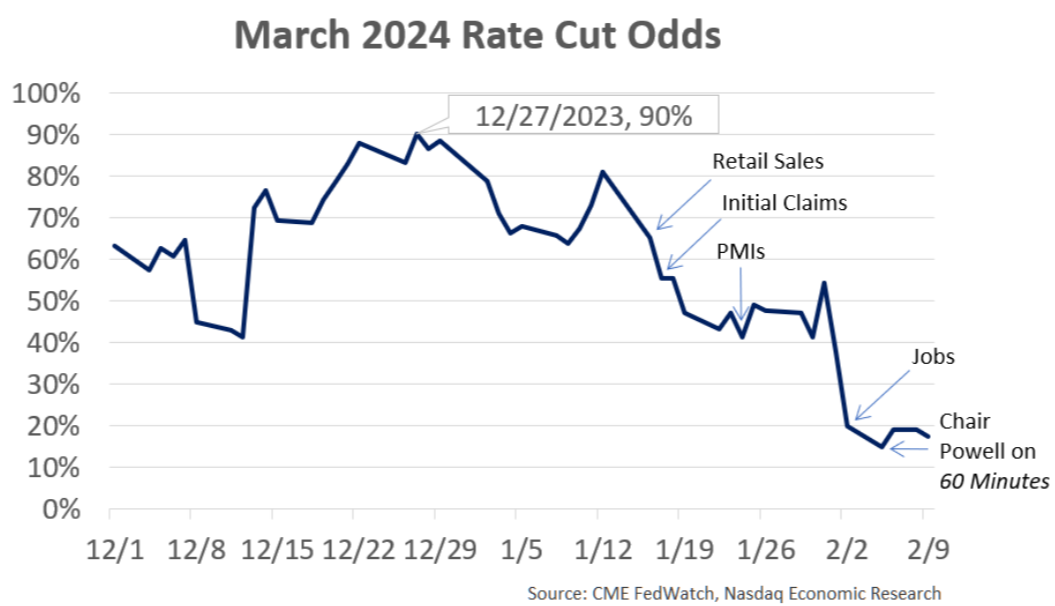

Better than expected economy + jobs market no deteriorating + hawkish Fed = rate cut odds for March collapsing

* source: Nasdaq Economic Research

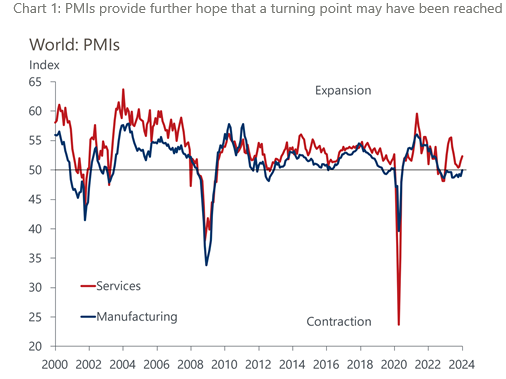

An index of sentiment among CEOs of US companies has turned positive for the first time in 2 years = Conference Board -BBG

| Graph below = odds of soft landing increasing

* source: Oxford Economics

1) KEY TAKEAWAYS

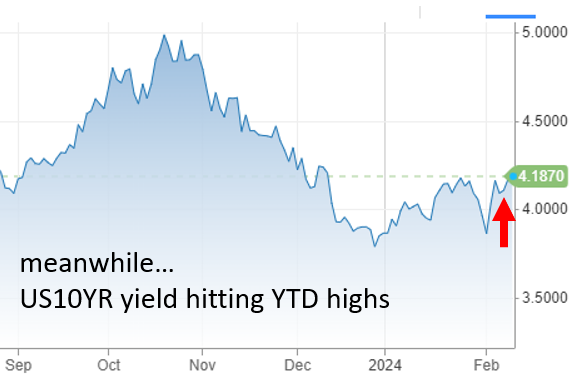

1) Equities MIXED / TYields + Oil HIGHER / Gold + Dollar + LOWER

-Inflation in Dec was even lower than first reported, the government says -CNBC

DJ -0.1% S&P500 +0.2% Nasdaq +0.6% R2K +0.4% Cdn TSX +0.2%

Stoxx Europe 600 -0.0% APAC stocks HIGHER, 10YR TYield = 4.175%

Dollar LOWER, Gold $2,023, WTI +1%, $77; Brent +1%, $82, Bitcoin $46,931

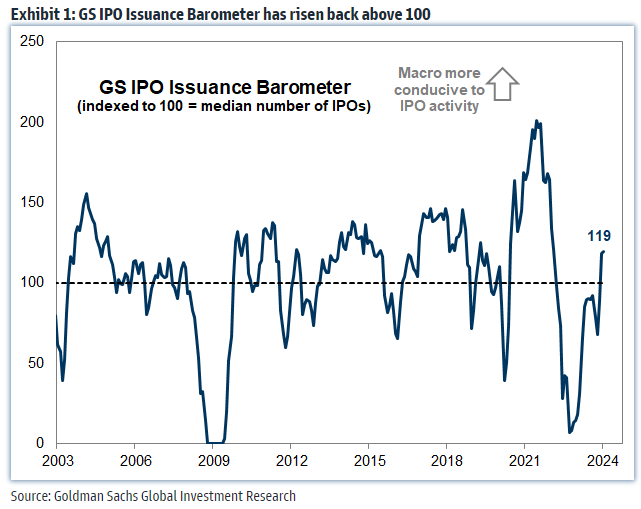

2) The GS IPO Issuance Barometer rose to 119 in January, the highest level since

February 2022.

* source: Goldman Sachs Global Investment Research

* source: CNBC

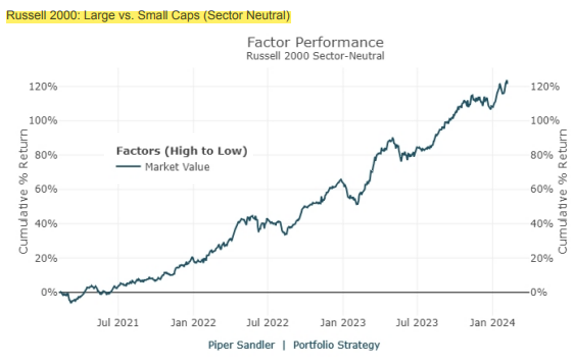

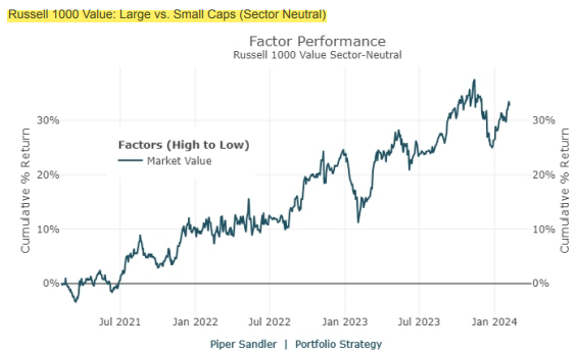

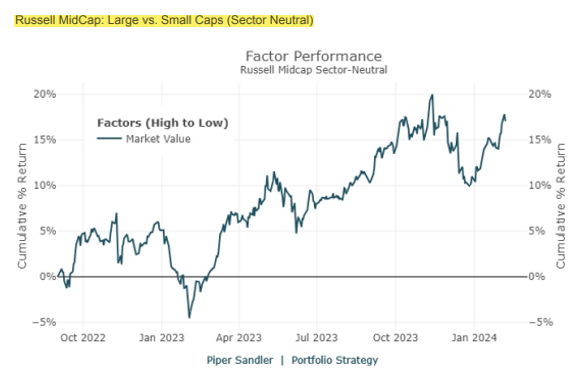

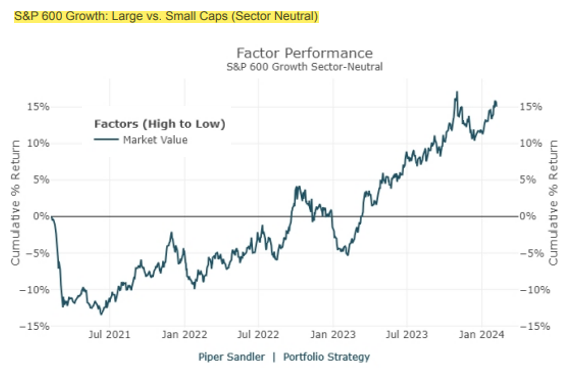

3) Larger Caps Are Besting Smaller Caps Nearly everywhere | "Large cap relative performance continues to be the market story. While it’s easy to explain leadership of larger caps with the Magnificent 7 story, what’s going on continues to be far more broad-based than that. For example, one can’t use the Magnificent 7 narrative to explain the massive outperformance of larger caps within the Russell MidCap index, or the Russell 2000, or the S&P 600 Growth Index…the list goes on." -Piper Sandler's Michael Kantrowitz

larger market caps outperforming within various indices

"What Could Return Us To Small Cap Leadership?

What usually gets small-cap leadership going is a broad-based EPS-estimate surge higher.

What’s A Smaller-Cap Manager To Do?

You can just buy the largest stocks in your benchmark, and even though that’s worked it’s not exactly an investment thesis rooted in rigorous analysis. Our preference is to be size agnostic and fundamentally strong."

-Piper Sandler's Michael Kantrowitz

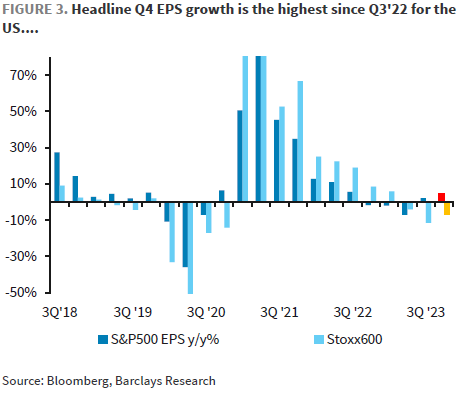

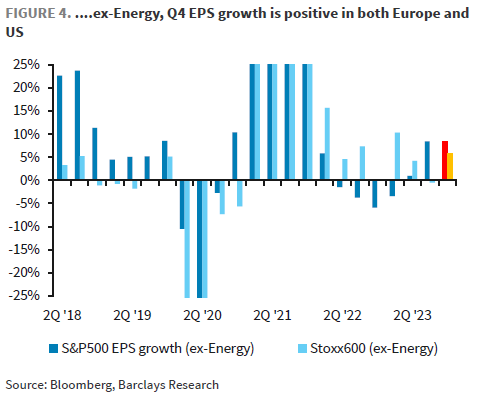

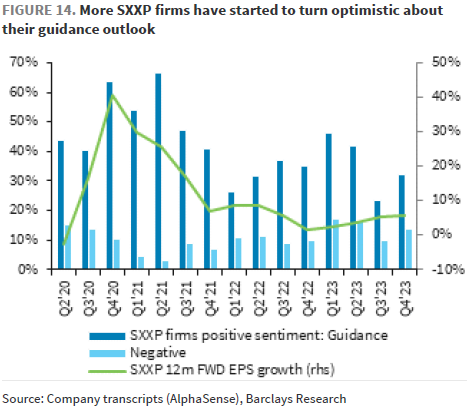

4) Barclay's Emmanuel Cau:

* source: Barclays' Emmanuel Cau

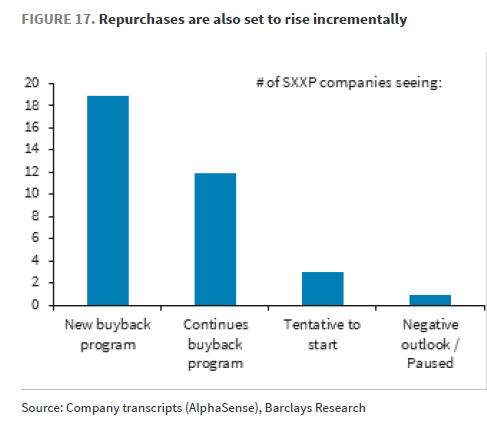

5) Share buybacks in focus and a source of support... | not only in the US but also across the pond in Europe

* source: Barcalys' Emmanuel Cau

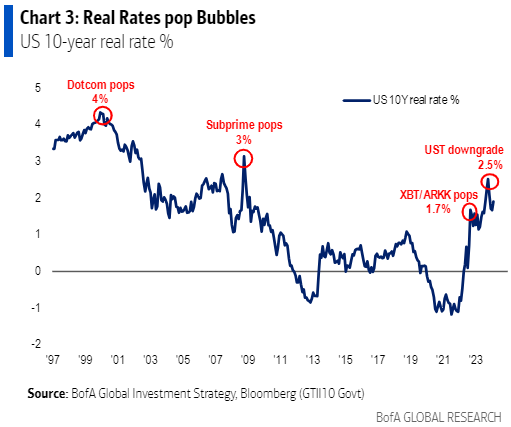

6) A rise in yields, especially an abrupt one usually break things... commercial real estate the next shoe to drop? | and the inverse of that is abrupt fall in yields create streams of malinvestments = bubbles

* source: BofA, Michael Hartnett, The Flow Show

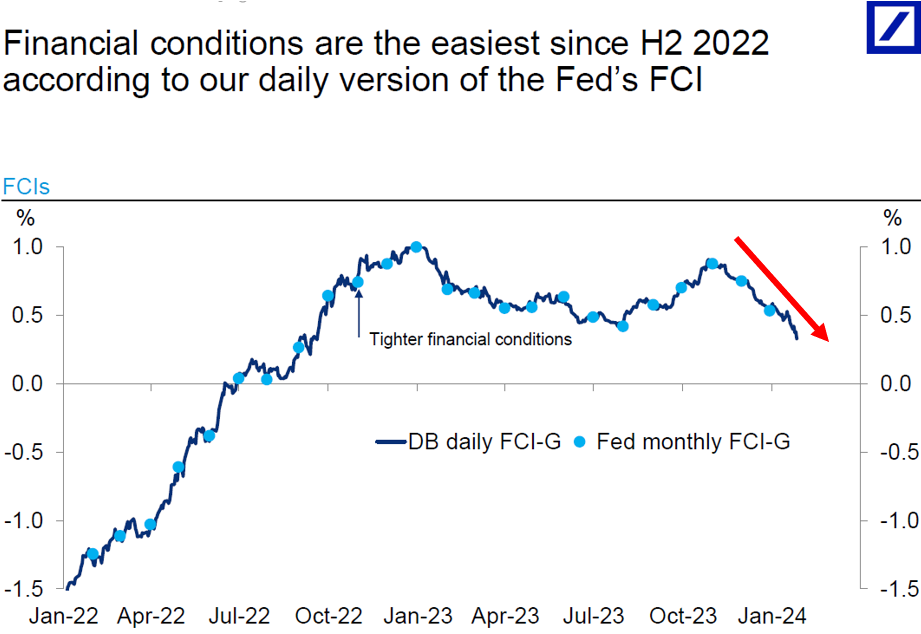

7) Financial conditions are easing, helping to push markets higher...

* source: DB

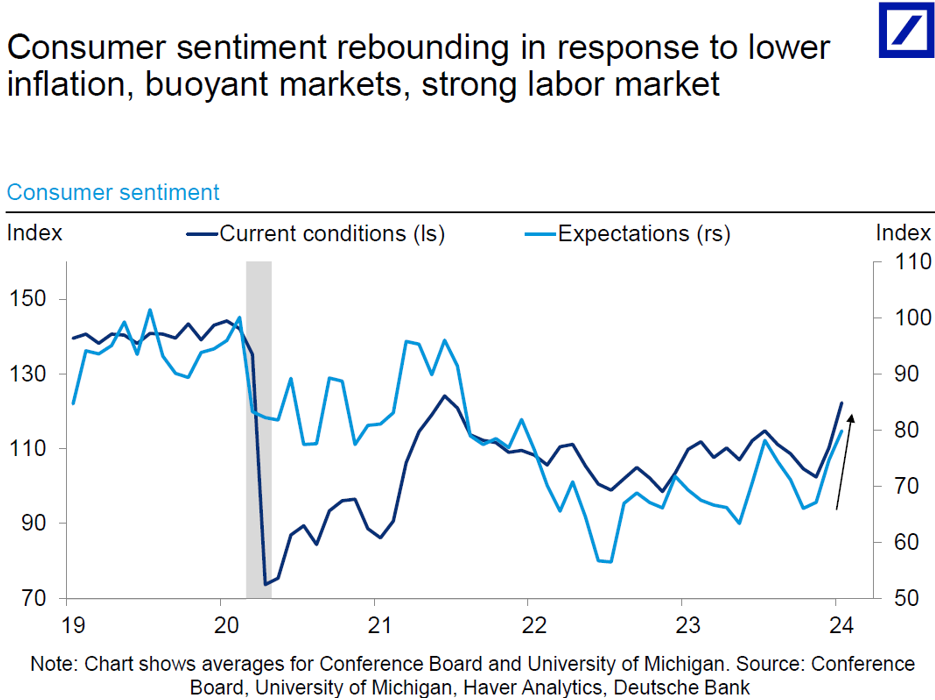

8) Consumer sentiment + expectations are improving...

* source: DB

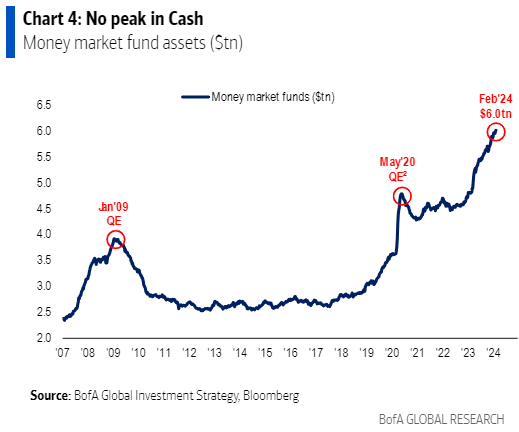

9) Capital continues to flow into money markets...

* source: BofA, Michael Hartnett, The Flow Show

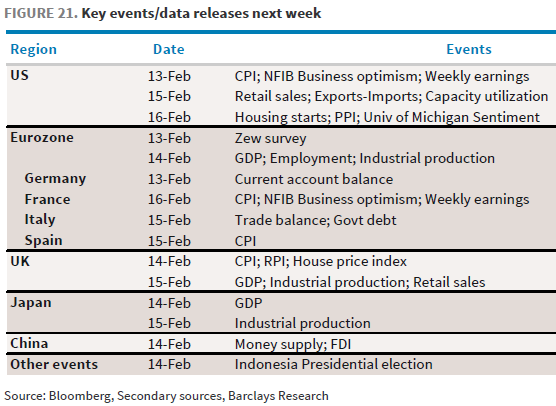

10) NEXT WEEK:

US: inflation + retail sales

Europe: all eyes on inflation + the labor market + growth indicators in the UK

China: inflation data

Earnings: Coca-Cola, Kraft Heinz, Cisco, and Applied Materials.

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Giant Chemicals Maker Dow Debuts Green Bonds to Slash Emissions - Yahoo

-Dow Inc., a maker of plastics for packaging, has tapped the green-bond market for the first time to borrow $1.25 billion as it looks to reduce its carbon emissions and plastic waste.

-Proceeds from such offerings will be used to finance or refinance a range of eligible projects, including energy efficiency, renewable energy, decarbonization and initiatives aimed at ending plastic pollution, according to its green financing framework. The projects also include the world’s first net zero ethylene cracker in Fort Saskatchewan, Alberta.

Germany’s Split Coalition Forces Delay to EU’s Strictest ESG Law - BNN

-Germany’s decision to place hurdles in the way of any agreement on the Corporate Sustainability Due Diligence Directive has led other countries to follow.

-Germany signaled that it would abstain if CSDDD was subjected to informal approval. The Free Democrats, a business-friendly coalition member, refused their backing because of what they see as too much red tape for its companies.

3) MARKETS, MACRO, CORPORATE NEWS

- China’s property crisis is starting to ripple across the world-BBG

- Chinese equity flows turn positive as Beijing signals support-FT

- China new bank loans in Jan hit record high on policy support-RTRS

- Chinese listed companies heed government's call for market stimulus-NIKKEI

- China's central bank to keep policy support for economy-RTRS

- Ueda says BOJ to keep policy easy in post-negative rate era-BBG

- ECB’s Kazaks says bets on spring rate cuts look optimistic-BBG

- ECB will probably cut rates this year, Villeroy says-BBG

- BoE's Haskel wants more evidence that inflation risks are waning-RTRS

- Australia central bank warns on inflation, market pushes out rate cuts-RTRS

- Special counsel: No charges for Biden in classified documents probe-WASHPO

- US Senate advances $95B Ukraine, Israel aid bill after failed border deal-RTRS

- Analysis-As S&P 500 breaches 5,000, its valuation hits lofty levels as well-RTRS

- Global share buybacks return with a bang as stocks hit records-BBG

- Treasury market shifts focus to inflation after auction Bonanza-BBG

- Biden is looking beyond tariffs to keep Chinese ‘smart cars’ out of the US-BBG

- US Bid to curb Iranian oil bedeviled by economics, election-BBG

- Putin tells Tucker Carlson Ukraine war can be ‘over in a few weeks’-POL

- US lawmakers urge Commerce to put ByteDance on export control list-RTRS

- Biden: Israel’s actions in Gaza are ‘over the top’-POL

- OpenAI's Altman in talks to raise funds for chips, AI initiative – WSJ-RTRS

- Disney’s Epic deal values Fortnite maker at $22.5 billion, a sharp cut-INFO

- OpenAI on track to hit $2bn revenue milestone as growth rockets-FT

- Children’s Place hires Centerview to help bolster cash reserves-BBG

- Paytm to acquire ONDC startup Bitsila amid payments bank crisis-MC

- Marubeni, Engie weigh Singapore’s Senoko Energy exit, sources say-BBG

- Saudi Arabia lines up Goldman, Citi for Aramco share sale-BBG

- Grab, GoTo are said to revive talks for ride-hailing mega merger-BBG

- Adani Power wins bid for Lanco Amarkantak at ₹4,101 crore-ECON

Oil/Energy Headlines: 1) OPEC+ output sees biggest drop in six months, but short of pledged cuts: Platts survey-PLATTS 2) Oil investors are adrift in Red Sea rip currents-RTRS 3) US oil refiners beat Wall Street bets, expect demand to grow in 2024-RTRS 4) Canada regulator orders Trans Mountain to address deficiencies after B.C. flooding-RTRS 5) India relaxed about OPEC+ cutting oil output, minister says-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.