ArcelorMittal S.A. MT recently inked a deal to purchase an 80% shareholding in Voestalpine’s Hot Briquetted Iron (‘HBI’) plant located in Corpus Christi, TX. Voestalpine will retain the balance of 20%. Per the deal, the Corpus Christi operations are valued at $1 billion and closing is subject to customary regulatory approvals.

The Corpus Christi facility covers an area of two square kilometers and employs over 270 people. It is located in an optimal coastal position with direct access to a broad and deep shipping channel, which facilitates cost-effective transportation to the Americas and Europe.

The plant has an annual capacity of two million tons of HBI, a high-quality feedstock manufactured through the direct reduction of iron ore. It is used to produce high-quality steel grades in an electric arc furnace (‘EAF’) and can also be utilized in blast furnaces, leading to lower coke consumption. HBI is a premium, compacted form of Direct Reduced Iron (‘DRI’) developed to overcome issues linked with shipping and handling DRI.

The company also signed a long-term offtake agreement with Voestalpine to supply a certain volume of HBI each year proportionate to the latter’s equity stake in its steel mills in Donawitz and Linz, Austria. The balance production will be delivered to third parties under current supply contracts, and to ArcelorMittal sites, including AM/NS Calvert in Alabama, upon the commissioning of its 1.5 million tons EAF. The commissioning is expected in the second half of 2023.

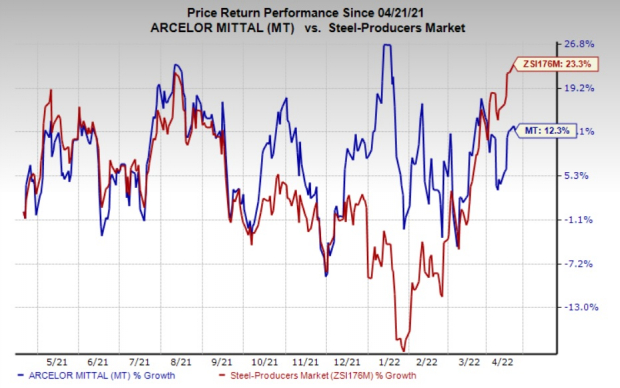

Shares of ArcelorMittal have increased 12.3% in the past year compared with a 23.3% rise of the industry.

Image Source: Zacks Investment Research

In its lastearnings call ArcelorMittal stated that it envisions global apparent steel consumption (“ASC”) to increase 0-1% in 2022. The company recorded ASC growth of 4% in 2021. The global steel industry is benefiting from a favorable supply-demand balance, supporting higher utilization and improved demand. ArcelorMittal sees overall ASC, excluding China, to grow in the range of 2.5-3% year over year in 2022.

The capex is expected to increase from $3 billion in 2021 to $4.5 billion in 2022.

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Key Picks

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Mosaic Company MOS, AdvanSix Inc. ASIX and Allegheny Technologies Incorporated ATI.

Mosaic has a projected earnings growth rate of 143.5% for the current year. The Zacks Consensus Estimate for MOS' current-year earnings has been revised 39.7% upward in the past 60 days.

Mosaic’s earnings beat the Zacks Consensus Estimate in three of the last four quarters while missing once. It delivered a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 133.6% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 54.7% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 43.6% upward in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 23.6%. ASIX has surged 88.8% in a year. The company sports a Zacks Rank #1.

Allegheny, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 684.6% for the current year. The Zacks Consensus Estimate for ATI's earnings for the current year has been revised 20% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 31.3% over a year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

AdvanSix (ASIX): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.