ANSYS, Inc. ANSS has announced that its AVxcelerate Sensors technology is now available through Cognata's Automated Driving Perception Hub (ADPH). Hosted on Microsoft Azure and powered by 4th Generation AMD EPYC processors and Radeon PRO GPUs, the ADPH platform provides original equipment manufacturers (OEMs) with seamless access to certified, web-based sensor models. This enables collaborative testing and validation of advanced driver assistance systems (ADAS) and autonomous vehicle (AV) functionalities using a “high-fidelity simulation platform with virtual twin technology.”

What Does This Collaboration Offer?

The ADPH platform enables OEMs and sensor manufacturers to test and validate certified sensors in compliance with various industry standards, including those established by the National Highway Traffic Safety Administration (NHTSA) and the New Car Assessment Program (NCAP). It features Cognata's sensor models, including thermal cameras, LiDAR, and RGB cameras with different lens distortions and utilizes Deep Neural Network (DNN) technology to deliver photorealistic images and simulations.

With Ansys AVxcelerate Sensors, the platform now features advanced radar models that simulate electromagnetic waves, improving signal strength and accuracy. These simulations provide raw data to refine radar algorithms, such as detecting frequency changes caused by moving objects (Doppler effect). By creating a virtual twin of the radar sensor, OEMs can accurately test and evaluate its performance.

Cognata's generative AI transfer technology, powered by AMD Radeon PRO V710 GPUs, further enhances RGB camera simulations by delivering high-fidelity virtual sensors that replicate real-world behavior within simulations.

ANSYS, Inc. Price and Consensus

ANSYS, Inc. price-consensus-chart | ANSYS, Inc. Quote

Ansys highlighted that the AVxcelerate Sensors platform brings real-time radar capabilities for modeling complex environments. This integration allows customers to design for real-world operations while meeting stringent regulatory standards, streamlining the typically lengthy validation process crucial for autonomous driving.

Strategic Partnerships Propel ANSS’ Growth

Ansys is leading in the high-end design simulation software market and its products are widely utilized by major manufacturing companies. By enabling virtual prototyping instead of physical prototypes, Ansys helps these companies significantly reduce costs. Its comprehensive product portfolio and cross-domain capabilities are expected to drive customer growth.

Moreover, the company’s strong collaborations with advanced technology providers, hardware manufacturers, specialized application developers and CAD, ECAD and PLM vendors are key growth drivers. The company’s partnership with CAD vendors – Autodesk, PTC and Siemens – enables data transfer among the CAD systems and the company’s products. Its partnership with BMW Group focuses on developing safe, robust ADAS and autonomous driving systems. Recent efforts with NVIDIA aim to advance 6G infrastructure, digital twins, AI-driven simulations and enhanced graphics. These strategic alliances strengthen Ansys’ market position and support revenue growth.

Recently, the company joined forces with Sony Semiconductor Solutions Corporation to elevate the validation of perception systems for ADAS and AVs. This collaboration leverages Ansys AVxcelerate Sensors to simulate real-world lighting and weather conditions, ensuring a high-fidelity evaluation of camera sensors and improving accuracy, safety and performance in AV systems. By integrating Sony's HDR sensor models into Ansys' virtual environment, the platform reproduces pixel characteristics, signal processing and system functions with predictive precision.

ANSS’ Zacks Rank & Stock Price Performance

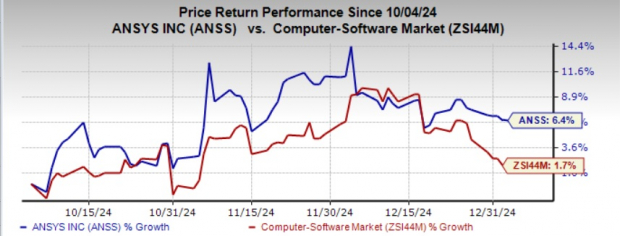

Ansys currently carries a Zacks Rank #3 (Hold). Shares of the company have jumped 6.4% in the past three months compared with the industry's growth of 1.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are BlackBerry Limited BB, Gilat Satellite Networks Ltd. GILT and RADCOM Ltd. RDCM. BB carries a Zacks Rank #1 (Strong Buy), GILT & RDCM presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BlackBerry Limited earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 131.25%. In the last reported quarter, BB delivered an earnings surprise of 200%. Its shares have surged 62.2% in the past three months.

The Zacks Consensus Estimate for Gilat Satellite’s 2024 earnings per share (EPS) is pegged at 48 cents, unchanged in the past 30 days. In the last reported quarter, Gilat Satellite delivered an earnings surprise of 75%. Its shares have jumped 37.9% in the past six months.

The Zacks Consensus Estimate for RADCOM’ 2024 EPS is pegged at 80 cents, unchanged in the past seven days. RDCM’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 25.36%. Its shares have surged 48.7% in the past year.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Gilat Satellite Networks Ltd. (GILT) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Radcom Ltd. (RDCM) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.