The U.S. hospitality industry had a horrible 2020, with hotel occupancy starting to decline at the end of the first quarter when the pandemic hit, and remaining below 40% through January this year. There has been a gradual increase in each successive month thereafter, taking the number to 59.3% in May. The average daily rate (ADR) followed a similar trend, but only started recovering in March. And similarly for Revenue per available room (RevPAR).

STR data shows that demand for hotel accommodation dropped to its lowest level in April 2020, when it was below 40% of the comparable 2019 level. It has improved steadily since, reaching 87% of the comparable 2019 level in May this year. However, revenue growth reached only 71% of the 2019 level, gross operating profit was at 72% and EBITDA at 64%.

Labor is a constraint, according to STR, with labor costs reaching only 64% during the month. The American Hotel & Lodging Association (AHLA) says that as of Jan 21, the industry employed 4 million fewer people than in 2019. A PWC report says that hotel unemployment improved in April to 13.8% from 19.9% in March).

This ties in with the weekly survey data from Destination Analysts, which found that in the week ending Jun 25, 43% of recent travelers felt that the travel industry was having trouble providing services. They also found that as a result of these experiences, 17.3% had decided to do more research when planning their next trip, 14.9% had decided to cut back on their travel while 11.8% had already changed their destination/attraction for an upcoming trip.

However, of the 44.6% of Americans that have taken overnight trips in the last three months, 60.3% were satisfied or very satisfied with their restaurant experience. There was less enthusiasm about hotels, events, attractions, onboard commercial airlines and in-airport businesses. Still, 28.2% were encouraged to travel more.

The AHLA sees particular weakness in business travel, with only 29% of travelers taking a trip in first-half 2021, 36% in the second half with an additional 20% coming next year. 2019 levels are not expected to be achieved until 2023 or 2024. This is a big blow for the industry because business travel tends to be more stable and better-distributed through the year.

An Accenture report concludes that this should drive hotels to target the leisure customer, who has also undergone a big change as a result of the pandemic and now expects a better focus on health and safety. The vast majority also prefers local travel where they don’t have to board a plane.

Most travelers want to physically connect with friends and family, so a lot of the trips are likely to be to their homes rather than hotels.

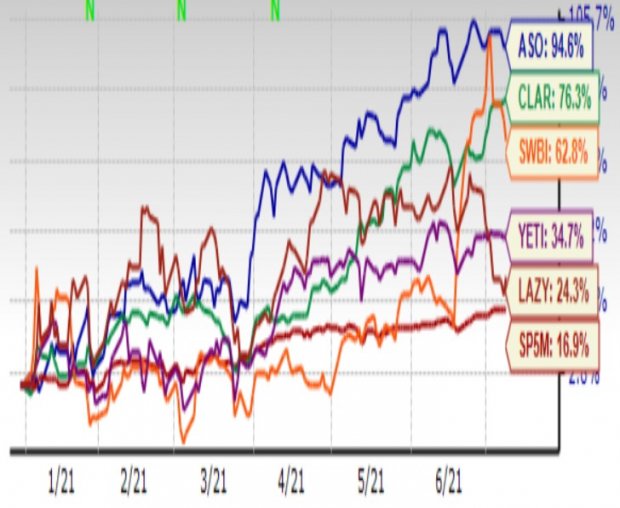

Which is why this summer is likely to be another good one for the Leisure and Recreation Products industry, currently positioned at the top 7% of 250+ Zacks-classified industries. And as many of us already know, when an industry is positioned in the top 50% (the higher the better), there’s historical data showing that it’s likely to offer above-market returns. Especially so, if the stocks we are considering also have a Zacks #1 (Strong Buy) or #2 (Buy) rank.

So let’s see what we have here-

Academy Sports and Outdoors, Inc. ASO, which offers outdoor, apparel, footwear and sports & recreation gear has the #1 rank we are looking for. With Value and Growth Scores of A; expected revenue growth of 9.9% and expected earnings growth of 23.8%; and a 90- day change in the fiscal 2022 (ending January) and 2023 earnings estimates of 62.9% and 28.1%, respectively, this stock looks like a solid pick.

Number two on the list is Clarus Corporation CLAR, which designs and manufactures outdoor equipment and apparel for climbing, mountaineering, backpacking, skiing and other outdoor recreation activities. While this Zacks Rank #1 stock’s Value and Growth Scores of F are less than desirable, the expected revenue growth of 32.7% and earnings growth of 81.4% are pretty encouraging. The estimate revision trend for 2021 shows a 23-cent increase to $1.27 in the last 90 days. The 2022 estimate shows a 30-cent increase to $1.55.

Next we have Smith & Wesson Brands, Inc. SWBI, the well-known manufacturer of pistols, revolvers, rifles, handcuffs and other related products and accessories. Apart from its Value, Growth and Momentum Scores of A, SWBI also has a Zacks #1 rank, which together indicate strong upside potential. And while the company is seeing somewhat difficult comps from a strong 2020, the estimate revision trend shows that it continues to move in the right direction.

So we find that the fiscal 2022 (ending April) earnings estimate is up 145.8% in the last 90 days. The 2023 wasn’t available 90 days ago, but since it became available 60 days ago, it has increased 66.3%.

#1 ranked YETI Holdings, Inc. YETI is known for its outdoor products targeting activities like hunting, fishing, camping, barbecue, farm and ranch, etc. The stock has got an encouraging B for Growth, but an F for everything else, which is not so hot. But a look at its double-digit revenue and earnings growth estimates for 2021 and 2022 are nothing short of exciting.

Moreover, there’s also a positive estimate revision trend: the 2021 earnings estimate is up 8.8% while the 2022 estimate is up 9.1% in the last 90 days.

Lazydays Holdings, Inc. LAZY is the last one I’m discussing here. You can head over to the industry page on zacks.com for more choices (it’s a really long list). This one has got an A for both Value and Growth and a B for Momentum. It’s currently expected to grow revenue and earnings by a respective 20.7% and 22.4% this year.

While estimates from 90 days ago aren’t available, I’m seeing a 17-cent jump in the 2021 estimate in the last 60 days and a 20-cent jump in the 2022 estimate. And this is definitely a good trend.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clarus Corporation (CLAR): Free Stock Analysis Report

LAZYDAYS HOLDINGS, INC. (LAZY): Free Stock Analysis Report

YETI Holdings, Inc. (YETI): Free Stock Analysis Report

Smith & Wesson Brands, Inc. (SWBI): Free Stock Analysis Report

Academy Sports and Outdoors, Inc. (ASO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.