Oshkosh (OSK) might lack the glam associated with electric vehicle-focused companies, but the specialty truck maker knows which way the wind is blowing.

Last Thursday, the company announced it is investing $25 million in Microvast, an EV battery manufacturer. The two have also signed a joint development agreement to advance future battery collaborations, which will see Microvast’s battery solutions used in Oshkosh’s offerings.

Oshkosh is no newbie where electric products are concerned; the company has been developing electric solutions for over two decades, starting with the launch of its first electric boom lift in the mid-90s.

Credit Suisse analyst Jamie Cook says Oshkosh’s business is “booming,” and is pleased about the company’s recent strong earnings. Furthermore, there could be a near-term tailwind; Via its collaboration with Ford, Oshkosh is one of the names still in the hunt for the lucrative $6.3 billion U.S. Postal Service contract to replace its aging mail delivery truck fleet.

“OSK is confident in their positioning on the upcoming postal service bid expected to be awarded in late March which we believe would be a positive catalyst for the stock and EPS,” Cook noted. “On the Commercial Front, OSK is encouraged by market opportunities and long-term trends and continues to progress on the simplification journey.”

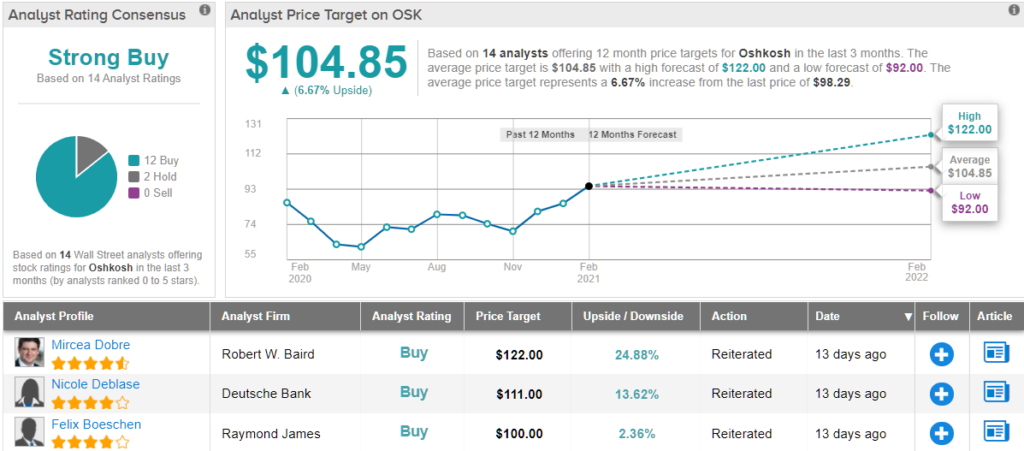

Another fan is Deutsche Bank’s Nicole Deblase. Although the analyst believes “COVID-related temporary cost reversals” could affect near-term margins, the analyst also highlights Oshkosh’s recent performance and the noises made by management as reason to back the company.

“We were impressed with the company's 1Q21 results, most notably the smaller-than-expected revenue decline within Access Equipment and the upward boost to Defense margins (9.7% vs. 8.9% DBe) via contractual adjustments (due to the new, recently-announced $911m JLTV contract). The company also sounded much more convinced that revenue can return to positive Y/Y territory in 2H21,” the analyst wrote.

Oshkosh has strong backing from the rest of the Street. Barring two Hold ratings, all 12 other analysts to have published a review over the last 3 months recommend OSK as a Buy. The strong Buy consensus rating is accompanied with a $104.85 price target. (See OSK stock analysis on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.