- TDF fees are generally lower in CITs than in mutual funds

- Most mutual funds do not have a CIT alternative, so the choice between the two is not straightforward

- CITs have an additional benefit. They serve as fiduciaries, whereas mutual funds do not.

There is increasing interest in using Collective Investment Trusts (CITs ) instead of mutual funds in target date fund (TDF) investing primarily because we’ve been told that CITs are cheaper. Essentially the same portfolio that is offered in a mutual fund TDF can be purchased for a lower fee as a CIT. In the following we take an up close look at these common beliefs and find that (1) CIT TDFs are indeed generally less expensive than mutual fund TDFs and (2) only a few mutual fund TDFs have a CIT alternative. Generally speaking, if you’re looking to use a CIT, it will likely be an offering that is only available as a CIT.

CITs are desirable because of their lower fees and because they serve as fiduciaries to the pension plan, but only ERISA plans may invest in them.

Overview

There are 53 CIT families on the Morningstar database. 47 are less expensive than the average mutual fund fee of 63 bps. The average CIT fee is 44 bps. 15 CITs are also offered as mutual funds, and all 15 are less expensive.

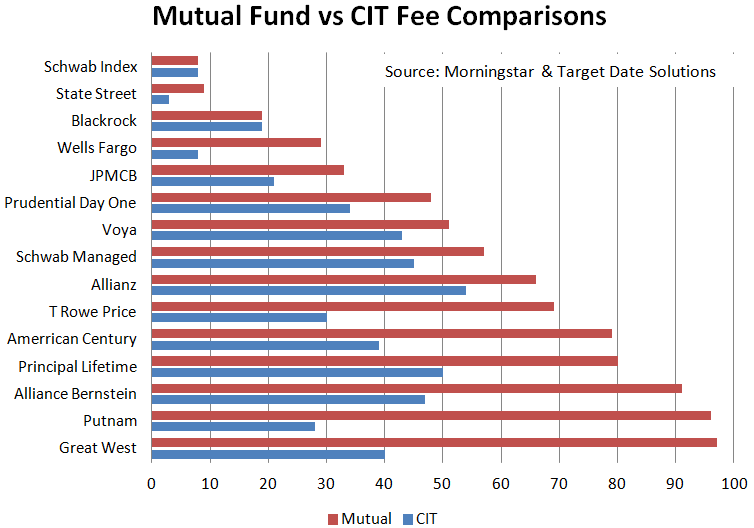

The following table provides the details.

Savings over mutual fund counterpart

15 CITs have mutual fund offerings as well. The average mutual fund fee across these 15 offerings is 55 bps, which is 12% higher than the 49 bps average CIT fee, but the savings vary widely by fund company as shown in the next graph:

How to use this information

Because of the proliferation of successful lawsuits that are based on excessive fees, fiduciaries are seeking the lowest cost TDFs they can find. Expanding your search to include CITs will be productive in this pursuit. But please bear in mind that fees are only one aspect of prudence. Some low cost TDF are imprudent, and some higher cost TDFs are prudent.

Ronald Surz is President of Target Date Solutions, sub-advisor of the SMART TDF Index CIT, and Chief Financial Officer of GlidePath Wealth Management, a new company.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.