Investors looking for disruptive technologies may want to consider the burgeoning artificial intelligence universe, one that has been made accessible via exchange traded funds (ETFs), including the Global X Future Analytics Tech ETF (AIQ).

Artificial intelligence, also known as “AI,” is an increasingly mainstream concept and ETFs like AIQ are mainstreaming the concept for investors, bringing high-growth opportunities of AI and big data together under the umbrella of a single fund.

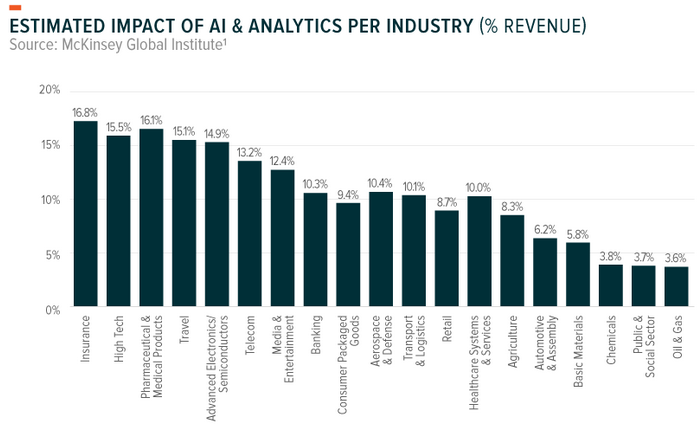

While AI may seem like a far-flung notion, the reality is that it is already touching various corners of our daily lives and, by some accounts, is one of the most practical technologies in recent memory. Data suggests AI has myriad useful (and profitable) applications for a variety of industries and sectors.

Sure, it's reasonable to expect that AI would benefit high-tech industries, such as technology itself, semiconductors, communication services and healthcare, but as the chart below indicates, AI and big data have positive revenue benefits for “lower tech” industries such as agriculture, materials and energy.

AIQ, which debuted in May 2018, follows the Indxx Artificial Intelligence & Big Data Index. The fund allocates nearly 91 percent of its combined weight to the technology, communication services and industrial sectors, but its industry diversity is robust, expanding beyond 10 groups, including semiconductors, multiple corners of the software space, retail and aerospace and defense, just to name a few.

The Personal Side Of AI

As noted above, AI has a slew of industrial capabilities, bolstering the long-term growth case for the market and funds like AIQ. However, there's also a personal side to the technology, one that's lucrative in its own right.

Think about personal assistants, such as Apple's (AAPL) Siri and Amazon's (AMZN) Alexa. Those are prime examples of technology being run on what's known as conversational AI. Alexa and Siri are undoubtedly nifty, if not impressive technologies, but there's a significant runway for growth in the conversational AI arena.

“As conversational AI advances, it could drastically change the way we input commands into a computer, challenging the keyboard and point-and-click,” according to Global X research. “In fact, the average person speaks somewhere between 120 and 150 words per minute, but only types between 38 and 40 words. If machines can understand and reach a conclusion based on speech, the speed of information flow could grow significantly.”

Conversational AI is already growing and that growth isn't limited to Alexa and Siri. In fact, the estimates for what the future holds for this market are astounding.

“Possible applications cut across industries and go well beyond smart speakers and chatbots,” notes Global X. “Conversational AI is expected to be omnichannel, multi-device, and multi-language, potentially disrupting the nearly $86 billion global outsourced services market by leveraging chatbots, messaging apps, digital/personal assistants, and voice search.”

Not Too Expensive

AIQ offers another pleasant surprises: accessing the rapid growth of the AI universe isn't as expensive as investors may initially believe it to be, particularly when evaluating companies in the ETF based on sales metrics.

AIQ trades at just 0.23x price-to-sales-growth and 0.24x enterprise-value-to-sales-growth. Based on those metrics, the slower growth S&P 500 is pricier than AIQ.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.