Amgen Inc. AMGN announced positive top-line data from the phase III study evaluating its biosimilar candidate, ABP 959, for the treatment of adult patients with paroxysmal nocturnal hemoglobinuria (“PNH”).

The DAHLIA study evaluated the safety and efficacy of ABP 959, a biosimilar candidate to Alexion’s [now part of AstraZeneca AZN] C5 inhibitor, Soliris, for treating adult patients with PNH.

AZN closed the acquisition of rare-disease drugmaker, Alexion, for $39 billion in July 2021.

The buyout of Alexion strengthened AstraZeneca’s immunology franchise and added blockbuster rare disease drug, Soliris, to the latter’s portfolio.

The above-mentioned phase III study compared ABP 959 to Soliris for addressing PNH.

Data from the study demonstrated no clinically meaningful differences between ABP 959 and Soliris based on the control of intravascular hemolysis as measured by lactate dehydrogenase (LDH) at week 27 of treatment – the study’s primary endpoint.

Also, the safety and immunogenicity profile of ABP 959 was comparable to that of Soliris.

The encouraging data on ABP 959, underlines Amgen’s strength and expertise in offering patients with high-quality, biologic therapies.

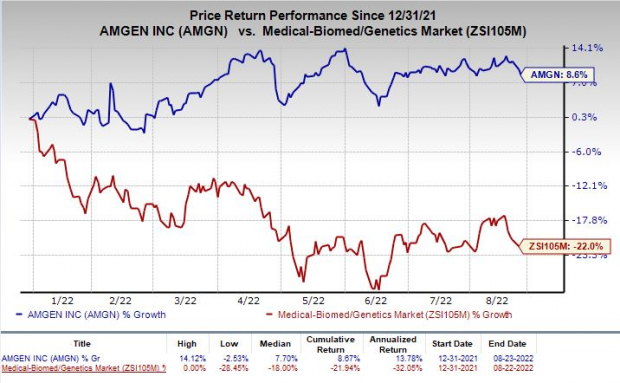

Shares of Amgen have rallied 8.6% this year against the industry’s decline of 22%.

Image Source: Zacks Investment Research

We note that revenues from biosimilars remain a key source of income for AMGN. The company boasts a strong portfolio of biosimilar products with potential new products expected to drive long-term growth.

Key biosimilars in Amgen’s portfolio include Kanjinti (a biosimilar of Roche’s Herceptin) and Mvasi (biosimilar of Roche’s Avastin), Avsola (a biosimilar to J&J/Merck’s blockbuster immunology medicine Remicade) and Amgevita (biosimilar of AbbVie’s ABBV Humira). In the United States, Amjevita is expected to be launched in early 2023.

Humira, AbbVie’s flagship product is a key top driver for the company and the drug continues to witness strong demand trends in the United States. AbbVie remains heavily dependent on Humira for revenues.

ABBV is facing direct biosimilar competition in Europe and other countries where Humira generics have already been launched.

Amgen’s biosimilars revenues are annualizing at over $2 billion in sales while it is expected to more than double by 2030 supported by the Amjevita launch and other biosimilars in late-stage development like ABP 959.

Zacks Rank & Stock to Consider

Amgen currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is Achilles Therapeutics plc ACHL,which has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Achilles Therapeutics’ loss per share estimates narrowed 6.4% for 2022 and 9.6% for 2023 in the past 60 days.

Earnings of Achilles Therapeutics surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. ACHL delivered an earnings surprise of 12.45%, on average.

Profiting from the Metaverse, The 3rd Internet Boom (Free Report):

Get Zacks' special report revealing top profit plays for the internet's next evolution. Early investors still have time to get in near the "ground floor" of this $30 trillion opportunity. You'll discover 5 surprising stocks to help you cash in.

Download the report FREE today >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Achilles Therapeutics PLC Sponsored ADR (ACHL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.