Investors continue to navigate their way through earnings season, undoubtedly one of the most critical periods of the entire year for stocks.

We’ve received a handful of quarterly results so far, including those from Goldman Sachs GS, Bank of America BAC, and Netflix NFLX, among others.

This week, several financial companies report their results, including American Express AXP, on Friday, January 27th, before the market open.

Below is a chart illustrating the stock’s performance over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

How does the company stack up heading into the release? Fortunately, we can use quarterly results from Discover Financial Services DFS to help provide an idea.

Discover Financial Services Q4

Discover posted better-than-expected quarterly results, exceeding the Zacks Consensus EPS Estimate of $3.58 by more than 5% and reflecting year-over-year growth of 4%.

The company generated $3.7 billion in revenue throughout the quarter, edging out our $3.6 billion estimate by roughly 2% and growing 28% Y/Y.

Total loans ended the quarter at $112.1 billion, climbing 20% year-over-year. In addition, net interest income grew 24% year-over-year thanks to higher average receivables and net interest margin expansion.

Roger Hochschild, CEO, said, “Our outstanding results in 2022 were driven by record loan growth and margin expansion, factors that should sustain strong revenue growth into next year."

Now, let’s take a look at American Express.

American Express

Over the last several months, four analysts have lowered their earnings outlook for the quarter, with the company currently carrying a Zacks Rank #4 (Sell). The Zacks Consensus EPS Estimate of $2.18 indicates zero change within the bottom line year-over-year.

Image Source: Zacks Investment Research

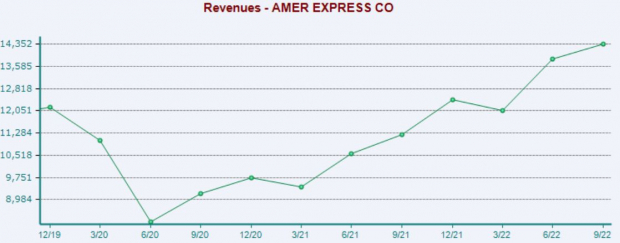

However, the company’s top line is in better shape, with the $14.3 billion sales estimate indicating a change of 17% year-over-year. Below is a chart illustrating the company's revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the Zacks Consensus Estimate for AXP’s net interest income presently stands at $2.7 billion, indicating a change of roughly 28% year-over-year and a 4.7% sequential climb.

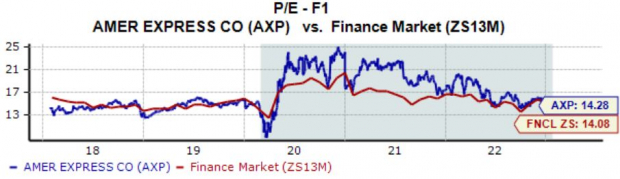

Regarding valuation, AXP shares currently trade at a 14.3X forward earnings multiple, below the 15.3X five-year median and marginally above the Zacks Finance sector average.

Image Source: Zacks Investment Research

Further, the company’s price to book currently works out to be 4.7X, above the 4.5X five-year median and the Zacks Finance sector average.

Image Source: Zacks Investment Research

AXP carries a Style Score of “B” for Value.

Putting Everything Together

With earnings season in full swing, investors are more than ready for companies to finally unveil what’s transpired behind closed doors.

That’s precisely what we’ll receive from American Express AXP later this week on Friday, January 27th.

Currently, estimates indicate zero change in earnings year-over-year but a solid uptick in quarterly revenue.

In addition, the company’s net interest income is forecasted to grow at a solid pace, precisely what we saw from Discover Financial Services DFS in its quarterly release.

Heading into the print, American Express carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of -4.3%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpThe Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.