There are more than 300 million users around the world who use Amazon (NASDAQ: AMZN). The company's e-commerce platform is the go-to option for many customers looking to buy things online. And with next-day or even same-day delivery options, it can sometimes be much more convenient than going to an in-store retailer.

But Amazon isn't capturing all of the market and catering to all customer needs. There are many consumers who are looking to save money amid inflation, and turning to cheaper online retailers such as Temu or Shein. They're willing to wait longer for purchases if it means a much lower price point for products.

Amazon, however, is going to focus on those types of customers with the launch of its newest service: Amazon Haul.

What is Amazon Haul?

Amazon Haul is a new storefront that will offer discounted items to better compete against Temu, Shein, and other e-commerce platforms that offer ultra-low-priced products. It promises to have items that are $20 or less, but most will be less than $10 and some as low as just $1. The caveat is that just like with those other low-priced sites, shipping speeds may not be fast and can take up to two weeks.

Consumers, however, have shown that fast shipping speeds aren't crucial, especially when it means they can save a lot more on their purchases. By offering a lower-priced storefront option, Amazon can reach a broader customer base and potentially unlock a huge growth catalyst for its operations.

Amazon Haul will initially be available to U.S. customers, and it will be accessible once users update the Amazon Shopping app. The company says it plans to innovate and refine this offering further as it will look for feedback from shoppers.

Amazon's growth rate could use a boost

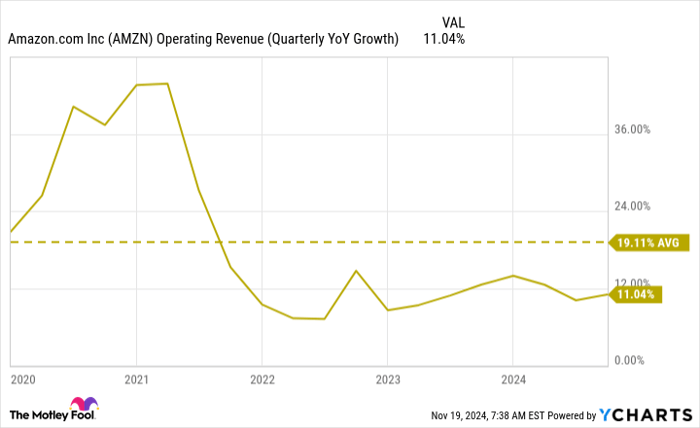

Amazon has generated steady growth in recent quarters but there's definitely been a slowdown compared with the early stages of the pandemic when people were spending more time at home and buying a lot of goods online.

AMZN Operating Revenue (Quarterly YoY Growth) data by YCharts

PDD Holdings, the company that owns Temu, has benefited from a much faster growth rate, by comparison. During the first six months of the year, the company's revenue doubled to $25.3 billion. PDD Holdings owns Temu and Pinduoduo, another popular e-commerce site that focuses on agriculture. Shein isn't a public company, so its numbers aren't publicly available. Some estimates, however, have pegged the company's 2023 sales at around $32.5 billion.

The launch of Amazon Haul should allow Amazon to chip away at some of the incredible growth these sites have been able to generate.

Does this move make Amazon a no-brainer buy?

Amazon's stock trades at more than 40 times earnings and entering trading on Tuesday, it was up more than 32% since the start of the year. It's a top e-commerce stock to own but it's not a terribly cheap one, with a market cap of $2.1 trillion.

If Amazon Haul proves to be a formidable option for customers looking to save money and who may have otherwise gone to Temu or Shein, then that can improve not just Amazon's top-line growth, but also its bottom line, resulting in a more attractive earnings multiple and valuation.

Overall, this looks like a great move for Amazon and I think it could make the stock a much better buy. It may take a while for Amazon to fine-tune the new service, but with the company's focus on the customer and looking for ways to make things better, I'm confident the end result will be a highly competitive service. And that will be a big win for both investors and customers, as it could bring much more traffic onto Amazon's platform.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $894,029!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.