The holiday season is a crucial sales period for both brick-and-mortar retailers and e-commerce players like Amazon (NASDAQ:AMZN). Despite macro pressures, the National Retail Federation (NRF) estimates holiday spending in the November to December period to increase between 3% and 4% to $957.3 billion and $966.6 billion. In particular, the NRF expects online and other non-store sales to grow between 7% and 9% to $273.7 billion and $278.8 billion. Wall Street analysts are bullish about Amazon’s holiday quarter and expect the solid momentum in the company’s recent performance to continue.

Solid Performance

Amazon impressed investors with its robust third-quarter results, with sales rising 13% year-over-year to $143.1 billion. The company’s retail business experienced robust momentum, as witnessed in the 13% rise in North America segment sales and 16% growth in International segment sales. The 12% rise in the company’s Amazon Web Services (AWS) cloud computing business also boosted the top-line growth.

The company guided for Q4 2023 sales in the range of $160 billion to $167 billion, reflecting year-over-year growth between 7% and 12%. This guidance slightly lagged the Street’s expectation of $167.2 billion. Regardless, Wall Street remains bullish on AMZN stock and sees further upside.

Analysts Optimistic about Amazon

On November 6, Jefferies analyst Brent Thill reiterated a Buy rating on Amazon stock with a price target of $175, given his optimism about Amazon’s holiday sales.

Thill said that third-party estimates indicate that U.S. holiday sales growth could decelerate to 4% from 6% last year. However, e-commerce sales growth is expected to accelerate to 9% from 7% in 2022. In fact, a survey of nearly 1,000 customers by the analyst’s firm also revealed slower overall holiday retail sales growth but accelerating e-commerce sales.

The survey results support Thill’s view that Amazon will be “a key holiday beneficiary” and “appears to be a clear winner in holiday ecommerce sales.”

Last week, Tigress Financial analyst Ivan Feinseth increased his price target for AMZN stock to $210 from $204 and reaffirmed a Buy rating. The analyst’s bullish view is based on Amazon's artificial intelligence (AI)-driven capabilities, the ongoing expansion of Prime Membership services, growth in online sales, and the growing advertising revenue.

Is Amazon a Buy, Sell, or Hold?

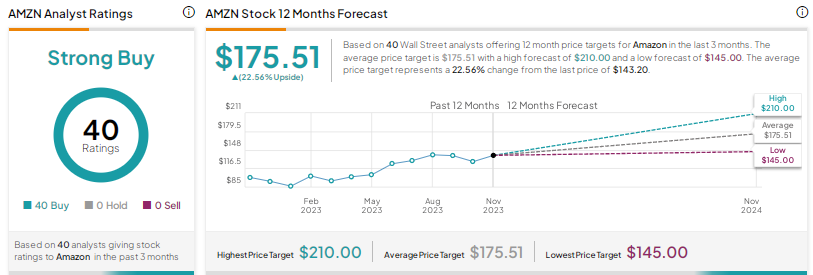

Overall, Wall Street is highly bullish on Amazon stock, with a Strong Buy consensus rating based on 40 unanimous Buys. The average price target of $175.51 implies 22.6% upside potential. Shares have risen 70.5% year-to-date.

Conclusion

Despite macroeconomic challenges, Amazon is expected to deliver strong sales in the holiday season. NRF estimates and other third-party surveys also indicate faster growth in e-commerce sales than overall retail sales in the holiday period, which bodes well for Amazon. Beyond the holiday quarter, analysts are also bullish on the company’s long-term prospects, thanks to its dominant position in e-commerce, solid prospects of AWS, the rapidly growing advertising business, and continued focus on cost cuts to improve profitability.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Credit: Amazon - Shutterstock photo — Shutterstock

Credit: Amazon - Shutterstock photo — Shutterstock