Key Takeaways

- Nvidia stock gained more than 140% over the past year thanks to investor interest in AI.

- Some analysts worry there is a growing bubble in AI stocks that may someday burst.

- Are stocks like Amazon a more reliable tech play to include in your portfolio?

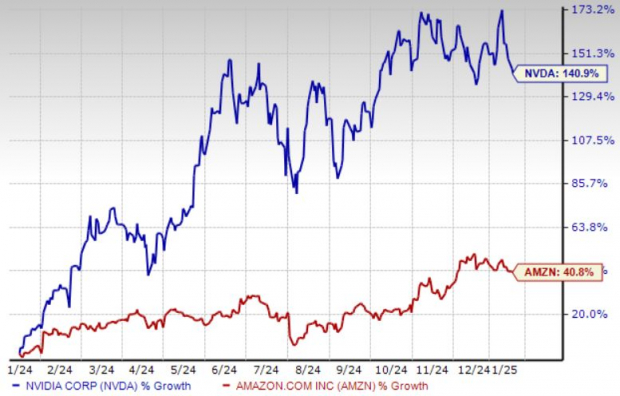

NVIDIA NVDA has undeniably been one of the standout performers in the stock market, skyrocketing 140.9% over the past year, with artificial intelligence (AI) as the driving force behind its remarkable success.

Yet, as analysts continue to debate the potential burst of the AI bubble in the coming years, investors may begin seeking a more stable and resilient technology stock, one that is less exposed to the volatility of AI investments. Now, the billion-dollar question is whether this will open the door for Amazon.com, Inc. AMZN to shine as a strong contender.

Let’s delve deeper into whether Amazon has the strength and versatility to pass the test and continue its upward trajectory after gaining 40.8% over the past year.

One-Year Price Chart

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Amazon & NVIDIA's Revenue Sources and Growth Drivers

Amazon

Revenue Streams Beyond AI: Amazon’s primary revenue sources include its cloud computing arm (AWS), advertising business and Prime memberships. In the third quarter of 2024, AWS contributed significantly with a $110 billion annualized run rate, growing 19.1% year over year. Similarly, Amazon’s advertising revenue surged 18.8% year over year, contributing $14.3 billion in the quarter. The Prime membership base also expanded, boosted by benefits like exclusive deals, faster delivery and perks such as free grocery delivery and fuel discounts???.

AI Usage as a Support Function: While Amazon leverages AI extensively (e.g., in AWS, customer experiences and operational optimization), it is not its primary growth driver but an enabler of efficiency across its diverse business operations.

NVIDIA

AI-Centric Growth: NVIDIA’s explosive revenue growth is primarily fueled by its dominance in AI-driven markets, with its third-quarter 2025 revenues reaching $35.08 billion (up 94% year-over-year). Key contributors include its data center business, which accounted for $30.8 billion, driven by high demand for AI training and inference workloads powered by products like H100 and the newly introduced Blackwell GPUs.

AI as the Core Business: NVIDIA is integral to the AI revolution, providing critical infrastructure for AI model training and inference. Their graphic processing units (GPUs) and accompanying software ecosystems dominate this space, rapidly ramping up AI-specific workloads and cloud infrastructure demand. Microsoft Corp. MSFT is another major company whose growth has been significantly driven by advancements in AI.

Secret to Amazon's Success: It's Not Just About AI

Many analysts believe that the current surge in AI stocks could continue for a few more years before a decline. Among high-performing hardware companies, NVIDIA appears particularly vulnerable to significant setbacks. This vulnerability stems from its heavy reliance on AI-driven growth, especially through its GPUs, which play a critical role in powering AI applications and data centers. While NVIDIA has established itself as a leader in this niche, the concentration of its revenues in the AI sector exposes it to heightened risks should demand in this space wane.

In contrast, Amazon is better positioned to weather a potential downturn in AI investments due to its diversified business model. This is because, unlike NVIDIA, Amazon's revenue streams extend well beyond AI, with its success anchored in its e-commerce dominance, innovative logistics and the robust expansion of AWS, its cloud platform. AWS not only contributes significantly to Amazon's revenues but also supports a wide range of applications, making it less dependent on the performance of AI alone. This broad foundation enables Amazon to remain resilient, even if the AI investment "bubble" were to burst.

Better Stock: AMZN vs NVDA

Hence, it is evident that Amazon, sporting a Zacks Rank #1 (Strong Buy), is not relying solely on AI, making it a more balanced investment option. You can see the complete list of today’s Zacks #1 Rank stocks here.

On the other hand, investors focused exclusively on AI and willing to embrace higher risks may consider NVIDIA, which carries a Zacks Rank #2 (Buy).

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.