We continue to wade through the 2024 Q4 earnings cycle, with a wide variety of companies unveiling quarterly results daily.

This week’s reporting docket is considerably stacked, including Mag 7 members Alphabet GOOGL and Amazon AMZN. Both companies have been at the forefront of market headlines over recent weeks due to the news of DeepSeek, with many questioning the big capital expenditures being deployed.

But how do expectations stack up heading into their respective quarterly releases? Let’s take a closer look at analysts’ expectations and a few other key metrics to keep an eye on

Alphabet Advertising Sales in Focus

Headline expectations for Alphabet haven’t budged much over recent months, reflecting an overall stable trend. The current Zacks Consensus EPS estimate of $2.12 suggests 30% year-over-year growth, whereas forecasted sales of $81.4 billion suggests a 12% move higher.

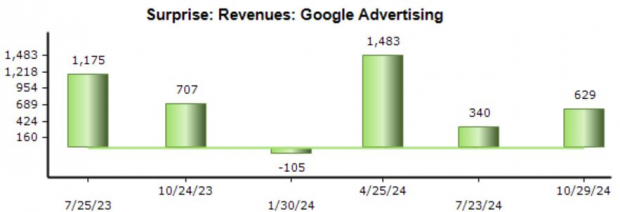

As usual, the company’s Advertising results will be a strong focus, which account for the bulk of Alphabet’s sales overall. For the period, the Zacks Consensus estimate for Advertising sales stands at $71.6 billion, nearly 10% higher year-over-year.

As shown below, Alphabet has regularly exceeded our consensus expectations on the metric, with just one miss over the last six quarters. The company’s advertising results will likely be boosted by AI implementations that have delivered more relevant results for consumers.

Image Source: Zacks Investment Research

It’s worth noting here that advertising rival Meta Platforms came out with positive results on this metric, providing us a small level of read-through of what to expect. Both companies have been implementing AI to boost user engagement.

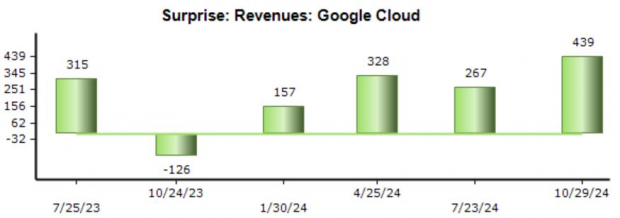

Another key metric to watch in the release is the company’s Cloud results, which have also been positive over the last six periods. Our consensus estimate for Cloud sales stands at $12.1 billion, reflecting a big 32% jump from the year-ago period.

The Cloud year-over-year growth rate here is quite significant, though it does reflect a small deceleration from the most prior period.

Image Source: Zacks Investment Research

Sundar Pichai, CEO, delivered a positive statement following its last release, stating, ‘In Search, our new AI features are expanding what people can search for and how they search for it. In Cloud, our AI solutions are helping drive deeper product adoption with existing customers, attract new customers and win larger deals. And YouTube’s total ads and subscription revenues surpassed $50 billion over the past four quarters for the first time.’

While the ad and cloud momentum are big positives, commentary surrounding CapEx will also take a front seat, though those fears have seemingly been eased following the release of Meta’s and Microsoft’s quarterly releases.

AWS Remains Key for Amazon

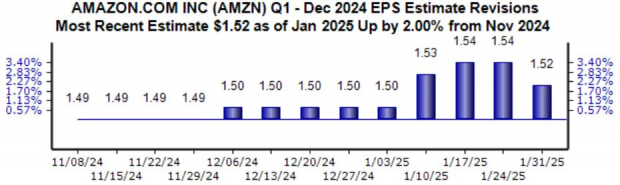

Analysts have shown a sliver of positivity for AMZN’s upcoming release concerning headline figures, with both EPS and sales expectations moving modestly higher over recent months. The company is expected to see a strong 50% year-over-year climb in EPS alongside a 10% sales boost.

Image Source: Zacks Investment Research

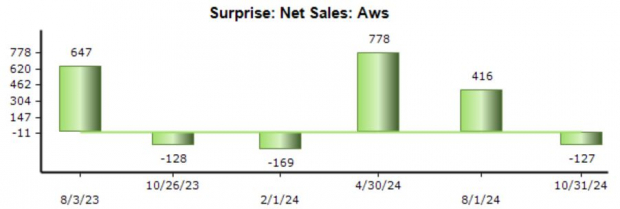

Like GOOGL, Amazon’s cloud results will be in heavy focus due to Amazon Web Services (AWS). AWS is a dominant player in the cloud computing market, flexing a significant market share globally. It provides various services, including computing power, storage, databases, and AI/ML tools.

AWS results fell short of our consensus estimate in the prior period, snapping a string of back-to-back beats. Our current expectation of $28.8 billion in sales for the metric reflects a 19% move higher year-over-year, nearly matching the same growth rate from the latest period.

The Cloud results will likely see tailwinds from increasing adoption of AI-related tools, with the company regularly updating the product suite.

Image Source: Zacks Investment Research

Bottom Line

Mega-cap titans Alphabet GOOGL and Amazon AMZN headline the reporting docket this week, nearly wrapping up the period for the Mag 7 group overall. After the duo reports, we’ll just have the beloved NVIDIA of the group yet to report, whose results are expected near the end of February.

The setup heading into the releases seems to be one of slight positivity, with results from peers Meta Platforms and Microsoft going a long way in easing fears concerning CapEx geared around AI infrastructure buildouts.

Advertising results will again be key for Alphabet, with investors hopeful that implementations geared toward user engagement continue to provide tailwinds for the business. Concerning Amazon, AWS results will likely take center stage again, with increased adoption of tools likely to boost the segment's results again. Guidance will be most critical for both companies, likely dictating their post-earnings moves.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.