Altria Group, Inc. MO is undertaking dedicated endeavors to bolster presence in non-combustible business amid rising popularity of less harmful alternatives to cigarettes. In sync with this strategy, the company through its subsidiary — UST LLC — signed an agreement to offload Ste. Michelle Wine Estates (Ste. Michelle) business to private equity firm, Sycamore Partners Management, L.P.

The transaction — which is likely to conclude in the second half of 2021 — is priced at $1.2 billion on a cash basis and the assumption of specific Ste. Michelle liabilities. Altria expects to utilize the net proceeds arising from the deal for share buybacks to boost shareholders’ wealth. The deal allows the company to enhance the transition of adult smokers to a non-combustible future.

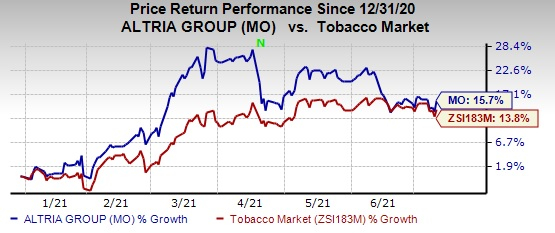

Image Source: Zacks Investment Research

Growth in Low-Risk Products: Key Catalyst

There has been a general shift among consumers toward several reduced risk tobacco products (RRPs) due to serious health hazards of smoking cigarettes. Altria has been responding to the changing market scenario by offering several oral tobacco products. Markedly, growth in the non-combustible business has been backed by the launch of IQOS as well as the commercialization of on!

The marketing and technology sharing agreement between Altria and Philip Morris International Inc. PM, pertaining to the sale of IQOS in the United States, is noteworthy. IQOS is one of the leading heated-tobacco products in the industry. The FDA approved the marketing of IQOS and HeatSticks as Modified Risk Tobacco Products in July 2020. Altria, through its subsidiary Philip Morris USA, Inc., is striving to make IQOS variants available across more stores in the United States.

Altria is also keen on expanding oral tobacco offerings. The company, through its subsidiary Helix Innovations, has full global ownership of on! — a popular tobacco-derived nicotine (TDN) pouch product. Management believes that on! is a worthwhile addition to Altria’s smokeless portfolio as oral TDN products are gaining popularity in the United States owing to their low-risk claims.

Notably, on! was sold in more than 93,000 stores by the end of first-quarter 2021. Quarterly revenues in the company’s Oral Tobacco products unit increased 4.2% from the year-ago quarter’s levels to $626 million, driven by greater pricing. Domestic shipment volumes in the segment rose 0.6% in the quarter, mainly owing to growth of on! oral nicotine pouches as well as trade inventory movements.

Other tobacco companies such as Turning Point Brands, Inc. TPB and British American Tobacco p.l.c. BTI have also been expanding their offerings in the low-risk tobacco space.

Coming back to Altria, we believe that the company’s dedicated efforts to strengthen presence in the low-risk offerings looks prudent. The Zacks Rank #3 (Hold) company’s stock have gained 15.7% so far this year compared with the industry’s growth of 13.8%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO): Free Stock Analysis Report

Philip Morris International Inc. (PM): Free Stock Analysis Report

British American Tobacco p.l.c. (BTI): Free Stock Analysis Report

Turning Point Brands, Inc. (TPB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.