Alnylam Pharmaceuticals, Inc. ALNY announced the submission of a supplemental New Drug Application (“sNDA”) with the FDA. The application seeks approval to expand Onpattro’s (patisiran) label for treating cardiomyopathy of transthyretin-mediated (ATTR) amyloidosis in adults.

Onpattro, a first-of-its-kind RNA interference (RNAi) therapeutic, was approved by the FDA in 2018 to treat the polyneuropathy of hereditary ATTR amyloidosis in adults.

The sNDA submission by Alnylam is based on data from the late-stage APOLLO-B study, which evaluated Onpattro for the treatment of ATTR amyloidosis with cardiomyopathy. The APOLLO-B study met its primary endpoint. Data from the study demonstrated significant improvement of treatment with patisiran on functional capacity and quality of life in patients with ATTR amyloidosis with cardiomyopathy at 12 months.

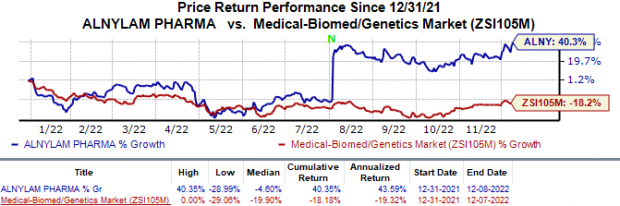

Shares of Alnylam were up 2.9% following the announcement. In the year-to-date period, the stock has surged 40.3% against the industry’s 18.2% decline.

Image Source: Zacks Investment Research

Apart from Onpattro, the company markets three other drugs — Amvuttra (for polyneuropathy of hereditary ATTR amyloidosis), Givlaari (for acute hepatic porphyria) and Oxlumo (primary hyperoxaluria type 1). During the first nine months of 2022, the company generated $632.7 million in product revenues. For full-year 2022, the company expects to generate product revenues in the range of $870-$930 million.

Alnylam faces stiff competition from Ionis Pharmaceuticals’ IONS Tysegi, which was approved by the FDA for treating polyneuropathy of hereditary ATTR amyloidosis in adults in 2018. With regard to pipeline development, Ionis is developing eplontersen in partnership with AstraZeneca AZN for the treatment of transthyretin-mediated amyloidosis as well as several antisense medicines to treat cardiovascular, renal and metabolic diseases and cancer.

This June, Ionis and partner AstraZeneca announced results from the phase III NEURO-TTRansform study evaluating eplontersen in TTR polyneuropathy. The study met its primary endpoints as well as key secondary endpoints. The interim analysis of 35-week data revealed that eplontersen led to highly statistically significant and clinically meaningful changes from baseline in each of these endpoints compared with the historical placebo. Based on these results, Ionis and AstraZeneca will file a new drug application (NDA) seeking approval of eplontersen for TTR polyneuropathy by 2022-end.

Ionis and AstraZeneca are also developing eplontersen for the treatment of cardiomyopathy in the phase III CARDIO-TTRansform study. In first-quarter 2021, Ionis/AstraZeneca increased the size and duration of the study with the aim to generate more robust data.

Alnylam Pharmaceuticals, Inc. Price

Alnylam Pharmaceuticals, Inc. price | Alnylam Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Kamada KMDA, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 28.6% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>AstraZeneca PLC (AZN) : Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Kamada Ltd. (KMDA) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.