Allscripts Healthcare Solutions, Inc. MDRX recently announced the launch of Guided Scheduling, the latest addition to its automation features in Allscripts Practice Management. Allscripts Guided Scheduling, launching in Allscripts Practice Management, is an artificial intelligence (AI) scheduling application that utilizes real-time provider, practice and industry data to improve providers’ days.

For investors’ note, the opportunity to access the AI functionality will be available to Allscripts Practice Management clients who upgrade to the 21.0 release.

Allscripts has partnered with Opargo to embed its engine within the Guided Scheduling application.

The latest addition to the company’s product suite is likely to solidify Allscripts’ foothold in the global practice management software space. The practice management software is a component of the company’s Core Clinical and Financial Solutions segment.

Significance of the Launch

Allscripts’ Guided Scheduling looks at crucial clinical and operational metrics, thereby enabling users to suitably schedule each patient visit. The scheduling application can increase the speed at which high-need patients receive care, improve utilization of all resources across an organization and reduce the impact of schedule churn (no-shows or last-minute changes and cancellations).

Further, by embedding this functionality in the existing Allscripts Practice Management scheduling solution, the Guided Scheduling’s set-up and configuration designs have been simplified. This allows system users to experience minimal disruption to their existing workflows.

Per management, this combination of real-time data, AI and proven principles from other industries is expected to be a game changer for its clients as well as the entire healthcare market.

Industry Prospects

Per a report by Research and Markets, the global medical practice management software market is projected to reach $739.1 million by 2029 at a CAGR of 10.6% between 2021 and 2029. Factors like the growing demand to maintain patients’ electronic health records worldwide, the need to increase the efficiency of current medical practices and institutions, and saving time and resources in the long run are likely to drive the market.

Given the market potential, the latest launch is expected to significantly boost Allscripts’ business on a global scale.

Recent Developments

Of late, Allscripts has witnessed a few notable developments across its businesses.

This month, the company’s business unit, Veradigm, entered into a collaboration with CareMetx. Per the terms of the new agreement, CareMetx is expected to combine its solutions and services directly into the Veradigm AccelRx specialty medication platform.

In September, Allscripts partnered with Eastern Health to advance health-care services and programs while maximizing health system efficiencies and general economic development in Newfoundland and Labrador, Canada.

The company, in August, announced robust second-quarter 2021 results, wherein it registered year-over-year uptick in both the top and bottom lines, along with a surge in total bookings.

Price Performance

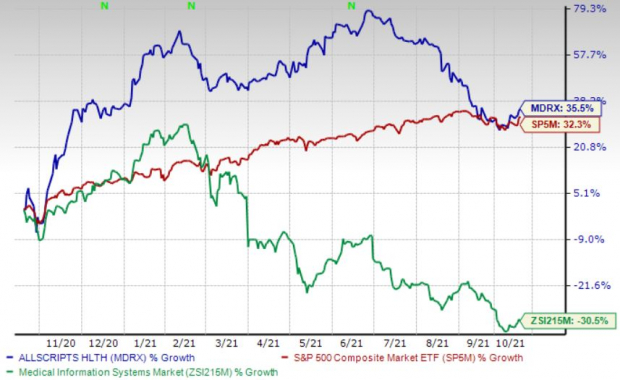

Shares of the company have gained 35.5% in the past year against the industry’s 30.5% fall. The S&P 500 rose 32.3% in the said time frame.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Allscripts carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, Intuitive Surgical, Inc. ISRG and West Pharmaceutical Services, Inc. WST.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical’s long-term earnings growth rate is estimated at 9.5%. It currently holds a Zacks Rank #2.

West Pharmaceutical’s long-term earnings growth rate is estimated at 27.3%. It currently carries a Zacks Rank #2.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Allscripts Healthcare Solutions, Inc. (MDRX): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.