By Goran Damchevski

This article was originally published on Simply Wall St News

Airbnb, Inc. ( NASDAQ:ABNB ) is transforming from a platform for vacationing to a platform where people decide where to be.

The statement is purposefully broad because Airbnb is targeting different aspects of presence.

The company started with offering short term vacation listings, then they expanded for longer durations, then they broadened to purpose of stays to include business trips, then came the Airbnb experiences where they started listing local activities, after that we saw the digital variant of experiences, later came the mixed work & travel trips, and now they have created an exclusive arrangement with Realpage to allow for home-sharing services.

As living changes, and becomes even more mobile, Airbnb is opening new possibilities for being present for their customers. This expanded vision of living needs a solid foundation of technology, skills, smart decisions and capital.

That is why we are going to see AirBnB’s ownership structure.

If we want to know who really controls Airbnb, Inc. ( NASDAQ:ABNB ), then we'll have to look at the makeup of its share registry.

Airbnb has a market capitalization of US$93b, so it's too big to fly under the radar.

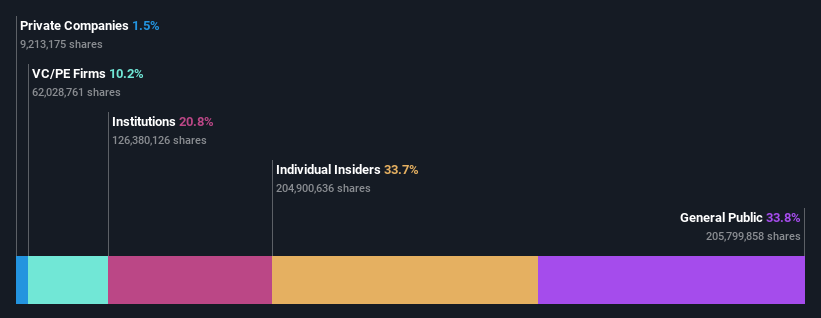

In the chart below, we can see who has bought into the company. Let's delve deeper into each type of owner, to discover more about Airbnb.

See our latest analysis for Airbnb

Nasdaq:ABNB Ownership Breakdown June 2021

Nasdaq:ABNB Ownership Breakdown June 2021What Does Ownership Structure Tell Us About Airbnb?

We can see that Airbnb does have institutional investors, and they hold a good portion of the company's stock.

This suggests some credibility amongst professional investors.

But we can't rely on that fact alone, since institutions also make bad investments sometimes.

When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth.

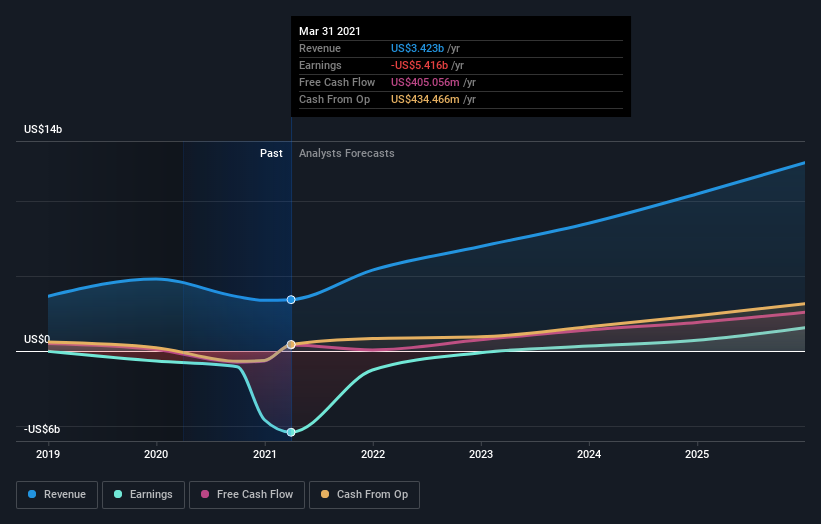

You can see Airbnb's historic earnings and revenue below, but keep in mind there's always more to the story.

Nasdaq:ABNB Earnings and Revenue Growth, June 2021

Nasdaq:ABNB Earnings and Revenue Growth, June 2021We note that hedge funds don't have a meaningful investment in Airbnb.

Insider Ownership

Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company.

Insiders own US$31b worth of shares in the US$93b company.

Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

In Airbnb's case, its Top Key Executive, Joseph Gebbia, is the largest shareholder, holding 11% of shares outstanding. The second and third-largest shareholders are Brian Chesky and Nathan Blecharczyk, with an equal amount of shares to their name at 11%.

Interestingly, the second and third-largest shareholders also happen to be the Chief Executive Officer and Member of the Board of Directors, respectively. This once again signifies considerable insider ownership amongst the company's top shareholders.

On further inspection, we found that more than half the company's shares are owned by the top 7 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

There is the very important issue of the voting shares for Airbnb. Insiders do currently control the majority of voting shares - These are 20 to 1 B-Class voting shares.

The rest of the shareholders are practically powerless within this structure when it comes to influencing the decision-making of Airbnb. The B-Class shares have a conversion date to A-Class (1 vote shares) in 20 years.

This means that Insiders have effectively made sure they stay at the helm of Airbnb for at least the next 20 years.

General Public Ownership

The general public, with a 34% stake in the company, should not easily be ignored.

While this size of ownership may not be enough to sway a policy decision in their favor, they can still make a collective impact on company policies by showing their satisfaction or lack of by holding or selling their shares.

Private Equity Ownership

Private equity firms hold a 10% stake in Airbnb.

This suggests they can be influential in key policy decisions. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company.

Key Takeaways & Next Steps:

Airbnb is heavily influenced by the locked-in insider ownership.

The effective absolute power of management can be viewed as an additional fixed cost for the company - Great to have in good times and while making smart decisions, but exacerbated if implementing bad projects and decisions.

On the positive side, the private equity ownership stake may serve as an active safeguard for accountability and pressure towards management.

For shareholders, it is important to understand the weight of the additional risk imposed by this ownership structure.

Incidentally, we would be much more optimistic if the company had the same ownership structure but a single class of shares, like the traditional company structures.

We don’t know if this trend of issuing multiple classes of shares for newer companies will result in a more productive business-model, and feel like time will reveal the outcome.

It's always worth thinking about the different groups who own shares in a company. But to understand Airbnb better, we need to consider many other factors. Take the risks for example - Airbnb has 2 warning signs we think you should be aware of.

Ultimately, the future is most important. You can access this free report on analyst forecasts for the company .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.