AI-focused “Fab Five” lift large caps to best earnings growth in almost 2 years

We wanted to hold off until we got Nvidia’s earnings before doing our Q1 earnings recap… and they did not disappoint (+468% YoY earnings growth for Nvidia)!

Now, Q1 earnings season is all but done for the S&P 500 (96% reported), and it turned out pretty well for large caps (and especially mega caps).

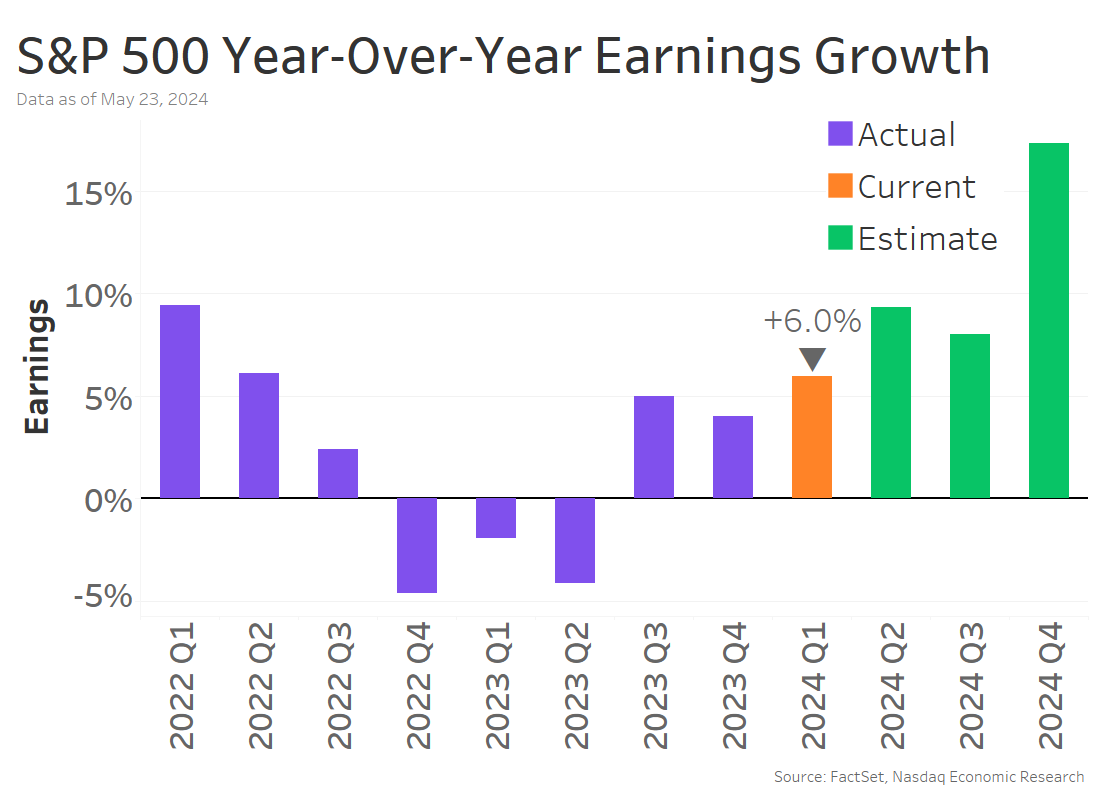

S&P 500 earnings grew +6% YoY in Q1 (chart below, orange bar) – the strongest growth in nearly two years.

But, as we showed a month ago, earnings were top heavy. Earnings for the AI-related “Fab Five” (Amazon, Google, Meta, Microsoft, and Nvidia) grew +85% YoY, while earnings actually fell 2% YoY for the rest of the S&P 500.

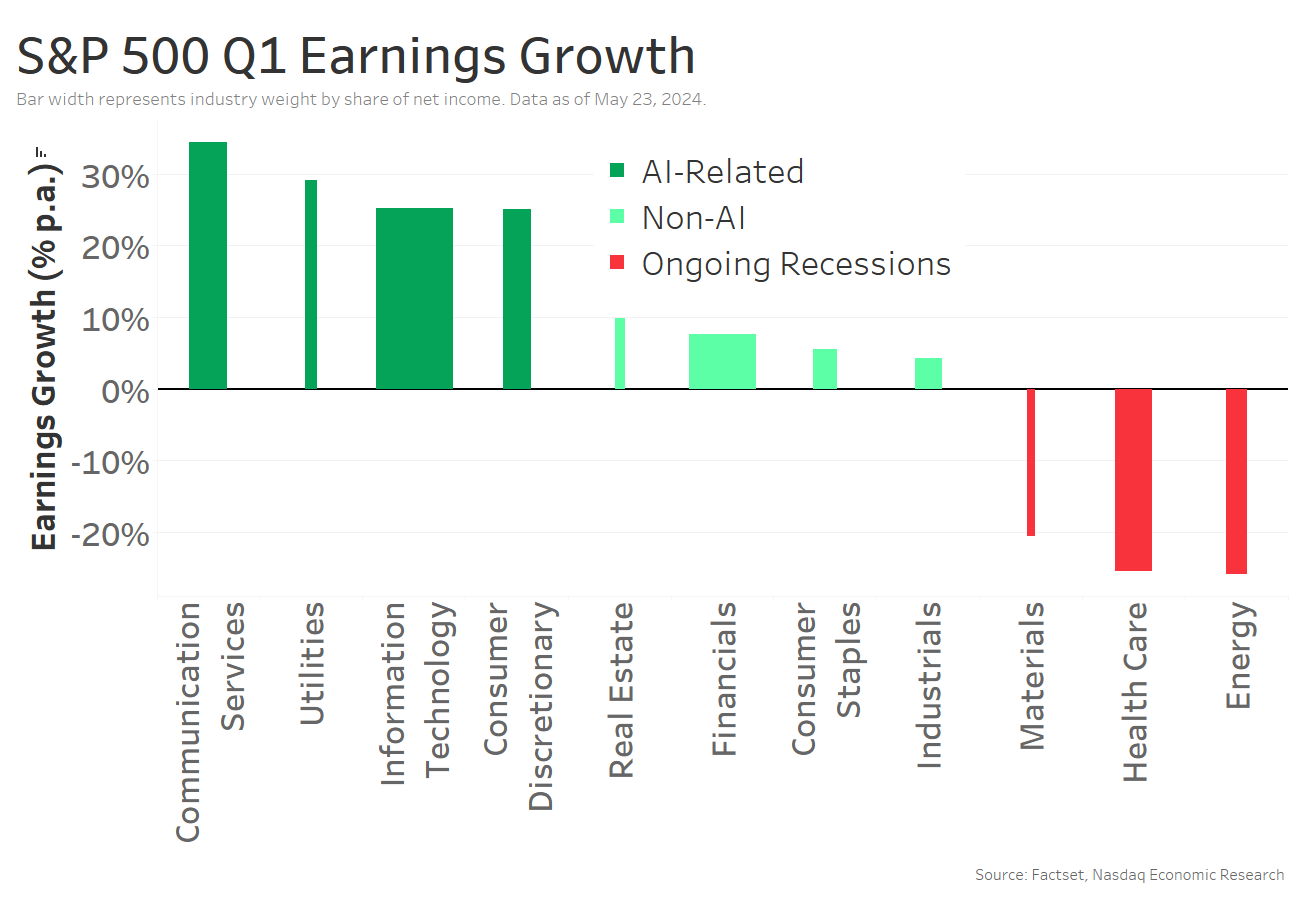

3 buckets of sector earnings: AI-related, ongoing earnings recessions, and everyone else

At the sector level, the divide wasn’t quite so stark. Instead they fell into three buckets: AI-related sectors, those still in earnings recessions, and everyone else (chart below).

- AI-related sectors saw 25%+ YoY earnings growth: Information Technology, Communication Services, Consumer Discretionary, and Utilities (dark green bars).

- Continued earnings recessions for Health Care, Energy, and Materials (red bars) for the same reasons (drop in Covid-related spending, 25% YoY drop in natural gas prices, and earlier manufacturing recession, respectively).

- Everyone else saw +4% to +10% YoY earnings growth. These sectors (Financials, Industrials, Consumer Staples, and Real Estate) aren’t AI hubs, but they’re still benefitting from a strong economy (light green bars).

Utilities benefitting from AI and relatively low valuations

Some may be wondering why Utilities is an AI-related sector. That’s because AI requires lots of computing power (a ChatGPT query takes 10x the energy of a Google search), which means big data centers that draw lots of power.

So, after two decades of flat electricity demand in the US, the rise of AI is creating demand for new energy infrastructure, and Utilities companies are benefitting.

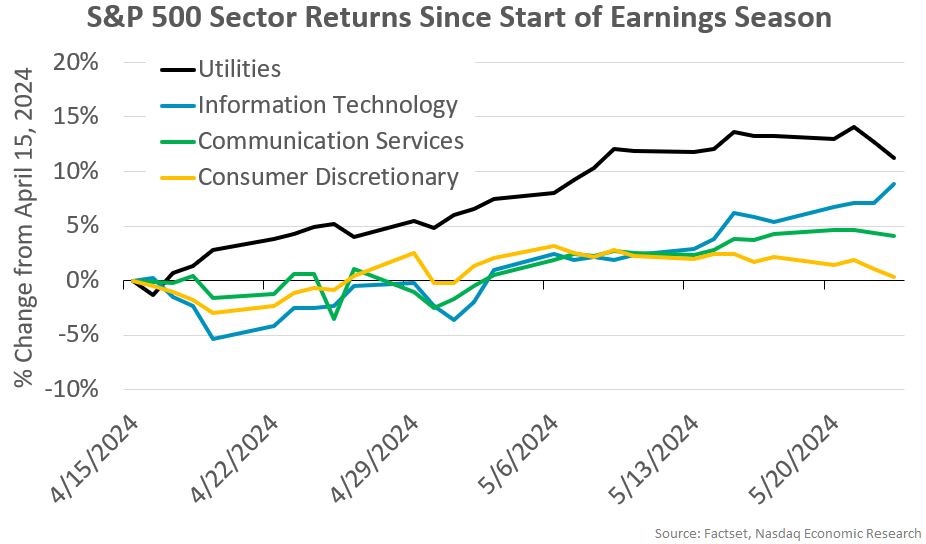

In fact, since the start of earnings season, Utilities has actually seen the highest price gains (chart below, black line) over the other AI-related sectors.

In part, that has to do with Utilities valuations being roughly 10% to 40% lower than the other AI-related sectors. So investors can get exposure to AI, without paying as much for future earnings.

Floating rate debt exposure, manufacturing tilt, and worse pricing power explains small cap recession

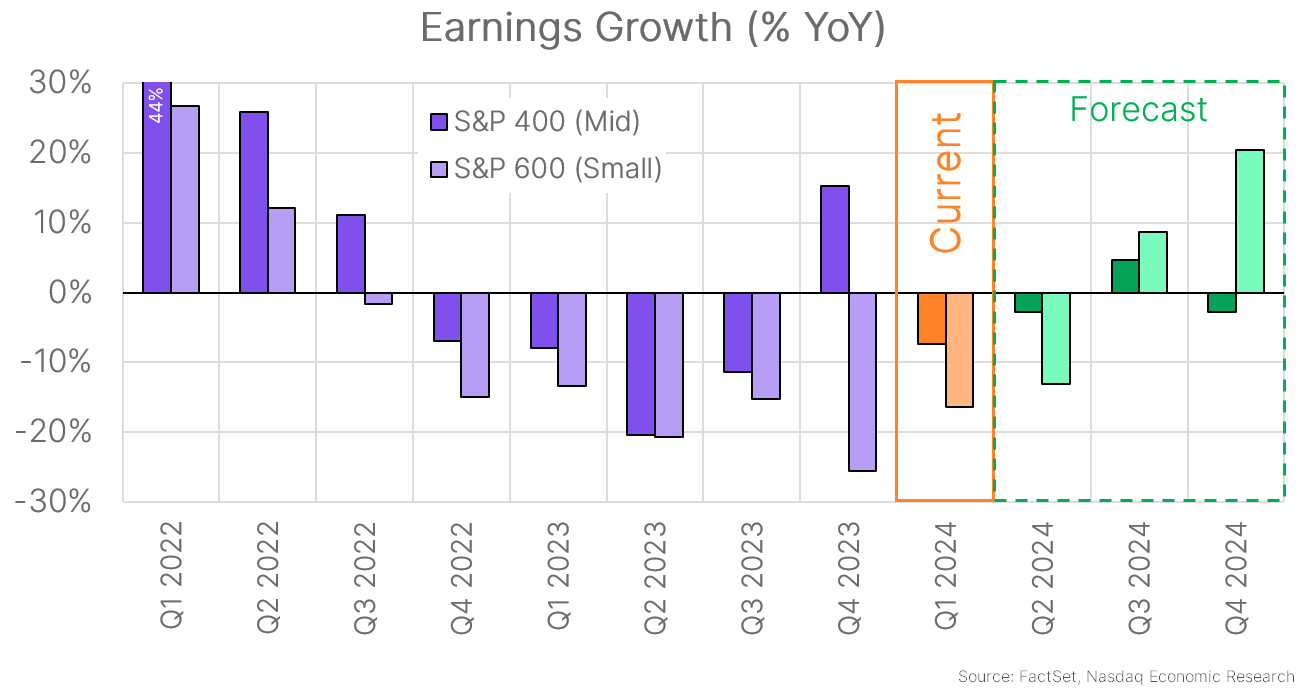

Looking at smaller companies, the earnings recession we highlighted previously for small caps continued. Small cap earnings fell 17% YoY (chart below, light orange bar).

There are a few reasons for this.

- Small caps are 5x more exposed to floating rate debt (as we’ve shown before), so higher interest rates have hurt their margins more than mid- and (especially) large caps.

- Sector tilt is another factor. Small caps have much more manufacturing exposure (23%) than large caps (10%) and much less tech exposure (13%) than large caps (30%), based on sector share of market value. So they’ve been hurt more by the recent manufacturing recession and haven’t benefitted as much from recent tech strength.

- Pricing power has been falling at smaller companies: plans to raise prices is around its low in 3½ years. Pricing power applies to input costs, too. Small businesses have less leverage to negotiate with suppliers than big businesses, and we see that in the data… Small businesses still rank inflation as their biggest problem, while large cap inflation concerns are their lowest in nearly 3 years.

Manufacturing revival and (slowly) falling rates to boost small caps

The good news for small caps is that a nascent manufacturing revival is underway – as confirmed by the May manufacturing PMI, which stayed in expansion for the 5th straight month. So that sector tilt should become a boost to small caps.

And, eventually, the Fed will start cutting rates (I promise!), starting to ease the rate burden on small caps.

That helps explain why small cap earnings are expected to increase +20% YoY in Q4 2024 (chart above, rightmost light green bar) – even above the +17% YoY projected for large caps (first chart, rightmost bar)! So hopefully the worst is behind them for small caps.