Affimed AFMD announced that it has initiated enrolling patients in a phase I/IIa AFM24-102 study to evaluate the safety, tolerability, pharmacokinetics and efficacy of its EGFR/CD16A targeted innate cell engager, AFM24, in combination with Roche’s RHHBY Tecentriq (atezolizumab) to treat patients with solid tumors.

Affimed will evaluate this combination in solid tumor indications that include non-small cell lung cancer (EGFR-wildtype), gastric- and gastroesophageal junction cancers, and pancreatic/hepatocellular/biliary tract cancer. It is to be noted that all patients participating in this study should have failed at least one prior line of treatment before receiving this combination.

The AFM24-102 study will consist of two parts. While the first part is a dose escalation phase to determine the maximum tolerated dose or recommended phase II dose of AFM24 plus atezolizumab, the second part is an expansion phase that will determine the safety of the AFM24-atezolizumab combination.

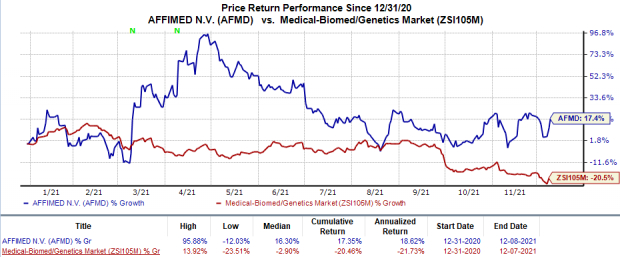

Affimed’s stock has rallied 17.4% so far this year against the industry’s 20.5% fall.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Apart from this study, Affimed is also evaluating AFM24 in other clinical studies. A phase I/IIa AFM24-101 study is evaluating AFM24 as a monotherapy in patients with advanced EGFR-expressing solid malignancies whose disease has progressed after treatment with previous anticancer therapies.

The company is also evaluating AFM24 in combination with NKGen Biotech’s autologous NK cell therapy, SNK01, in a phase I/IIa study in solid tumors, initiated by Affimed last month.

We note that atezolizumab is an anti-PD-L1 checkpoint inhibitor marketed by Roche under the trade name Tecentriq. Tecentriq is Roche’s leading immuno-oncology drug for multiple indications.

Affimed N.V. Price

Affimed N.V. price | Affimed N.V. Quote

Zacks Rank & Stocks to Consider

Affimed presently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the same sector include IVERIC bio ISEE and Precision BioSciences DTIL. While Precision BioSciences sports a Zacks Rank #1 (Strong Buy), IVERIC bio currently carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Precision BioSciences’ loss per share estimates for 2021 have narrowed from $1.17 to $0.65 in the past 30 days. The same for 2022 has narrowed from $2.39 to $1.91 in the past 30 days. Shares of Precision BioScienceshave risen 9.2% in the year so far.

Earnings of Precision BioSciences beat estimates in all the last four quarters, delivering a surprise of 76.9%, on average.

IVERIC bio’s loss per share estimates for 2021 have narrowed from $1.18 to $1.09 in the past 30 days. The same for 2022 has narrowed from $1.17 to $1.03 in the past 30 days. Shares of IVERIC bio have gained 114% in the year so far.

Earnings of IVERIC bio missed estimates in three of the last four quarters and surpassed expectations once, with the negative surprise being 5.6%, on average.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Affimed N.V. (AFMD): Free Stock Analysis Report

Precision BioSciences, Inc. (DTIL): Free Stock Analysis Report

IVERIC bio, Inc. (ISEE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.